Techcombank pre-tax profit of 6,800 billion in the first quarter of 2022, deposits reached 330,000 billion

Techcombank (Techcombank – TCB) has just announced its business results for the first quarter of 2022.

Techcombank reported a pre-tax profit of VND6,800 billion in the first quarter of 2022

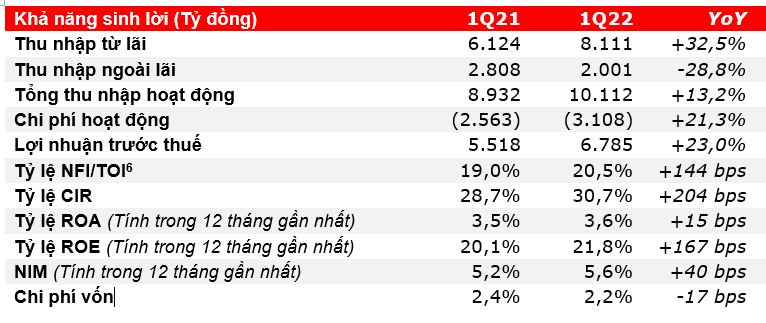

Accordingly, total operating income for the period increased by 13.2% y/y to VND 10.1 trillion, driven by strong growth in both interest income and non-interest income.

Specifically, interest income reached VND8.1 trillion, up 32.5% y/y, thanks to an expanded credit portfolio and stable net profit margin (NIM).

Service income increased by 24.1% to VND 2.0 trillion, with the contribution of fees from investment banking (IB) and letters of credit (LC), money & payments increased by 35.3% and 55.1% respectively over the same period last year.

Fees from investment banking (IB) services reached 1.1 trillion dong thanks to a 132.5% increase in fees from bond issuance consulting and a 41.0% increase in fees from other IB services. Techcom Securities continues to provide many new products and services to serve with a customer base that has more than doubled compared to the same period last year.

Source: Techcombank

The cost-to-income ratio (CIR) stood at 30.7% with operating expenses up 21.3% y/y. The bank said that the increase in operating costs was mainly due to investments in technology and new headquarters (D’Capitale) to expand the business, which increased depreciation costs. Consulting costs (among other costs) increase to support strategic decisions of the bank.

Provision costs decreased significantly, down 74.3% year-on-year, as many customers continued to recover when the Covid-19 pandemic was under control, resulting in lower provisioning, or a amount of the previous provision is reversed.

As a result, Techcombank reported a pre-tax profit of VND 6.8 trillion in the first quarter of 2022 (up 23% over the same period last year).

Techcombank made a record profit in the first quarter of 2022. (Photo: TCB)

Casa has a record high of 50.4%

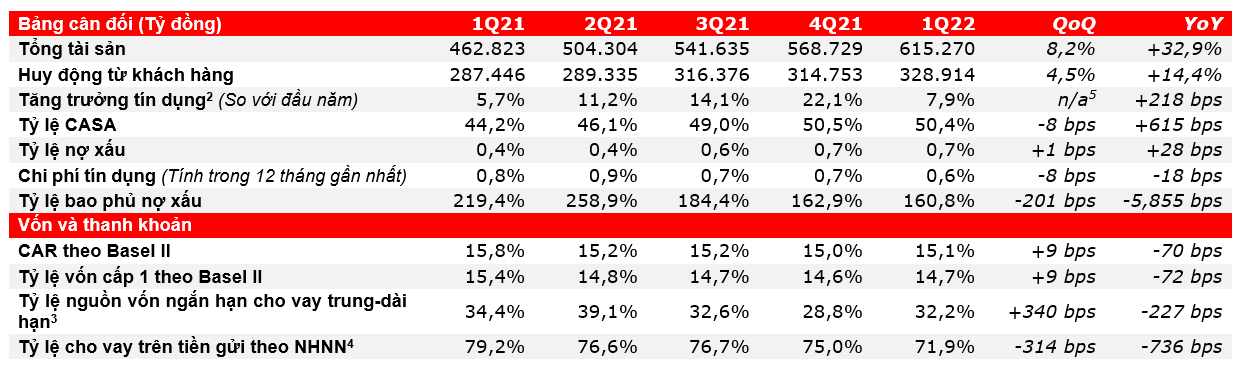

As of March 31, 2022, Techcombank’s total assets reached VND 615.3 trillion, up 32.9% over the same period in 2021.

