Top 10 debt securities investment banks by the end of Q1

Up to this point, commercial banks have in turn announced their financial statements for the first quarter of 2022.

On April 28, an economic research organization completed a report gathering data on the top 10 commercial banks investing in debt securities by the end of the first quarter of 2022, defining the latest scale at this time.

According to specialized theory, equity securities (Equity Security) are securities issued to the market by a joint stock company. This product is to confirm ownership of a part of the company’s assets and income. This also means that an investor who owns securities is a person who owns a part of the company and enjoys the benefits from the company.

And debt security (Debt Security) is a type of security to certify the lender-borrower relationship between the owner and the issuer. Debt securities come in many forms such as corporate bonds, government bonds, municipal bonds, local government bonds, etc.

This type of security is bought or sold between two entities and has certain terms such as borrowed amount, interest rate, maturity and renewal period. In some developed economies, debt securities are traded quite commonly on the stock market.

In Vietnam, corporate bonds – a type of debt security – are becoming increasingly popular, associated with a market with rapid growth in recent years.

Recently, corporate bonds (DN) have become a topical topic, when a number of events arise that state management agencies must intervene; Potential risks to investors show signs of being revealed, accordingly.

However, as mentioned in a recent article, corporate bonds in Vietnam should be distinguished in two groups: corporate bonds issued by credit institutions and those of non-credit enterprises. This distinction is also used to determine the coefficient of risk involved.

Previously, corporate bonds issued by credit institutions had a lower risk coefficient, but other credit institutions invested (owned) did not have to make provision for risks. But now, the State Bank has regulations to make provision, as well as separate in determining the types of capital to declare the capital adequacy ratio (CAR). This may be a regulation that is meant to limit the situation of turning on the capital wall, increasing the CAR ratio in the system…

As for corporate bonds issued by non-credit economic organizations, as clearly shown in the past time, many functional clues have continuously warned of potential risks, even arising.

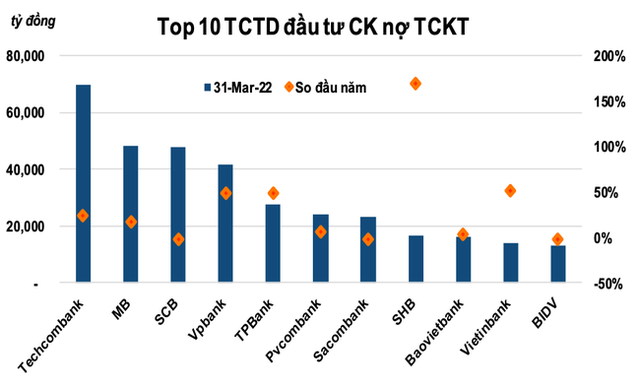

Latest update, according to the above-mentioned economic organization, the top 10 commercial banks with debt securities investment balance of economic organizations as of March 31, 2022 include: Techcombank, MB, SCB, VPBank, TPBank , PVcomBank, Sacombank, SHB, BaoVietBank, VietinBank and BIDV.

The top 10 above shows that not all of the leading commercial banks in the market invest heavily in debt securities of economic organizations. And in this top 10, SHB has the highest growth compared to the beginning of the year.

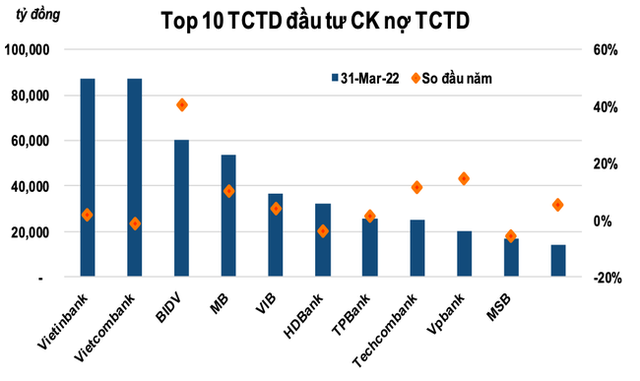

Meanwhile, with debt securities issued by credit institutions, the top 10 commercial banks with investment balances as of March 31, 2022, in contrast, the leading commercial banks with large balances such as VietinBank, Vietcombank, BIDV , MB, VIB, HDBank, TPBank, Techcombank, VPBank, MSB…

at Blogtuan.info – Source: cafebiz.vn – Read the original article here