Nearly 70% of Asia’s largest stocks fell in just 2 months

The capitalization of prominent enterprises such as Tencent, Taiwan Semiconductor Manufacturing Co. and Samsung Electronics fell as high raw material costs and supply chain concerns pressured manufacturers. However, the capitalization of energy and commodities companies in India, Thailand and Malaysia increased as their output was boosted and benefited from higher prices.

Nikkei Asia compared the capitalization of Asia’s largest businesses from February 23, a day before Russia launched its military operation in Ukraine, to April 22. According to the QUICK-FactSet database, 627 companies were valued at more than $10 billion as of March 23, of which 31% recorded an increase in capitalization while 69% saw a sharp decline in value in 2 months.

When the conflict occurred, the global market was also affected by the fact that the US Federal Reserve (Fed) began to implement a policy tightening roadmap. The conflict between Russia and Ukraine destabilizes the market, directly affects economies closely linked with Russia and pushes up global food and energy prices sharply.

Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Manageme, said: “Most of the Asian market is still highly trade-oriented. The Russia-Ukraine conflict is also unlikely. remove the region’s role as an important trading partner with the EU.”

China’s economic growth momentum has slowed, Mitra added, with import growth falling to nearly 0% year-on-year. Moreover, the Fed’s tightening of monetary policy also affects the growth rate of the world’s largest economy and many other countries later this year. According to him, these factors and rising input costs have become the main obstacle to the prospect of Asian stock markets.

Market capitalization of Asia’s top enterprises.

According to QUICK-FactSet data, large Chinese stocks have led the Asian downtrend for the past two months. Shares of ride-hailing firm Didi Global fell 59% – the largest of the 627 companies tracked. Meanwhile, JD.com lost 27%, Tencent and Alibaba both fell 23%.

High-valued tech stocks are among the most vulnerable to rising interest rates because future earnings will be limited. However, tight monetary policy is not the only factor causing the sharp decline.

Mike Leung, chief investment officer of Wocom Securities, said: “The market is concerned that China will not meet its growth target. The strict blockade regulations in Shanghai and likely to be applied in Beijing are getting worse. disrupting supply chains, along with transportation. The main economic indicators all slowed down in March.”

Meanwhile, in Singapore, shares of Sea – Shopee’s parent company, plummeted 27% as the company was affected by the tightening of monetary policy by central banks and investors fleeing technology stocks. . Taiwanese chip maker TSMC also lost 11% of its market value, while Samsung lost 8% in the two months since Russia launched a military operation in Ukraine.

Last month, Samsung delayed shipments of smartphones and other products to Russia amid the massive withdrawal of Western corporations from the country. The blockade of Shanghai also raised concerns about disruption to the supply chain.

Meanwhile, according to QUICK-FactSet data, the biggest gainers in Asia since the Russia-Ukraine conflict are mainly in the energy and commodity-related sectors, especially in the emerging economies. emerging economy.

India’s Adani Total Gas topped the list, with a 49% increase. It is one of the most prominent corporations in the South Asian country, supplying natural gas to industrial, commercial and residential customers.

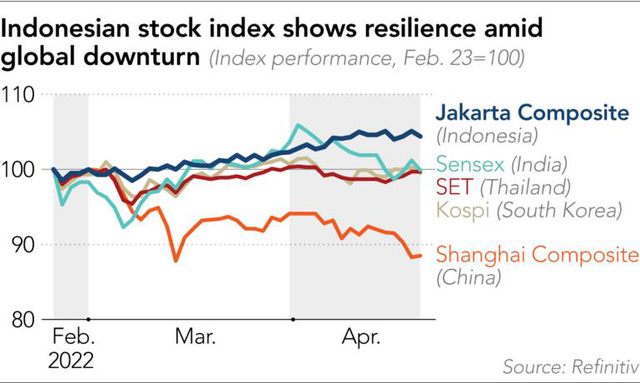

The main indices of the stock market of Indonesia, India, Thailand, Korea and China.

In Thailand, the capitalization of oil and gas company PTT Exploration and Production increased 14%, while Malaysia’s Petronas Chemicals Group increased 12%.

Indonesia’s Astra International Group, which deals in sectors from auto manufacturing to palm oil and coal mining, also recorded a 25 per cent increase in capitalization. Astra benefited from rapid increases in palm and coal prices, while its sales nearly doubled in the first three months of this year compared with the same period in 2021. The business is seen as a “backbone” for the economy. Indonesia because of its activities in many fields. The main index of this country’s stock market outperformed other indexes, by more than 4% in 2 months.

In the future, experts believe that an important factor for the market is commodity inflation due to the impact of the Russia-Ukraine conflict, the Fed tightens monetary policy and the dollar continues to strengthen. spread in China.

“The slowdown in China’s economy will hit most parts of Asia,” Mitra said. However, it could also be relatively profitable for economies with little connection to China. China like India.”

Morningstar’s Tan sees Asia facing more challenges in the future. “We maintain our view that supply and logistics disruptions will be less affected than in 2020. However, investors are also under other major pressures such as the Fed raising interest rates,” he said.

Refer to Nikkei

at Blogtuan.info – Source: cafebiz.vn – Read the original article here