Simultaneously increasing deposit interest rates, which bank’s lending profit margin narrowed the most?

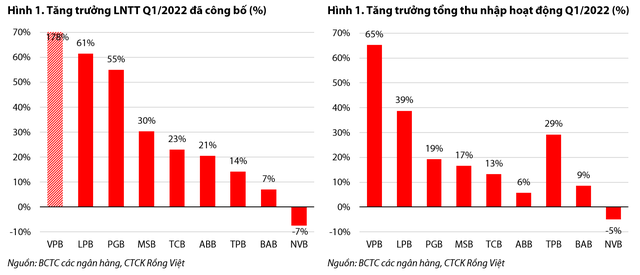

Amid growing concerns and the impact on stock prices, a number of banks have announced their first-quarter results for 2022, showing strongly divergent earnings growth.

Growth advantage favors big banks

With about 9 banks publishing their financial statements at the time of data collection, VDSC estimates the average growth in total net interest income of this group at 21%, total operating income at 36%, and growth in pre-tax profit reached 70%. In which, VPBank announced abnormal growth in profit thanks to the bancassurance prepaid fee.

The growth of income components shows a large contribution of non-interest income, CIR and cost of credit. Net interest income grew strongly at large private banks due to high credit growth compared to the beginning of the year and the continued disparity between credit expansion and deposits.

VDSC believes that, although the growth of real estate loans and corporate bonds has slowed down, credit still recorded a sustainable growth momentum, as of April 19, 22, increasing by 6.37% from the beginning of the year and increased 16.0% year-on-year in 2021, the highest since the beginning of the pandemic. Strong growth came from both short-term loans of 6.84% and long-term loans of 5.86%, of which home and auto loans contributed significantly.

”This shows that disbursement is still taking place normally in most banks. However, the credit policy may have been changed to be retail oriented and lending to businesses not for real estate purposes,” the analysis team assessed.

VDSC expects the growth rate of balance sheet among banks will continue to diverge sharply in 2022 and the advantage will be in favor of big banks.

From the 1Q2022 business results of a number of banks, momentum is in line with this expectation in the leading private banks while the smaller banks posted negative growth. On a year-on-year basis, the high credit growth limit in 2021 and the strong credit expansion in the first quarter of 2022 have brought about good credit growth at large private banks, supporting net interest income.

According to VDSC, despite the recovery in the first quarter of 2022, the deposit growth rate of these big banks is still slower than the credit expansion process. This has also supported the interest margin (NIM) ratio.

The divergence in profit growth among banks will continue into the second quarter of 2022, before the industry as a whole benefits from low comparability and credit growth limits are usually raised in the second half of 2022.

The uneven growth in credit and deposit growth was one of the reasons why some banks’ NIMs expanded in the first quarter of 2022.

Which bank has the strongest NIM contraction?

Assessing NIM prospects, VDSC believes that there will be a relative divergence. Interest rate movements in the first quarter of 2022 have proved this. 5 out of 9 banks that published their financial statements saw NIM decrease QoQ. 3 out of 4 banks with expanded NIM are group 1 banks – large-scale private banks.

Accordingly, deposit interest rates in the first quarter of 2022 increased by an average of 3 basis points compared to the fourth quarter of 2021. Average lending yields fell 8 basis points. This led to a narrowing of the market interest rate differential 1 of many banks.

Deposit rates increased the most at Techcombank (29 basis points), VPBank (19 basis points) and TPBank (14 basis points). These banks also had the highest deposit growth. Only 3/9 banks reduced the average deposit interest rate quarterly.

Lending interest rates increased the most at VPBank (55 basis points), VPBank was also the only bank with positive lending rates in the first quarter of 2022.

Lending interest rates fell the most in the quarter at Bac A Bank, followed by TPBank. For TPBank alone, deposit yields increased by 14 basis points, but lending rates dropped sharply, leading to a continuous contraction in TPBank’s NIM (quarterly).

VDSC’s data shows that TPBank’s NIM decreased from 6.8% in the fourth quarter of 2021 to 6.4% in the first quarter of 2022; Techcombank decreased from 6.9% to 6.5%, Bac A Bank decreased from 2.9% to 2.2%; while VPBank increased from 9% to 9.3% and NCB increased from 4.5% to 4.9%.

Deposit rates listed at private banks are increasing. This is reflected in the increase in average deposit interest rates in the first quarter of 2022 compared to the fourth quarter of 2021. Meanwhile, state-owned banks have maintained interest rates since mid-2021. The rate of increase in deposit interest rates at leading private banks is slowing down, so expect listed deposit rates. listing was quite stable in the second quarter of 2022. Towards the end of the year, it is expected that interest rates will still increase compared to current levels.

“Private banks have been more active in attracting deposits due to their smaller size. Rates have slowed recently, but we expect momentum to return in the second half of 2022.” , VDSC emphasized.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here