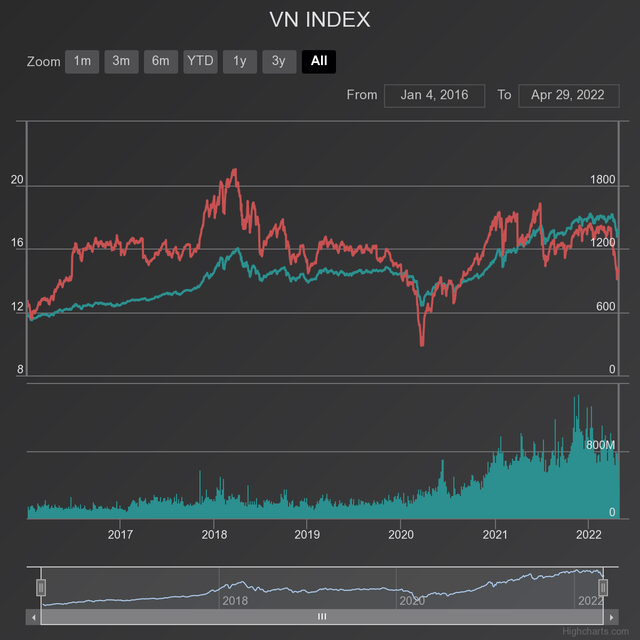

The deep correction pulled the market P/E below 15 times, is stock valuation cheap enough?

Looking back at history, the correction of VN-Index is a very common thing. Statistics for the past 21 years, the stock market has experienced many ups and downs, at least there will be a market correction in a year.

If you look at the general index of the market, the decrease is not too large, but for investors who use high leverage, they can suffer heavy losses or even burn their accounts if they buy hot speculative stocks. In particular, the VN-Index’s deep drops pulled the P/E index below 15 times. This leads many investors to ask, is the market valuation cheap enough?

P/E VN-Index has fallen below 15 (Source: Algoplatform)

Discussing at a recent seminar, Ms. Tran Khanh Hien, Director of VNDirect Analytics, said that the current market P/E level is less than 15 times – the cheapest in the last 3-4 years, especially the P/E level. VN30 is much cheaper than P/E VN-Index. An attractive valuation with a profit prospect of enterprises in the whole market is forecasted at about 23%, an impressive figure compared to other countries in the region. Therefore, if there are no unexpected events, this valuation area is cheap compared to the company’s profit growth.

Besides the valuation factor, Ms. Hien still highly appreciates the prospect of the stock market thanks to the favorable factors of the economy. Accordingly, the figures related to FDI and exports are still bright spots, showing that our economy is recovering strongly. Although there is pressure on the risk that inflation may escalate, it is still under control.

Ms. Tran Khanh Hien, Director of VNDirect Analytics Division

According to Ms. Hien, what investors need to pay attention to is policies related to capital and financial markets. Accordingly, major economies are moving to raise interest rates, only Vietnam, Thailand and China maintain the loosening monetary policy.

It is forecasted that the State Bank will maintain the policy of raising the basic interest rate in the first 6 months of the year, but the deposit interest rates of the joint stock commercial banks have increased somewhat, but mainly only locally. Regarding credit growth, as of mid-April, it was 6%, a strong increase showing that businesses have started to confidently borrow again to boost production.

Also giving his opinion on the market valuation, Mr. Minh Le – VN VALUE fund leader said that the current PE valuation ground is cheap enough if interest rates remain stable as forecast. In comparison, Mr. Minh said that the deposit interest rate of 6.5%, in the coming time, may remain at that level. However, investing in businesses has a P/E of 15 times, but the company’s profit growth next year can be up to 20%. Therefore, if interest rates continue to move sideways, P/E is currently at a very attractive level.

According to Mr. Cao Minh Hoang – Investment Director of IPA Fund Management Company: “The outlook for this year is relatively optimistic thanks to the large amount of room for support packages from the Government. At the same time, Vietnam’s economy is starting to show signs of excitement again after two years of being affected. strong from Covid. On the other hand, I think the rate hike forecasts are already reflected in current market values. With the above prospects, I think the market P/E deserves at 15 – 17 times“.

After many fluctuations, Mr. Hoang said that the stock market is still a very effective investment channel if we go long-term, long-term investors have the opportunity to win after each market fluctuation, and short-term investment must accept the fluctuations of the market due to many different factors.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here