Opportunities and challenges go hand in hand

In recent years, the capital mobilization channel through corporate bonds (Corporate bonds) has developed into a relatively large capital mobilization channel in relation to the credit loan channel from credit institutions or through stock market.

The developed corporate bond market also supports businesses to mobilize capital for production and business, reducing dependence on bank credit channels, which is a cross-cutting view of the Party, National Assembly and Government.

In fact, the development of the corporate bond market in the past period has helped many businesses mobilize capital for production and business. Especially when the epidemic is under control, the volume of bond issuance has increased rapidly, showing that businesses are stepping up the issuance of bonds to raise capital to restore production.

In addition, corporate bonds also orient investors to focus on medium and long-term investments instead of bank savings; improve the publicity and transparency in the process of raising capital for bonds.

The “big brothers” in the bond market

In view of the strong development of the corporate bond market, the Government issued Decree No. 153/2020/ND-CP dated December 31, 2020 to replace Decree 163 and Decree 81 amending, with the spirit of aiming to The goal is to ensure sustainable development, market health, and information transparency.

Decree 153 provides quite adequate guidelines for issuers. Specifically, enterprises issue bonds on the principle of self-borrowing, self-paying, self-responsibility for the efficiency of capital use and debt repayment ability.

After new decrees were issued and took effect, the legal framework of the bond market has been increasingly improved. In addition, the corporate bond market showed an initial shift from private issuance to public issuance.

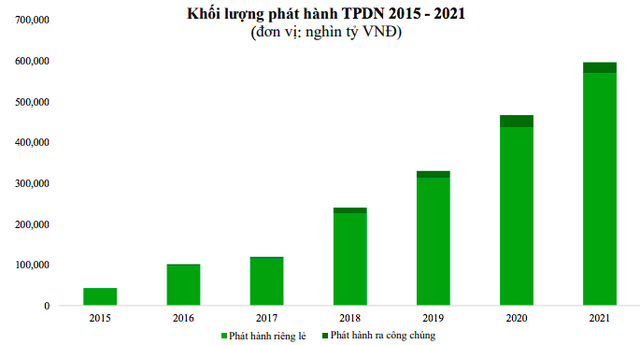

According to a report by Foreign Trade Bank Securities Co., Ltd., in 2021, the whole country has a total of 964 domestic corporate bond issuances with a total value of VND 594,520 billion, of which 937 are private placements with a total value of VND 594,520 billion. total value of about VND 570,000 billion (accounting for 95.8% of total issuance value) and 23 issuances to the public with VND 26,340 billion (accounting for 4.6% of total issuance value).

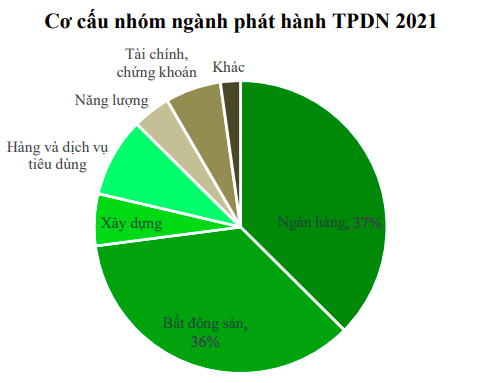

In which, commercial banks continued to lead in terms of issuance value with a total issuance volume of 223,010 billion dong, accounting for 37%. Top 5 banks with remarkable issuance volume during the year such as Vietnam Prosperity Commercial Joint Stock Bank – VPBank (VND 27,000 billion), Asia Commercial Joint Stock Bank – ACB (VND 22,200 billion), Investment and Development Commercial Joint Stock Bank Vietnam Development Bank – BIDV (VND 20,08 billion), Vietnam International Commercial Joint Stock Bank – VIB (18,000 billion VND) and Ho Chi Minh City Development Commercial Joint Stock Bank – HD Bank (15,520 billion VND).

The developed corporate bond market supports businesses to mobilize capital for production and business, reducing dependence on bank credit channels.

Real estate ranked second with a total issuance value of 214,440 billion dong, accounting for 36%, of which about 29% of the value of issued bonds was unsecured or secured by shares. Issuing interest rates fluctuate between 8%-13%/year, accounting for most of the issuance value in 2021, which is 1-3 year term, accounting for 67.33%.

In December 2021 alone, there were 80 separate issuances of corporate bonds in the country with a total issuance value of up to 65,757 billion VND. Banking and real estate were the two largest bond issuers with VND 46,926 billion and VND 9,538 billion, accounting for 71.36% and 14.5% of the total issuance value of the month, respectively. The banking sector with the issuance volume in December accounted for more than 1/5 of the total issuance volume of the whole year of 2021.

