Stocks are still good in the long term

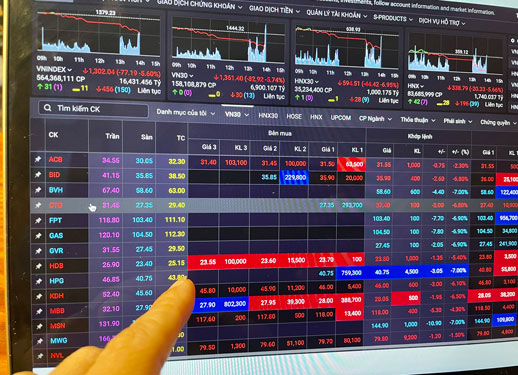

After many weeks of continuous “loss”, individual investors could no longer keep their composure when witnessing the market stock On April 25, it dropped to more than 80 points – an unprecedented decrease of the VN-Index, other indexes also fell deeply and large-cap stocks fell to the floor.

Decline

Although the “bottom-fishing” cash flow appeared at the end of the session to help stop the fall of the general market, the VN-Index still lost 68.31 points, equivalent to a decrease of 4.95% and closed at 1,310.92 points. This is the lowest point of this index since July 30, 2021 and has lost more than 220 points since the VN-Index peaked above 1,530 points at the beginning of the year. On the whole HoSE, there were only 37 gainers, 443 losers (176 stocks fell to the floor) and 21 stood still. The market capitalization of this floor evaporated 270,000 billion VND, equivalent to 11.7 billion USD.

Investors’ losses are getting heavier and heavier after the market’s plunge on April 25. Photo: SON NHUNG

On the HNX, HNX-Index dropped 21.61 points (-6.02%), down 337.51 points. On the whole floor, there were 54 gainers, 193 losers (53 stocks falling to the floor) and 33 stocks of standing still. As for UpCoM, the UPCoM-Index also lost 4.61 points (-4.43%), down 99.54 points.

The total matched value on all 3 exchanges HoSE, HNX and UpCoM reached 22,228 billion dong, down 16%, of which, the matching value on HoSE alone decreased by 15%, to only 19,576 billion dong. The bright spot was that foreign investors continued to net buy more than 200 billion dong on HoSE.

On securities associations, groups, individual investors and consultants all discussed why the market dropped so sharply after losing hundreds of points last week.

Talking to a reporter of Nguoi Lao Dong Newspaper, some securities experts said that the sharp drop in the market can only be explained by the depressed psychology of investors. “The cash flow is limited, the account is negative 30%-40%, using margin (borrowing from a securities company) is sold off the mortgage, sold at a loss, but did not dare to buy back, causing many investors to give up, They just want to cut their losses, but no one is excited to participate in the market right now” – an expert commented.

In particular, many investors were asked by securities companies to sell and return their accounts to a safe rate because they used leverage to “bottom-fish” stocks in the previous few sessions, but the stock price did not go up. deeply reduced. An investor in a house in District 7, Ho Chi Minh City said that he had just sold all of his shares in his account because he was “call margin” by a securities company (required to add more money to cover loan losses – PV) after the stock price The shares he holds fell below the safe threshold. “I spent 3 billion dong, borrowed more from a securities company to “catch” stocks, but the market kept falling, making my account almost wiped out. The more I bought, the less I bought, “bottom-fishing” became “catch” The knife falls “so the loss is bigger” – this investor expressed.

A securities expert said that the market’s decline on April 25 could be considered excessive when large – small, good – bad stocks were sold “in spite of” but because there was no cash flow to support the price, even If the supply is not too large, the stock price will still fall to the floor. “Currently, the market is breaking all fundamental and technical analysis, which largely depends on the psychology of investors because the more they fear, the stronger they sell,” said this expert.