Total credit balance of customers on the individual report at the end of the first quarter reached 418.9 trillion VND, up 7.9% compared to the end of 2020.

In the consolidated report, outstanding loans to individual customers increased by 49.1% over the same period last year, reaching VND 171.6 trillion.

Outstanding credit outstanding to large corporate customers (including loans and corporate bonds) and small and medium-sized enterprise customers was 18.1% compared to the end of the first quarter of 2021, reaching VND 270.9 trillion.

Total deposits as of March 31, 2022 were VND 328.9 trillion, up 14.4% over the same period last year.

Other sources of capital mobilization continued to be strongly exploited. Syndicated loans increased nearly 3 times to VND 34.3 trillion and valuable papers reached VND 32.7 trillion, up 25.7% compared to the first quarter of 2021.

CASA balance reached VND 165.7 trillion, maintaining a high CASA ratio at 50.4% as of March 31, 2022, unchanged from the fourth quarter of 2021.

CASA of individual customers contributed 107.8 trillion VND, up 24.8%. At the same time, efforts to expand the offering of product packages also helped increase CASA of corporate customers by 42.2%.

Term deposits reached VND 163.2 trillion, up 1.8% compared to the end of the first quarter of 2021.

Source: Techcombank

In terms of liquidity and capital, Techcombank maintained ample liquidity with a loan-to-deposit ratio (LDR4) of 71.9%. The ratio of short-term capital for medium-long-term loans3 was at 32.2% at the end of Q1 2022, lower than the level prescribed by the State Bank.

Capital adequacy ratio (CAR) according to Basel II reached 15.1% at the end of the first quarter of 2022, much higher than the minimum requirement of 8.0% of pillar I, Basel II, and inched slightly compared to the end of the year. 2021.

In terms of asset quality, Techcombank’s bad debt ratio at the end of the first quarter of 2022 was at 0.7% with a healthy bad debt coverage ratio of 160.8%, reflecting the quality and stability of assets in and around the world. after the COVID-19 pandemic.

Debt restructuring under the program to support customers affected by Covid-19 is 1.6 trillion dong, equivalent to 0.4% of total outstanding loans, lower than 1.9 trillion dong at the end of 2021.

In the first quarter of 2022, Techcombank attracted more than 0.2 million new customers, bringing the total number of customers to more than 9.8 million. The volume and value of transactions via electronic channels of individual customers in this quarter respectively reached 194.6 million transactions (up 42.2% over the same period last year) and 2.7 million billion VND (up 38.9% over the same period last year).

In 2022, Techcombank targets pre-tax profit of VND 27.0 trillion, up 16.2% compared to 2021. Bank credit is expected to increase 15.0% to VND 446.6 trillion or higher. , within the level prescribed by the State Bank (SBV).

Customer deposits will grow in line with actual credit as the Bank continues to leverage its strengths from optimizing asset-liability management (ALM). Techcombank plans to maintain the bad debt ratio below 1.5%.

“Techcombank posted good business results in the quarter 2022. The bank is operating with high profitability and recording strong demand from customer segments. However, the economic situation is still complicated. complex.

During the first quarter, the Omicron outbreak caused disruption to several businesses, including our own. And recently, the right move by the regulators to soundly operate in the bond and real estate markets has created a certain amount of anxiety in the financial markets.

However, we believe these challenges will provide opportunities for organizations that are working to control risks and build sustainable long-term business plans, such as Techcombank. Entering the second quarter of 2022, we see that Vietnam’s international borders have fully reopened, restrictions on domestic economic activities have been lifted, and the economy is growing rapidly.

Therefore, there are reasons for optimism. The bank is now stronger than ever and well-positioned to serve the dreams and aspirations of the Vietnamese people, as we together transform the financial industry and elevate the value of life.”

Mr. Jens Lottner, CEO of Techcombank

at Blogtuan.info – Source: danviet.vn – Read the original article here