Accumulate 20 billion USD, evaporate in the next minute

Bill Hwang is an American investor based in New York on Wall Street. The Wall Street Journal reported that Hwang lost $20 billion within 10 days at the end of March 2021.

This “collapse” caused Wall Street to suffer a “shock”, many big banks were shaken.

The story of this businessman is used by many users as a typical example of the funny saying: “The city is also a stock, a failure is also a stock.”

(According to the original sentence “The city is wild Tieu Ha, defeated the wild Tieu Ha” in Chinese history)

Desperately born, grown up from the “investment star” furnace

Bill Hwang real name Sung Kook Hwang. In 1982, he immigrated from Korea to the US and changed his name to Bill at this time.

Bill Hwang is a very private person, revealing little about himself. One of the information that he himself said during a church service in New Jersey in 2019 said that he came from a difficult family.

“I grew up in a pastoral family. We used to be poor,” Hwang said. “I must confess to you that I am not very poor right now. But I’m used to living a few steps below what I can afford.”

As for his education, Hwang attended the University of California at Los Angeles and later earned a Master of Business Administration from Carnegie Mellon University.

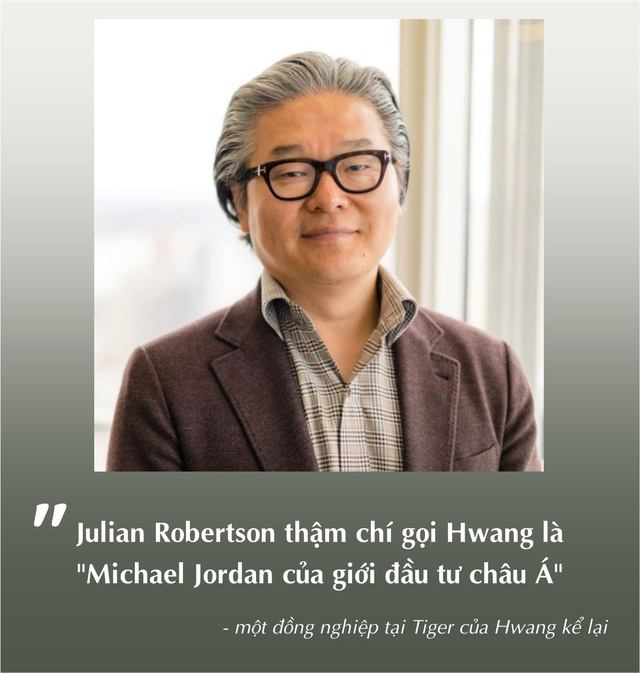

In 1996, after a short time as a trader at two securities companies, he became an analyst at the famous hedge fund Tiger Management (Tiger fund) of Julian Robertson – a famous and talented investor. in the industry.

This is considered a great opportunity for Hwang to have the opportunity to learn from “the best” like Robertson. This “investment star” furnace later produced a series of talented investors, establishing a series of successful hedge funds such as Viking Global Investors, Coatue Management or Tiger Global Management.

During his time working here, Hwang witnessed a time when Tiger lost up to 2 billion USD due to mixed market investment in the Japanese yen. But Robertson remained calm and accepted the loss, instead of trying to find a way to save the wrong decision.

Therefore, one of the most valuable lessons Hwang has is this: Accepting losses is part of the game.

In 2001, when Tiger closed, it was Robertson who advised Hwang to open his own investment fund and offered to inject initial capital to help him. Thus, the Tiger Asia Management fund was born.

Initially, Hwang only invested in Asian companies, specifically those doing business in domestic markets in Korea, China, and Japan. He often splits his investments evenly and has a habit of keeping his calculations private, even from his market analysis team.

When these calculations brought “sweet fruit”, many investments won big, the amount of assets held by Tiger Asia at one time increased to 10 billion USD. These things make Tiger Asia’s capital contributors more confident in Hwang’s decisions.

However, accepting “super profit” also means accepting “super risk”. Like most investors, Hwang can’t always be right.

In 2008, Tiger Asia short sold a large number of shares of Volkswagen AG with the expectation of buying them back later at a lower price. However, soon after, the news that Volkswagen was about to merge with the luxury car company Porsche pushed the stock price up four times.

Hwang was forced to accept that his wrong decision caused serious damage. This made many investors angry, withdrawing their money and leaving. At the end of the year, Tiger Asia’s assets decreased by 23%.

