Liquidity dropped rapidly, a series of securities stocks fell 40-50% from the top, some stocks were about to hit the bottom in a year

Vietnam’s stock market is going through one of the bleakest times since a new wave of investors landed two years ago. Selling pressure prevailed so VN-Index continuously lost points and liquidity dropped rapidly. Securities stocks – the group that is most sensitive to market fluctuations, is of course not an exception to this trend.

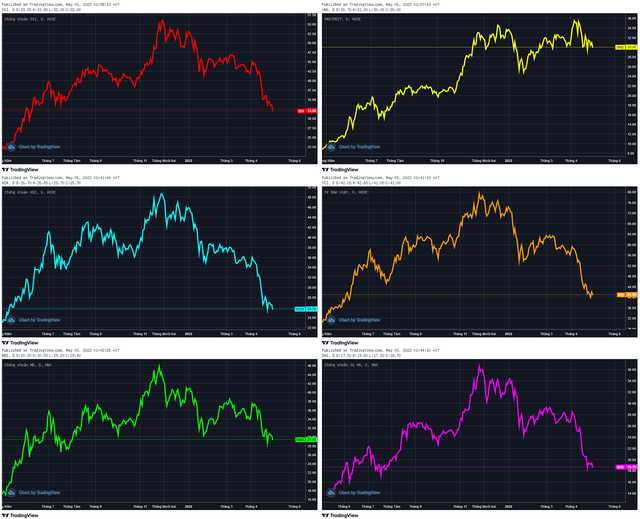

Many securities stocks are looking for 1-year bottoms

Before the storm emerged from the beginning of April, most securities stocks also “failed” when facing strong profit-taking pressure at the peak at the end of November last year. SSI, HCM, VCI, MBS, SHS, AGR, BSI, CTS, FTS, … have all “evaporated” 40-50% from the peak. The “healthiest” name in the group, VND, also lost more than 15% in the past 1 month.

The downhill process is gradually eroding significantly the gains of last year’s unprecedented large stock wave. Some names such as HCM, VCI, and SHS have reached the lowest price range in nearly a year and are still constantly searching for the bottom. It is not excluded that there will be more bottom-breaking stocks in the near future if the market has not prospered again.

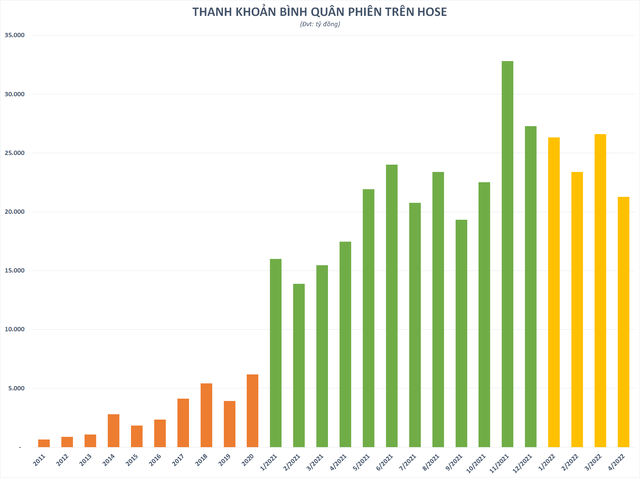

In April, the market recorded many sessions of liquidity falling to the lowest level within 9 months. The average trading value on HoSE also dropped sharply compared to the previous month, to the lowest level since September 2021. Most likely, low liquidity will remain in the near future when interest rate hike is almost inevitable under pressure from inflation.

Liquidity has dropped sharply recently

In the early morning of May 5 (Vietnam time), the US Federal Reserve (Fed) raised interest rates by 50 basis points, marking the strongest interest rate hike in more than 20 years. This move is not surprising when it matches what was discussed in the minutes of the Fed meeting in March 2022. However, this rate hike will push the federal funds rate to the range of 0.75-1% and according to data from CME Group, the market is expecting the Fed to raise it to 3-3. 25% by the end of 2022.

Fed Chairman Jerome Powell said, “Inflation is too high and we understand the difficulties it causes. Therefore, we are acting urgently to contain inflation. The Committee’s overall view is yes. may continue to raise interest rates by 50 basis points at the next meetings and have not considered raising interest rates by 75 basis points.”

The domestic interest rate level has remained low throughout 2020 and 2021 to support the economy to overcome difficulties caused by the Covid-19 pandemic. However, under pressure from the hawkish moves of the Fed, it will be difficult for Vietnam to stay out of the interest rate hike trend and this will more or less affect the cash flow into securities in the near future.

Risk of “offside” in market forecasts

Liquidity suddenly dropped sharply, causing many securities companies to face the risk of “offside” in the scenarios of developing business plans in 2022.

For example, VNDirect forecasts that the liquidity on 3 exchanges in 2022 will increase by 10-15% compared to the average in 2021 to about 29,000 – 31,000 billion VND/session. VSDC even assessed that the average order-matching liquidity of the whole market could fluctuate at 30,000 – 35,000 billion VND/session. Be more cautious, but BSC’s figure is also at a high level of 28,500 billion dong/session.

Low liquidity will put direct pressure on brokerage revenue of securities companies. Margin lending was also affected by the limited transaction size. In addition, the proprietary trading segment is highly dependent on market fluctuations in which liquidity is an important factor.

In strategic reports at the beginning of the year, a series of securities companies predicted that the VN-Index would reach a high score in 2022, most of which ranged from 1,700 to 1,900 points. However, with the recent developments, it is not easy for the market to reverse in the rest of the year when the macro supporting factors are somewhat shaken.

The last 2022 Annual General Meeting of Shareholders also revealed the rather conservative business plans of securities companies, even some names even “reversed” profits. In an industry outlook report, KIS Securities said that revenue and profit of securities companies are not expected to grow significantly in 2022, especially compared to the high base of 2021.

Slowing profit growth will make it difficult for securities companies to attract investors in capital raising plans this year. Not to mention, the large amount of additional shares issued last year has not yet been absorbed. Therefore, it is not surprising that securities stocks are often easily engulfed by selling pressure in recent unfavorable market sessions.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here