Do the following 3 things correctly so that public procedures are no longer “mainstream”

Deadline for submission of personal income tax finalization documents in 2021 direct tax settlement no later than the last day of the 4th month from the end of the calendar year, in case the deadline for submitting tax finalization dossiers coincides with a prescribed holiday, the time limit for submitting tax finalization dossiers is the next working day. according to.

Therefore, the deadline for finalization of personal income tax in 2021 of individuals who directly finalize tax is May 4, 2022.

For dossiers with additional PIT payable after finalization of more than 50,000 VND, it is necessary to pay attention to declare tax on time so as not to be penalized for administrative violations.

Particularly for PIT refund dossiers, no regulations on penalties for administrative violations due to overdue declaration shall be applied. In case an individual has a PIT refund but is late in submitting a tax finalization declaration as prescribed, no penalty will be applied for administrative violations in filing tax finalization overtime.

Therefore, individuals who have an overpaid tax amount when finalizing and request a refund are not required to be on time on May 4, 2022.

In principle, every month when paying income, the paying agency has temporarily withheld PIT. Then, in the personal income tax finalization period (usually according to the calendar tax period), the paying agency will make the final settlement, that is, recalculate the total taxable income, the total deductions, and then calculate the total taxable income. exact total amount of PIT payable in the period.

If the tax amount according to this calculation is greater than the amount temporarily paid in the year, the taxpayer (NNT) will have to pay the remaining amount.

On the contrary, if the tax amount after finalization is smaller than the amount temporarily paid in the year, the taxpayer will be refunded the difference.

In the case that at the time of tax finalization, the taxpayer who is “abandoned”, that is, has quit his job at the old agency and has not worked at the new agency will not be able to authorize tax finalization but must do it himself. Personal income for yourself.

Currently, the tax authority has implemented an electronic filing method on the electronic tax system so that taxpayers can register and use an electronic tax transaction account without having to bring a paper copy to the tax authority. Tax.

With this method, taxpayers can proactively complete and submit documents anytime, anywhere without having to go directly to the tax office, minimizing administrative procedures, saving time and costs. and take initiative in personal work, prevention of covid 19 epidemic.

Some points to note for those who do tax finalization by themselves and make electronic tax returns

One documents that need to be prepared include: Identity card, household registration book, proof of personal income tax deduction (this will be sent to you by your old agency)

Two is that you need an account to make the online declaration, the account name is your personal tax code, the password is issued by the tax office and you will change the password after you have created the account.

