Disillusioned with the issuance of Bitcoin bonds, El Salvador is at risk of becoming the next default country

Over the past five months, after making Bitcoin a legal tender, President of El Salvador Nayib Bukele has attempted to sell Bitcoin-backed bonds to international investors. He emphasized that this is a better option than traditional borrowing from banks in the US.

However, this plan did not work. The government of this South American country has so far raised a single penny in an effort to “find” $1 billion. With negotiations with the IMF at an impasse, the country’s creditors are concerned that El Salvador won’t be able to pay off its $800 million bond maturing next year.

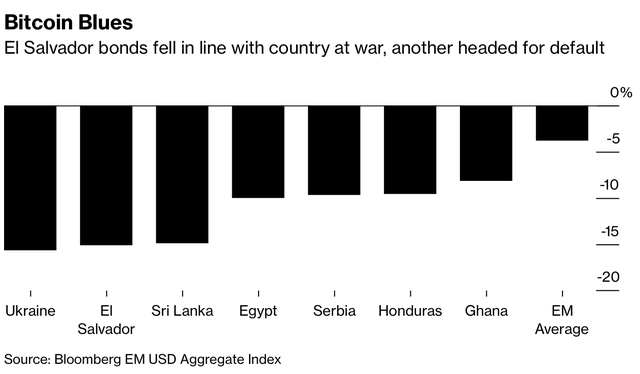

The price of El Salvador government bonds dropped sharply in April to 15.1%, only lower than the decrease of Ukrainian government bonds due to being affected by the escalating conflict. The country’s bonds maturing in 2023 currently yield 24% – a sign that investors are braced for the possibility of default.

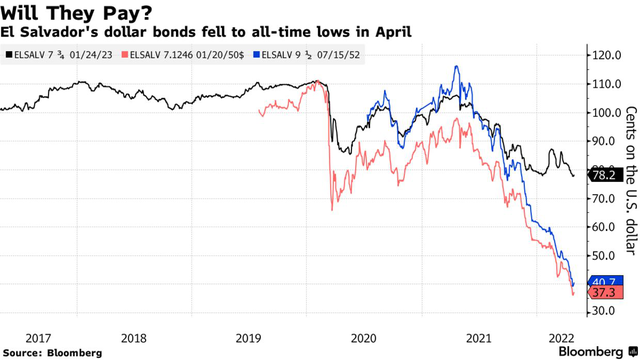

Ever since El Salvador refused to enter into talks with the IMF and adopt Bitcoin as legal tender last year, investors have “lost patience” with the country’s government bonds. They are concerned not only about the ability to pay the debt, but also the willingness of the 40-year-old president to pay. Now, as the bond’s January maturity date approaches, the par value of the 78-cent bond is showing that many bondholders have lost confidence.

Jared Lou, portfolio manager at William Blair Investment Mgmt LLC, said: “If Bukele hasn’t been able to raise capital in the bond market, what can the country do to pay it off? re-elected in 2024, it’s likely that Bukele won’t be willing to repay the debt or help the value of the bonds rebound.”

El Salvador’s dollar bond price fell to its lowest level in April.

While the plan to raise $1 billion in a Bitcoin-backed bond issue is said to be… unusual, some investors still expect that it will at least help the government of El Salvador raise a cash amount. It is not clear at this time whether the deal will continue.

Meanwhile, neither the presidential office nor the country’s Ministry of Finance have commented on the drop in bond prices. In recent comments, the Finance Minister and President of the Central Bank of El Salvador said the country was “not at risk of default”.

El Salvador has been planning on issuing a “volcanic bond” in March, using blockchain and half of the proceeds to buy Bitcoin. However, the deal has been delayed and the government has so far not submitted to Parliament the digital securities bill required for the issuance.

The proceeds won’t necessarily be used to pay off bonds maturing in January. However, if successful, further deals could be a source of funding for El Salvador in the future.

The face value of government bonds in El Salvador dropped sharply, second only to Ukraine.

This is part of a larger plan to attract crypto fans to a community called “Bitcoin City”. It is expected that this place will be powered by geothermal plants built at a nearby volcano.

Usually, the IMF, which is seen as a last resort to borrow money, has urged the El Salvador government to reconsider the adoption of Bitcoin as a fiat currency, as the currency poses major risks to stability. finance. However, negotiations with the country have stalled and the institution will assess the risks of Bitcoin before agreeing to lend.

In February, Fitch downgraded El Salvador to CCC due to the country’s growing reliance on short-term loans, limited financial resources and an increasing public debt burden – expected to equal 87%. GDP in 2022.

Refer to Bloomberg

at Blogtuan.info – Source: cafebiz.vn – Read the original article here