TikTok Rises, Big Tech Not Enough to Allay Worries of Growing Ad Recession

The war in Ukraine, rising inflation, changes to Apple’s privacy, and an overall drop in ad spend help explain why Facebook, Google, Amazon, and Twitter are all reporting revenue numbers. disappointing this week. But there is another growing threat to them: TikTok.

The app for viral short videos has grown in popularity, becoming the world’s third-largest social network last year, behind Meta’s Facebook and Instagram, according to Insider Intelligence. Atlantic Equities analysts wrote in a note: “Across the industry, short-form video continues to account for a larger share of time-preferred. The key drivers of and benefiting from this trend are: TikTok, with some concerned that this is creating a competitive challenge for Meta.”

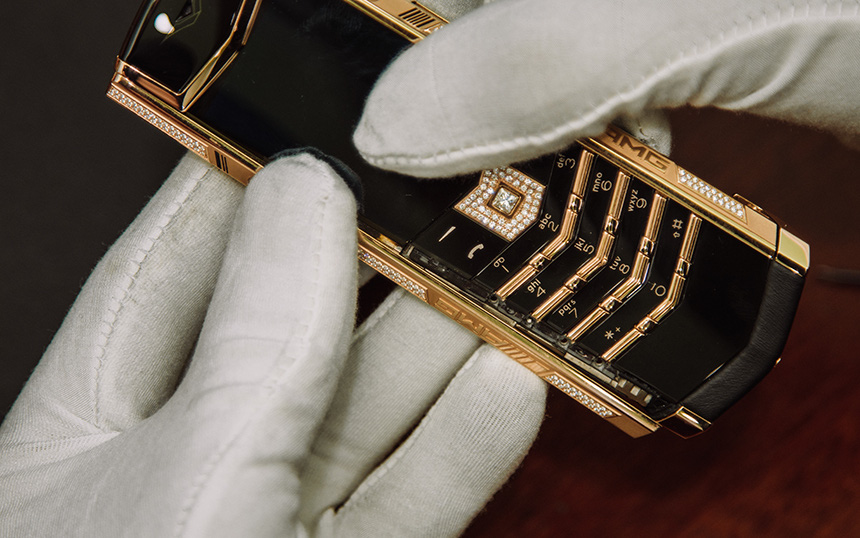

TikTok accounts for a large share of earnings reports from the tech sector, as digital ad giants struggle to keep up. Photo: @AFP.

It is known that TikTok is owned by China’s ByteDance, which is privately held, and is reported to be worth $140 billion. Insider Intelligence estimates TikTok will have 755 million monthly users globally this year, and says its market share on the social network will hit 20% this year, close to 25% in 2024.

By 2022, Twitter and Snapchat are expected to generate $5.58 billion and $4.86 billion in ad revenue, respectively. However, as far as TikTok’s ad revenue goes, it’s expected to triple this year from $3.88 billion to $11 billion. This is more than the total ad revenue of Twitter and Snapchat combined. And surprisingly, TikTok’s $6 billion in ad revenue, more than half of its total, is forecast to come from the US, despite regulatory concerns regarding user data being sent from America to China. Furthermore, TikTok’s ad revenue will reach $23.58 billion by 2024.

Meta said that Facebook’s ad revenue grew only 6.1% in the first quarter of 2022, the slowest growth in the company’s 10-year history as a public company. Meta also has a product called Reels that competes with TikTok in the short-form video market. The company told investors that 20% of time on Instagram was spent on Reels, while 50% of time on Facebook was spent on video. “Short-form video is growing very quickly,” Facebook CFO Dave Wehner said in the earnings report.

In Alphabet’s annual report, the company recognized ByteDance as a competitor in the social network, along with Meta, Snap and Twitter, and a competitor in digital video services, where Amazon, Apple, Disney and Netflix also have similar competing services.

Alphabet’s first-quarter results this week trailed estimates, largely due to a major shortcoming at YouTube, which was supposed to grow 25% but ended up only 14%. Consumers are spending more time on YouTube Shorts, which grew to 30 billion views in the quarter, a quadrupling from a year earlier, executives say.

‘TikTok Competition Concerns’

YouTube is testing ad formats on Shorts, but in the meantime, analysts are slashing their growth forecasts. Stifle reduced its estimate of YouTube’s growth rate for the second quarter from 13% to 10%, and Cowen Equity Research reduced its forecast from 19.7% to 7.5%.

“We think the earnings results were largely positive, but not enough to assuage investors’ growing advertising recession worries,” BMO Capital Markets analysts wrote in a note. , as well as growing concerns about TikTok competition after YouTube missed out once again with margins no longer reaching the same magnitude as before.”

Last week, the Snap platform reported disappointing results, with CEO Evan Spiegel telling investors that the first quarter of 2022 “proves more challenging than we expected.” Recently, Twitter had a revenue shortfall in the first quarter. The company did not comment on details as it is being acquired by Elon Musk. Then there’s Amazon. Unlike the major social media platforms, Amazon is not explicitly tied to TikTok. Brands are advertising their products on Amazon’s dominant app and e-commerce site.

Still, even Amazon’s fast-growing ad business fell short of analyst estimates, up 23% from a year earlier to $7.88 billion, but still low. $8.17 billion more than expected, according to StreetAccount.

“The pandemic and the ensuing war in Ukraine have brought extraordinary growth and many challenges,” Amazon CEO Andy Jassy said in a statement. announced, referring to the company’s widespread downturn. Here, ads don’t appear much in the company’s Q1 earnings report.

“We hear there’s growing concern that TikTok is a competitor to YouTube’s mobile location,” Michael Nathanson, an analyst at MoffettNathanson told Alphabet executives. “The new trend is likely to point to weakness at YouTube as concerns grow about changing engagement and monetization trends at TikTok,” said Loop Capital analysts. Loop’s Alan Gould brought the matter up with Facebook executives.

“You’ve been pretty open about competition issues on TikTok, which seems to be affecting the entire industry right now,” Gould said during the earnings call.

TikTok dominates tech earnings, Big Tech struggles to compete with digital advertising. Photo: @AFP.

The Rise of TikTok

Earlier this month, a Piper Sandler survey of more than 7,000 US teenagers found that TikTok had overtaken Snapchat as the social networking platform of choice for US teens. Meta-owned Instagram makes the top 3. Meanwhile, data from Cloudfare shows that from September to December of last year, Tiktok.com was the most popular website in the world, while Facebook.com comes in at number three. A year earlier, TikTok’s domain was the seventh most popular website, while Facebook.com was in second place.

According to Hootsuite, TikTok is the most downloaded app in 2021, with 656 million downloads — marking the third year in a row it holds the top spot. Instagram, the second most downloaded app, was downloaded 545 million times by 2021, Hootsuite research says.

While TikTok attracts younger users of the social network, Facebook is struggling to keep them. Last year, a leaked internal memo revealed that the percentage of teen users on its flagship platform has dropped 13% since 2019 and is expected to drop another 45% over the next two years. .

TikTok had its billionth user in 2021, four years after its global launch, half the time it took Facebook, YouTube or Instagram, and three years faster than WhatsApp. Insider Research asserts that: “Overall, TikTok’s growth into a global phenomenon is unbelievable quickly.”

at Blogtuan.info – Source: danviet.vn – Read the original article here