From next year, will submit to the General Meeting of Shareholders a cash dividend of 30% of profit after tax

VPBank plans a huge capital increase, unaffected by stock market fluctuations

Information at the General Meeting of Shareholders (AGM), Mr. Ngo Chi Dung – Chairman of VPBank’s Board of Directors said that in 2022 VPBank continues to plan to sharply increase its charter capital to nearly VND 80,000 billion through private placement to shareholders. foreign investment and pay dividends or bonus shares from equity.

Accordingly, VPBank is expected to issue a maximum of more than 2,237 million shares in the first phase to increase its charter capital from VND 45,056 billion to VND 67,434 billion, equivalent to a rate of 50% (shareholders owning 1,000 common shares are entitled to receive a share capital of VND 65,056 billion, equivalent to VND 67,434 billion). entitled to receive 500 new shares). The expected implementation time is in the second or third quarter of 2022.

Next, in the second phase, VPBank plans to privately issue up to 15% of charter capital to foreign investors, bringing the total foreign ownership ratio in VPBank to a maximum of 30% of charter capital. The maximum number of shares to be issued is 1,190 million shares. The issue price is decided by the Board of Directors according to the agreement and negotiation between the two parties, ensuring not to be lower than the book value of VPBank.

Issuing time for foreign investors is after approval from the competent state agency, expected in 2022. If the two issuances are completed, VPBank’s charter capital will be up to 79,334 billion dong, the highest level of charter capital in the banking system today.

Previously, in 2021, VPBank’s charter capital increased sharply from VND 25,000 billion to more than VND 45,000 billion through stock dividends at the rate of 80%.

“Whether the stock market is favorable or not does not affect the bank’s capital increase, this year will certainly increase capital successfully,” emphasized Mr. Nguyen Chi Dung.

VPBank’s 2022 Annual General Meeting of Shareholders. (Photo: VPB)

VPBank’s shareholders’ meeting also approved the plan to issue shares under the employee selection program (ESOP) with the expected number of 30 million shares from treasury shares.

These shares will be restricted from being transferred for 3 years from the closing date of the sale. This rate will be gradually released at the rate of 30%, 35%, 35% over the years.

The expected selling price for the number of shares is 10,000 VND. The proceeds from the issuance will be used to supplement the working capital of the bank.

Real estate credit tightening does not affect 107% profit growth target

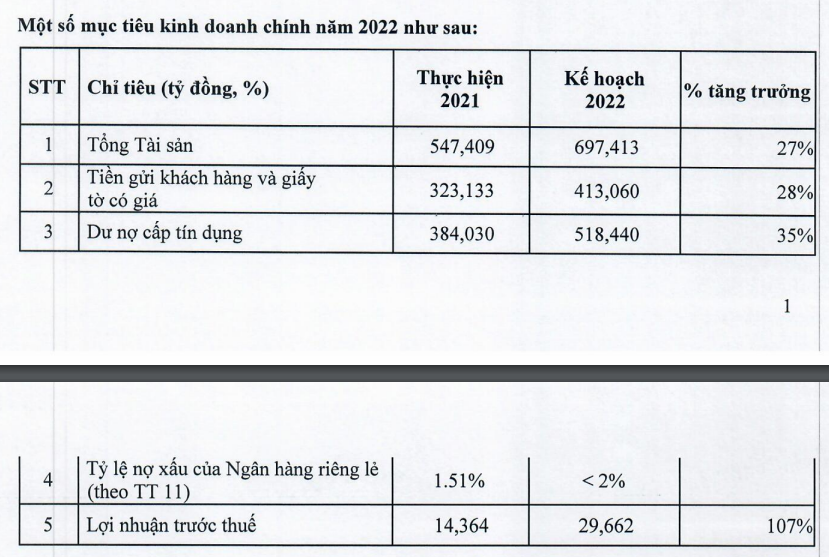

In terms of profit plan, VPBank aims to increase pre-tax profit in 2022 to VND 29,662 billion, up 107% over the previous year. This profit is currently only ranked 2nd in the whole system, after Vietcombank (over VND 30,000 billion).

Total target assets increased by 27% to VND 697,413 billion; deposits increased 28% and credit increased 35%. VPBank said that the 35% credit growth figure was given based on the needs and capacity of the bank, while the actual figures will be implemented based on the maximum limits and regulations of the State Bank.

Regarding VPBank’s 2022 profit plan, in the discussion, a shareholder asked: Does the government’s tightening of credit in real estate affect the bank’s 2022 profit plan?

Responding to shareholders, Mr. Nguyen Duc Vinh, General Director of VPBank said: The guidelines and policies of the State are very normal, when the market develops too hot, it is necessary to take measures to contain it. However, real estate is an important sector of the economy in general and for the banking industry in particular.

Currently, real estate loans account for less than 10% of VPBank’s total outstanding loans. However, lending to real estate buyers continues to be an important segment of the bank. Home loans are necessary, however, for loans to buy resort real estate, loans with speculative elements, the Board of Directors will have control measures.

In 2022, even if the real estate market is quiet, it will only have a small impact on the bank’s operations, which will be offset by other business segments. The bank’s business plan is completely based on the general situation.

Sharing with investors about the goal of increasing pre-tax profit of nearly VND 30 trillion, VPBank’s General Director Nguyen Duc Vinh admitted that this will be a challenging plan, but the bank has favorable factors. to make this growth goal a reality.

“Why have we set such a big target? Firstly, we believe that the market demand of the economy will increase again after a difficult period, especially thanks to the Government’s strategies in the future. supporting economic recovery with hundreds of trillions of dong being put into the market. Second, VPBank with a solid foundation and ready system will have high growth potential,” shared Mr. Vinh.

Mr. Ngo Chi Dung – Chairman of VPBank’s Board of Directors emphasized that, with the capital foundation reached by the end of this year, VPBank not only has enough grounds to ensure high growth as planned in the next 5 years but also expected by the Board of Directors from next year. will submit to the General Meeting of Shareholders a cash dividend of up to 30% of the annual profit after tax.

at Blogtuan.info – Source: danviet.vn – Read the original article here