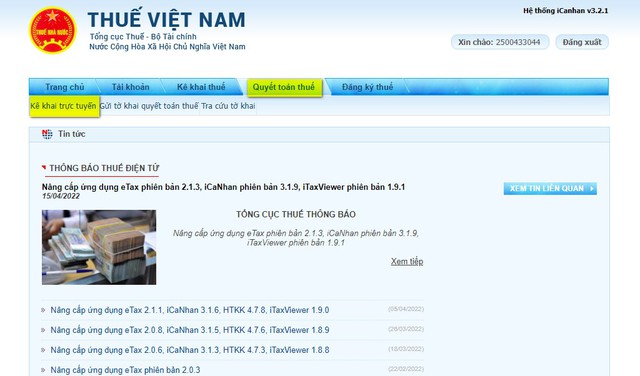

You log in to thuedientu.gdt.gov.vn and click register

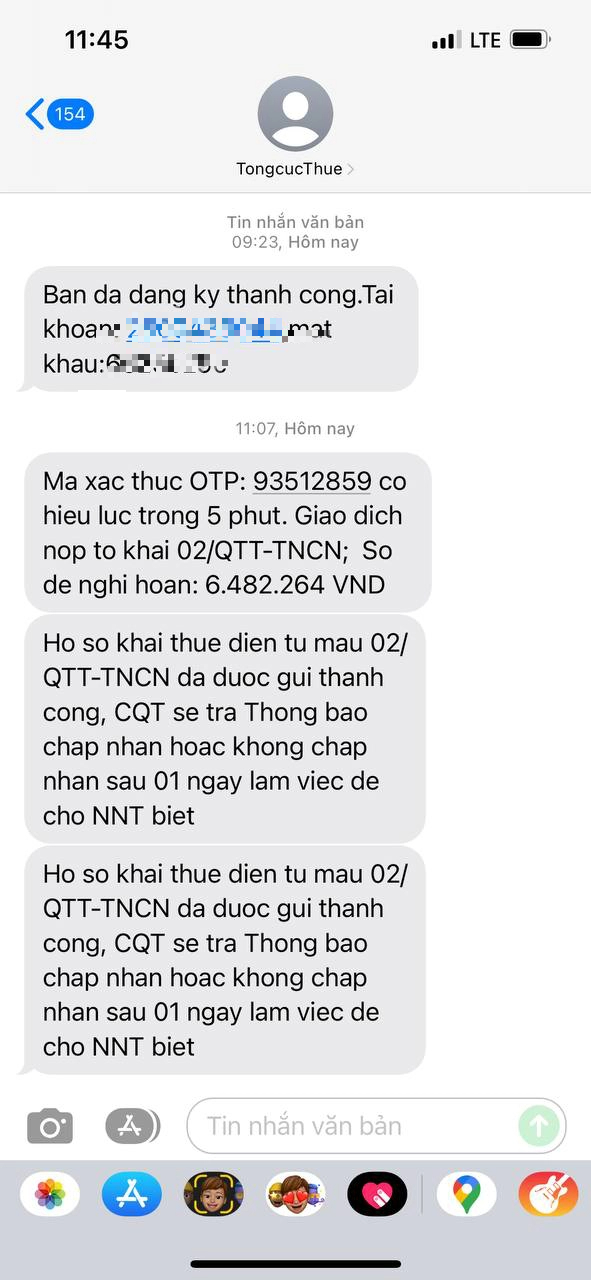

In the case of the writer, due to going directly to the Tax office at the place of permanent registration, my password was manipulated by the tax officer on the system and sent a message from TongcucThue immediately. It is not clear, how long will it take to receive the password in the cases of online operations and waiting.

But remember the principle, you must have this password to log in and make an online profile.

After successfully logging into your account, go to the Tax Finalization / Online Declaration section

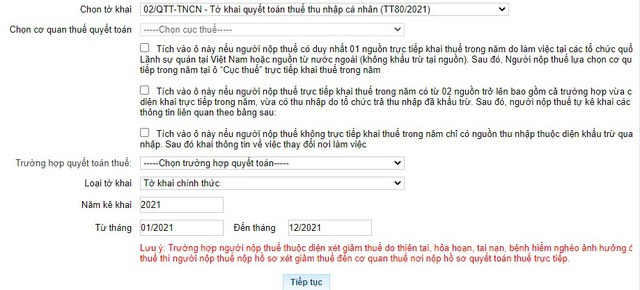

At this time, a screen will appear for you to choose a declaration, depending on which case you choose to choose the corresponding declaration. Note that currently the tax finalization is being carried out according to Circular 80/2021/TT-BTC issued on September 29, 2021. You read the content and fill it correctly according to your income situation.

Next will appear a declaration screen for you to fill in information, in which note the items to be filled in: Total income tax incurred in Vietnam, Tax withheld at the income paying organization. These information must match with the PIT withholding documents (old) sent to you by the paying agency.

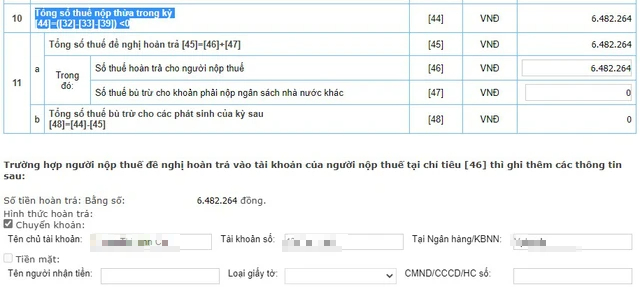

The system will automatically calculate the Total amount of overpaid tax in the period (in TH the writer gets a refund), fill in the tax refunded to the taxpayer and fill in the bank account number below.

Next, you need to press to complete the declaration but…. everything here begins to become “messy” with the “unspread mats”.

The third thing You need to prepare that is pre-installed itax viewer software, this is very familiar to accountants who often have to file online tax declarations, but if you are not in the industry, you will inevitably be surprised.

To submit the declaration, you must export the declaration as an xml file. The itax viewer software is used to read the xml file, so be prepared before rendering the declaration to make sure you don’t have to do it again and again.

Don’t forget to attach a scan file of your withholding documents including ID card (CCCD), household book and PIT withholding documents provided by the income paying agency.

Upon successful submission of the declaration, the General Department of Taxation will send you a message like this

After successfully submitting the electronic tax return, all you have to do is wait for the tax agency to return the acceptance/disapproval notice after 1 working day.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here