Like a drought and a shower, Vietnam’s stock market had the strongest increase in Asia, investors celebrated because “two weeks of losing a car but getting the wheel back”

After two weeks of hard work to find a new bottom, VN-Index lost a total of 214 points, equivalent to a market capitalization of 36 billion USD. However, on April 26, VN-Index recovered strongly and became the stock market with the strongest increasing amplitude in Asia.

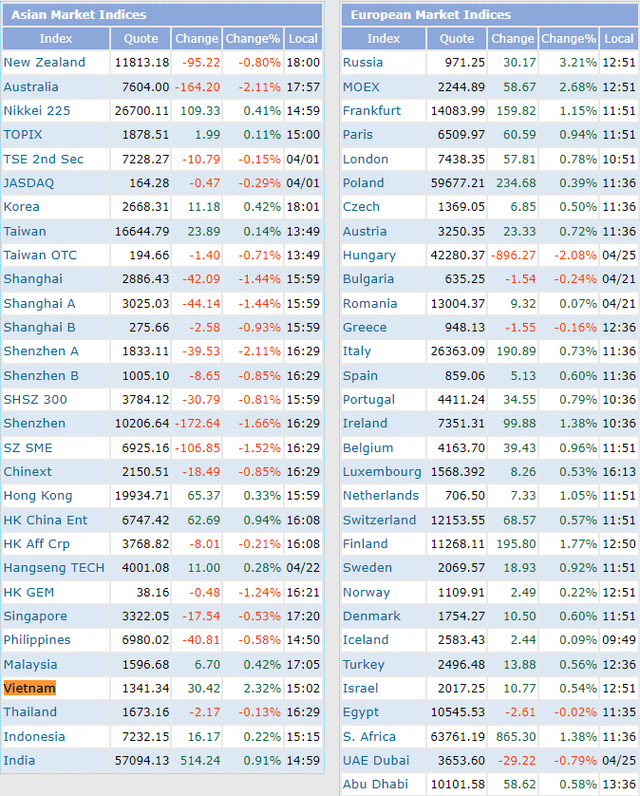

Specifically, VN-Index recovered strongly in the afternoon session and closed at 1,341 points, up 30 points, equivalent to 2.32%. This increase helped VN-Index surpassing stock indexes such as Nikkei, Shanghai, HSI, Kosppi… becoming the index with the highest increasing amplitude in Asia during the day.

VN-Index gained the most in Asia in the session of April 26

In particular, in the session, VN-Index had a “divine retreat” from -50 points at the beginning of the morning session to an increase of 30 points at the end of the session. If calculated from the lowest level of this session, VN-Index has increased 80 points from the “bottom”. Liquidity on 3 exchanges reached more than 24,000 billion dong.

Cash flow was quite active in times when VN-Index fell deeply, bottom-fishing force appeared in key stocks and banks right from the morning such as VPB, SAB, VIC, VNM, HPG, TCB… In the afternoon, the gaining momentum was spread out a series of stocks that have changed from floor to ceiling gain, such as speculative groups, real estate, industrial park real estate, etc.

On 3 exchanges, more than 700 stocks gained, making investors as happy as “rainfall meets rain” because their accounts reduced losses.

Across forums and groups about securities, investors eagerly showed off their losses. While the market’s water was boiling hot, the slight rebound after a series of deep declines in the stock market was enough for investors to regain their psychology and be less pessimistic.

Some shares of investors on the forums:

“For two weeks the stock was green, fell, the account was negative 50% including margin, but now the stock is green. It looks strange, I’m not used to this feeling”

“Now my list of 6 codes has 5 purple codes, but it takes ten more purple sessions to see the shore”

“Two weeks lost the car, the market returned to the wheel in the afternoon”

“A negative 500 million in the morning and a minus 440 million dong. If you sit still and do nothing, you can earn 60 million dong/day”

Although the decline in the past 2 weeks of many stocks caused investors to fall into heavy losses, the market’s recovery also made them reduce their losses, which is a joy in the midst of a difficult market, most investors are suffering from financial difficulties. serious money loss.

In terms of capitalization, on April 26, HOSE’s capitalization increased slightly back to 120,000 billion VND (equivalent to 5.2 billion USD), after losing 36 billion USD in the past two weeks.

On April 26, Minister of Finance Ho Duc Phuc said that, following the direction of the Prime Minister, the Ministry of Finance has worked with relevant agencies such as the State Bank of Vietnam and the Ministry of Public Security. Recently, there have been many false rumors that were not released by the authorities, causing the stock market to shake and drop. This is a pity.

The working session between the Ministry of Finance and relevant agencies such as the State Bank of Vietnam and the Ministry of Public Security discussed solutions to stabilize the capital market, financial market and stock market, contributing to promoting the growth of the economy. development of the economy.

“We agreed not to criminalize economic relations and the recent events are a wake-up call for the market to return to stable operation, ensuring fair and healthy business in the market. .

We put in place policies to protect the interests of investors, even investors or businesses that have made mistakes, and also create conditions to overcome mistakes to stabilize production and business, ensure benefits for shareholders and jobs for employees, thereby helping the business to develop again,” said Mr. Phuc.

The messages that do not criminalize economic relations have affected investor sentiment, making them less pessimistic about the rumors that surround the market.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here