Derivatives – “New wind” for investment market in Vietnam

Although born after traditional forms of investment such as gold, real estate, savings, … but the derivatives investment channel has attracted more than 1,000 investors participating in the transaction.

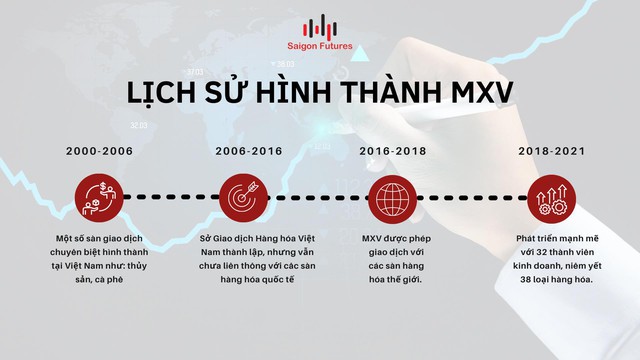

Formation process in Vietnam’s financial market

In Vietnam, the demand for financial investment is growing, people with idle capital tend not to save money in banks because of low interest rates, instead, they will choose investment channels with low interest rates. Better returns, faster payback. Therefore, investment channels from abroad have many favorable factors to enter the Vietnamese market such as: cryptocurrencies, derivatives,… However, crypto-currencies have not yet been established. recognized by Vietnamese law and not yet licensed for legal transactions.

For derivatives, this is an investment channel licensed and managed by the Ministry of Industry and Trade under Decree No. 158/2006/ND-CP and Decree 51/2028/ND-CP. Accordingly, the Commodity Exchange of Vietnam (MXV) is a unit licensed by the Ministry of Industry and Trade to connect with the World Commodity Exchanges. MXV offers a full range of contract trading types including: Standard Futures Trading (Futures), Options Trading, and Spread Trading based on Contracts standard term. The commodities traded at MXV are divided into 4 groups: agricultural products (soybean, raw rice, wheat, corn…); industrial raw materials (cotton, coffee, rubber, cocoa, sugar…); metals (platinum, silver, copper, iron ore…); energy (crude oil, natural gas, blended gasoline).

By the end of Q1/2022, MXV had more than 33 trading members and 4 brokerage members, of which Joint Stock Company Saigon Futures (abbreviated Saigon Futures) is one of the first business members, together with MXV to build and develop the derivatives market to this day.

About Saigon Futures Joint Stock Company

Saigon Futures was licensed by the Vietnam Commodity Exchange on October 22, 2018 under the operating license number 20/2018/QD-MXV. Over more than 4 years of establishment and development, Saigon Futures has further affirmed its position and reputation in the domestic derivatives market, through the awards and titles that Saigon Futures collective has achieved. In 2020, Saigon Futures was honored to receive the “Excellent Business Member” award, recognizing the company’s contributions to developing the commodity market into a safe and effective investment channel.

On June 4, 2020, Saigon Futures was one of the few businesses allowed to trade energy products such as crude oil and natural gas.

Especially in 2021, Saigon Futures is a business member to receive the SME100 (Fast Moving Companies Awards) award honoring the top fast and reliable small and medium enterprises in Asia by SME magazine. Asia voting and organizing.

During more than a period of establishment and development, Saigon Futures has always been in the Top 3 leading business members in the derivatives brokerage market in Vietnam.

To achieve these achievements, Saigon Futures constantly develops and improves the quality of personnel training, applies 4.0 investment technology to bring good results to customers. In terms of personnel, we have a team of fundamental analysts and technical analysts with solid financial background and knowledge, 100% of our team of highly trained consultants and collaborators. from the Vietnam Commodity Exchange. In terms of technology, Saigon Futures is a technology leader in the derivatives market with an e-KYC online identity account opening system, trading account management system and investment advisory groups. Exclusive deals for individual, corporate and VIP customers.

On August 23, 2021, Saigon Futures launched an e-KYC account opening system built on the basis of AI artificial intelligence and OCR (optical character recognition) technology allowing users to Quickly extract information according to identification documents, save time to register to open an account, along with Face Matching technology, help accurately identify the user’s face, increase security and accuracy.

With the motto “Dedication – Integrity – Objectivity – Professionalism”, Saigon Futures has been constantly making efforts to improve creativity, professionalism and professional ethics in the commodity derivatives market, creating value value differences in capacity and technology, in order to bring customers safe, fast and effective transaction experiences.

Saigon Futures Joint Stock Company

Top 3 business members of the Vietnam Commodity Exchange leading the market share of derivatives, the enterprise won the SME100® award

Hotline: 0286 686 0068

Email: [email protected]

Website: www.saigonfutures.com

Fanpage: Saigon Futures Inc.

Youtube: Saigon Futures

LinkedIn: Saigon Futures_Commodity Trading Firm

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here