Will recover

Securities expert Nguyen Hong Diep said that during this sharp price drop, not only the groups directly involved in bad news such as speculative stocks, real estate but also stocks of companies with high prices. Good business results were also sold at floor price. “In some times, stocks can create asymmetric increase/decrease, but in a longer cycle, they will tend to balance back. Once the difference between the market and the general market price is too large, the floor price sell-off is possible Stock this year is no longer a place where easy money can be earned There will be many new investors leaving the market and a part of cash flow will also be withdrawn to find look for opportunities elsewhere,” said Mr. Diep.

However, experts say that securities are still a good investment channel in the long term. Economic expert – Dr. Dinh The Hien said that in the first trading session of the week, some “diamond” stocks in the VN30 basket also fell to the floor, the market was red when losing nearly 70 points, making many people worried. However, in the long term, securities are still a good investment channel, with an average return of 20%-30% higher than savings accounts and high liquidity.

Looking back, the stock markets of Southeast Asian countries have witnessed two extremely bad times with the Asian financial crisis in 1998 and the global financial crisis in 2008. But on average, fertility The annual return of this investment channel is still superior to that of bank deposits, such as the Philippines market up 10% and Indonesia up 13.6%…

“Vietnam’s securities have also experienced two severe crises, but the average return in the period 2000 – 2014 is still about 12%/year. Even this adjustment period in April 2022, if the market drops to 1,200 points, and recover, the average annual growth rate is still 12.56% – a very good increase compared to other countries’ markets and compared to savings” – Dr. Dinh The Hien said and said that if investors do not ” “surf” to earn high returns, but investing in good foundation stocks or allocating portfolios to open-ended funds is still better than saving.

Financial expert Lam Minh Chanh statistics that from 2020 to now, the stock market has dropped sharply 4 times. In which, the strongest decrease was 33.51% in early 2020 when the VN-Index fell from 991.46 points to 659.21. The “crash” caused the market to take 10 months to return to the old mark, then rebounded sharply. By January 2021, the market again fell about 12% but it only took 1 month to recover and surpass the old peak. In July 2021, the market lost about 11% and recovered after 2 months, then went straight to 1,500 points by the end of the year.

Currently, the “collapse” of the VN-Index from the peak of 1,524.7 points on April 4 until now, equivalent to 14.66%, has not yet shown any sign of bottoming. “No one can predict the market at this stage, not sure how much longer the market will stop, but I’m sure after the ‘crash’ comes the ‘recovery’ and continued growth in the long term. thanks to the value of good businesses. People should refrain from “surfing” because it is very risky.

If “surfing”, stay away from stocks that are speculative or show signs of manipulation… and limit the use of margin because it’s easy to “burn” your account. Always adhere to take profit, stop loss and do not “catch the bottom”, because it is difficult to know where the bottom is. However, I firmly believe that there are many stocks now whose value has fallen far from its true value. Long-term investors can choose to buy slowly. The stock price will then recover to show the value of the business,” – Mr. Lam Minh Chanh recommended.

According to MBS Securities Company, with foreign investors still maintaining a net buying circuit in the past 4-5 weeks, the declines are still opportunities for long-term investors such as institutions. As for short-term investors, it is not advisable to average the price, limit the use of margin and usually after the deep decline sessions, the market will have a technical recovery rhythm, which investors can take advantage of to restructure their portfolio. or reduce the proportion of shares.

Before the bad situation of the stock market, on the afternoon of April 25, there was a three-party meeting between the Ministry of Finance, the Ministry of Public Security and the State Bank to reach consensus on not to criminalize civil and business relations. economic. Talking to the press after the meeting, the Minister of Finance emphasized: “The recent cases are a wake-up call for the market to return to stability, transparent and healthy development and fair competition. “.

According to the Finance Minister, false rumors made the stock market shake and drop points. “This is regrettable, we will put in place policies to protect the interests of investors. For businesses that have made mistakes, we create conditions to overcome and stabilize production – business, ensure the interests of shareholders, keep jobs for employees” – emphasized the Minister.

at Blogtuan.info – Source: Soha.vn – Read the original article here