Saigon girl with a stable income of 15 million/month is still not enough

High income means you have the right to enjoy a better life. But in fact, there are many young people who are too self-indulgent, giving themselves the right to spend so lavishly that they don’t have enough savings if there is an accident in life.

Thu Tra (28 years old, currently living in Saigon) said she is also looking for ways to overcome her unplanned spending habits.

Tra is currently working as a data entry for a start-up company in the e-commerce industry. Working in an office is not too hard. Her monthly income is 15 million.

Although her income is high and stable, her friend has trouble with the habit of spending too much, indulging in her own hobbies, so she often has to borrow money before her salary is due.

Tea shared: “Breakfast I usually eat at the foot of the company, sometimes it’s noodle soup, sometimes it’s bread, about 30k/meal. After that, I bought another cup of cold coffee or tea for 20k and went to the company to work. At noon, I spent an extra 50-100k to order food outside, in the afternoon “happy” to order milk tea with colleagues, about 40k/cup. Sometimes I come back from work to buy something to eat, not to mention shopping for miscellaneous things. There are days when I spend less, some days I even exceed this number“.

Not only is she comfortable in eating and drinking, but Tra also often coffees with friends, loves to buy clothes, especially hot models at the familiar stores she follows on Instagram. Therefore, the scene of running out of money to spend when it is not yet due to receive a salary occurs as usual. Even her close friends also “smooth” her about the monthly loan.

“Still single, parents at home also have an income, so they don’t need to provide support, and have no long-term financial plan, so how much money I earn, I use it all for myself. Also because there is not much money pressure, I will buy whatever I feel like. If you don’t have enough money, you can borrow a temporary loan and then pay it back next month. All my friends are easy-going people with stable incomes, when borrowing, there is no problem at all“.

Although her income is high and stable, her friend has trouble with the habit of spending too much, indulging in her own hobbies, so she often has to borrow money before her salary is due.

Without a specific spending plan or rule, Tra buys things largely on inspiration, even though she knows early on that this expense may not be necessary. She thinks that her biggest problem is not knowing how to control herself, “how to make money stir that copper”.

“I myself also realize that the vicious cycle of borrowing from month to month is not okay, but the habit of spending forever can’t be fixed. I usually borrow the previous month, when I receive the next month’s salary, I will pay the debt and then use the remaining money to spend until the middle of the next month.“.

Although she realizes that her spending is problematic, most of the time she thinks about it, she is still struggling to remind herself without finding a way to overcome this habit.

The question here is how to get rid of the situation of “upside down” borrowing money from the middle of the month, how to save money?

– Immediately change the concept of spending

The concept of bad consumption like unplanned spending, spending for pleasure rather than pragmatism, upholding the principle of personal enjoyment… of Tra is the cause of her friend’s financial trouble. Therefore, first, Tra has to establish or change her own spending concept and force herself into the framework immediately.

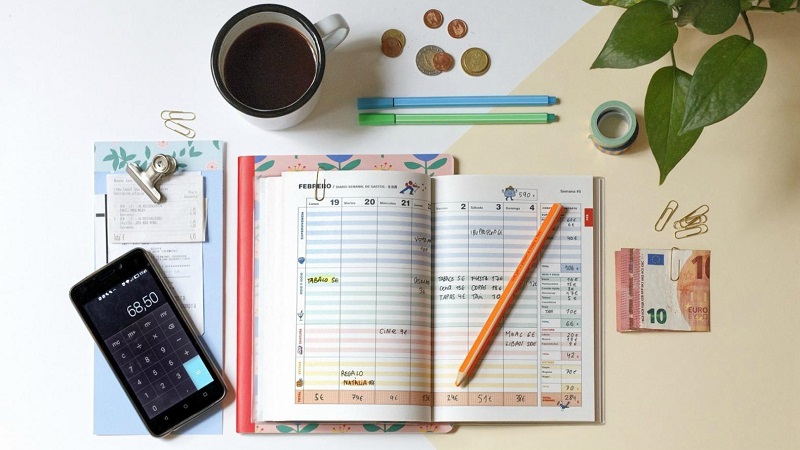

– Build the habit of recording expenses

This is an effective spending management habit applied by Japanese housewives. Recording these expenses will help Tra, who usually doesn’t care much about where his money goes, how to know his source of money.

By recording all daily expenses, Tra will not only understand where her money has been spent, but also be able to adjust spending and balance between items in the most reasonable way.

If it is not possible to record all, Tra can download the application to record spending on the phone. Set yourself a reasonable budget, control all revenues and expenditures within this budget and summarize them at the end of the day/month. Then compare with the previous day or the previous month. That way, you’ll know where you’re overstretching your hands.

– Reduce or stop borrowing from friends

Of course, she couldn’t afford to pay, so she borrowed from friends to use for personal purposes, even though her finances didn’t allow it. This method makes not only Tra herself but also her friends struggle. Ideally, Tra needs to control herself so that she doesn’t fall into a crisis of imbalance between spending and income. Reduce or try not to buy things that are beyond your means.

– Must learn how to manage money

After understanding where I’ve spent money, what I need, and what I don’t need, Tra can create a spending management plan. With the money required to spend each month, Tra should keep it separate as soon as she receives her salary. The next amount is savings into the emergency fund, preferably from 10% to 20% of income, ie 2 – 3 million/month. The rest is money you can spend on yourself.

– Save more

The biggest amount that Tea needs to spend each month will usually be food, accommodation and other living expenses. So, if you want to save more, you will need to organize everything clearly. For example, changing from a large rented room to a smaller room, sharing a room with friends, cooking by yourself instead of eating out,…

Each correct choice can help Tea save more. When long-term accumulation over 1 month, 1 year, 2 years will be able to become a large amount.

Tea can also choose for herself an appropriate savings method, such as right after receiving a monthly salary, deduct a part to save. You can remove the piggy bank, send it to your parents or, more quickly, choose a 3rd platform like a bank.

The article is written according to the character’s narration

at Blogtuan.info – Source: Afamily.vn – Read the original article here