In addition, there are 6 issuances of bonds to the international market with a total value of 1,740 billion USD, including: Vingroup (500 million USD), green bonds of BIM Real Estate Joint Stock Company (200 million USD). USD) and Novaland’s convertible bonds ($300 million), Vinpearl’s sustainable bonds ($425 million), HDBank’s tier-2 equity-increasing bonds ($165 million) and Co. Phu My Hung development (150 million USD).

Potential risks

Although the corporate bond market grew rapidly and had many positive results, it also revealed a number of limitations and potential risks for investors and the financial market.

According to the Ministry of Finance, the corporate bond market has shown signs of “hot” growth, there are some phenomena of capital mobilization that do not comply with the provisions of the law.

The Ministry of Finance recognizes that enterprises raise capital through bond issuance on the principle of self-borrowing, self-paying and self-responsibility for capital efficiency and debt repayment ability. However, many enterprises issued large volumes of bonds with high interest rates but inefficiently used capital or faced difficulties in production and business situation, etc., leading to the failure of enterprises to repay principal and interest. bonds for investors, causing instability to the bond market in particular and the financial market in general.

According to the Ministry of Finance, in the market, there is a phenomenon of organizations providing services of soliciting and distributing corporate bonds to the wrong target audience for investors who are not professional securities investors.

Bond issuance volume increased rapidly in the period 2015-2021.

For investors, the law stipulates that investors self-assess risks and take responsibility for individual corporate bond purchases. Only professional securities investors are allowed to participate in individual corporate bond transactions to protect individual investors who do not have experience, ability to analyze and evaluate risks.

However, there are still cases where “dodging” the provisions of the law to become a professional securities investor with the purpose of buying individual corporate bonds will directly cause risks to investors and investors. The bond purchase amount may not be recovered.

Not only that, these cases will be punished according to the provisions of law. The Government has issued Decree No. 156/2020/ND-CP of the Government stipulating penalties for administrative violations in the field of securities and securities market, including violations on issuance and trading of securities. providing services on private corporate bonds and issuing corporate bonds to the public.

The Ministry of Finance and the State Securities Commission will strengthen inspection of service provision on corporate bonds by service providers to strictly penalize violations.

Market development orientation in 2022

The corporate bond market in 2022 is forecasted to continue to have development steps with the expansion of both scale and diversity of products.

The growth potential exists in the long term considering the growth of the economy is accompanied by the need to expand the business of the enterprise, which leads to the need for capital.

Besides, the low interest rate level continues to be a favorable condition for the corporate bond market in 2022 to continue to develop.

In order to ensure sustainable, transparent and effective development, the market needs to be transparent with information, operate safely and effectively, improve the legal framework, strengthen management, supervision, and perfect the model. market organization model, improve the quality of market infrastructure and services.

Currently, the Ministry of Finance is urgently formulating and submitting to the Prime Minister for promulgation a strategy for developing the stock market in the 2021-2030 period. This strategy includes objectives, solutions and roadmap for implementing solutions to develop the bond market.

This ministry proposes the objectives of developing the bond market in terms of both size and depth, improving liquidity and diversifying products; strives that by 2025, the size of the bond market will reach about 47% of GDP, of which the size of the corporate bond market will reach 20% of GDP. By 2030, the bond market will reach about 58% of GDP, of which the corporate bond market will reach 25% of GDP.

However, challenges and opportunities also go hand in hand when increased competition comes from bank credit channels; The legal framework continues to improve, requiring members to be highly adaptive.

Therefore, in order to achieve the above goal, the Ministry of Finance proposes that the Government continue to improve the legal framework on the corporate bond market so that the market can develop sustainably, transparently and effectively.

Encourage enterprises to diversify types of bonds in accordance with capital mobilization needs; promote the sale of bonds to the public; develop standards for issuing green bonds to both create capital mobilization channels for businesses and attract more investors.

Encourage securities companies to expand their operation scale, improve financial capacity, diversify and enhance service efficiency.

Improve infrastructure, market services and enhance transparency and market operation efficiency, deploy a separate corporate bond trading market for professional individual investors at the Stock Exchange and enhance provide specialized information page on corporate bonds.

Banking and real estate lead the corporate bond issuance volume in 2021.

Completing and upgrading the secondary market infrastructure of corporate bonds issued to the public to promote businesses to issue bonds to the public and list and trade on the stock market.

Strengthening management, supervision and implementation of payment, checking the issuance situation, providing services on individual corporate bonds for real estate businesses, enterprises with large issuance volume, high interest rates, and other businesses. Enterprises have business results at a loss, issuers do not have collateral…

Issuers ensure the successful issuance of corporate bonds, limit debt repayment risks, assess in detail the current financial situation, and develop business development plans and use plans. capital needs to be mobilized appropriately, choose an experienced bond issuance consultant and distributor, which is highly appreciated in the market.

For investors, the management unit recommends that in addition to carefully considering the product, when investing, it is necessary to choose a reputable issuer that ensures solvency.

In addition, investors should access official and reliable information sources to make the right investment decisions, minimizing possible risks.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here