In 2012, the US Securities and Exchange Commission (SEC) accused Tiger Asia of engaging in insider trading and deliberately interfering to adjust the price of two international bank stocks. Tiger Asia had to pay a large amount of fine.

This scandal caused him to shut down Tiger Asia, pouring the remaining $200 million into Archegos.

The game “level up”: Super profit and super risk

According to Bloomberg, in the early years, Archegos “poured money” into technology stocks such as Amazon (online shopping platform), Expedia Group (online travel shopping company) and LinkedIn (professional social network) business that Microsoft bought in 2016).

Hwang believes that technology stocks are the right investment direction. And his belief was correct. In 2016, Archegos made nearly 1 billion USD. By 2017, the company’s capital amount had reached about 4 billion USD.

Hwang’s calculations brought great profits, so he won everyone’s trust. Photo: FT

Through the use of swaps, Archegos has steadily raised the leverage ratio on stock purchases. Initially, this ratio was only about “2x”, meaning that for every 1 million USD of capital, the company would borrow another 1 million USD from the bank. After that, the ratio went up to “5x” and in some cases even more.

The worrying thing is that Hwang borrowed a lot of money from many different banks to invest in just a few stocks and kept this secret. Some investment funds and banks that cooperate with Hwang include Morgan Stanley, Goldman Sachs, Credit Suisse and Wells Fargo & Co…. When investments are still consistently profitable, there is almost no doubt or alarm signal.

In the fourth quarter of 2020, Hwang was a resounding success. While the S&P 500 is up 12%, 7 of the 10 stocks that Archegos invest in have gained more than 30% in value. In which Baidu, Vipshop and Farfetch increased by 70% in value.

This helps Hwang become one of Wall Street’s most “favored” customers. Banks continued to lend more capital as they witnessed Hwang continuously pouring money into the market, increasing its reputation with profitable investments.

Even so, Hwang’s investment is extremely risky. Once the “chain is broken”, the whole investment chain will collapse. This happened with the event that Viacom, one of the companies in which Hwang focused his investments, began selling off a large amount of stock and debt totaling up to $3 billion.

Prior to that, Viacom’s stock had tripled its original value thanks to Hwang’s successive buying efforts. However, to cope with fierce competition from rivals such as Apple TV, Disney+, HBO and Netflix, the company had to work to accumulate more capital.

As soon as the news was released, the stock price immediately dropped 9% the next day and continued to drop up to 23% the next day. Hwang’s huge investment suddenly turned into a heavy loss, thereby threatening the swap he made with the bank. The meager cash on hand is also not enough to pay the deposit to the parties, increasing the risk buffer. This made the banks that loaned him “fearful”.

Morgan Stanley was the first unit that decided to take action to “save itself”. With no prior notice, the company quietly sold off all the shares worth $5 billion from the swap with Archegos to a group of hedge funds.

The next day, Goldman, Deutsche Bank AG and Wells Fargo also sold out groups of shares from the swap contract with Archegos worth more than tens of billions of dollars.

This series of actions helped these entities come out of the crisis with a certain loss, but at the same time dragged the stock price down even further and caused huge damage to the rest.

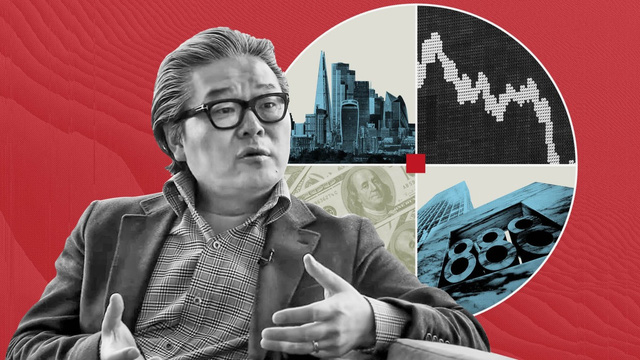

Credit Suisse lost $4.7 billion, Nomura lost $2 billion, while Archegos company lost all its estimated assets of $20 billion and had to declare bankruptcy.

Building number 888 at 7th Ave. (New York) was once the headquarters of Archegos.

The incident with “whale” Bill Hwang has left a great shock in the hearts of many investors, even making Wall Street wobble for a long time.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here