Without regretting a high discount, is it easy for Russia to “break” the flow of crude oil from Europe to China?

An official at the private refinery based in Shandong said it has not publicly reported these transactions with oil suppliers from Russia since the conflict to avoid attracting scrutiny. and may be affected by sanctions from the United States.

The official also added that the refinery has also received some quotas for buying Russian crude from state-owned commodity trading companies, which are considered to represent Beijing, and have mostly refused to sign. new supply contracts.

Many Western companies are struggling to secure the insurance, shipping or financing necessary to purchase Russian exports, fueling Chinese expectations that there is a shortage of supplies and will participate in the auction to buy unsold barrels of oil from Russia.

Purchases from China’s private refiners have also revealed how some importers are bypassing traditional routes to access cheap Russian oil, helping Beijing maintain its position. low when the West punished Moscow.

The US and UK have embargoed Russian oil, and the EU is discussing the embargo and introducing restrictive measures. From May 15, commodity transactions with companies based in the EU and Switzerland will not be able to sell Russian oil anywhere in the world.

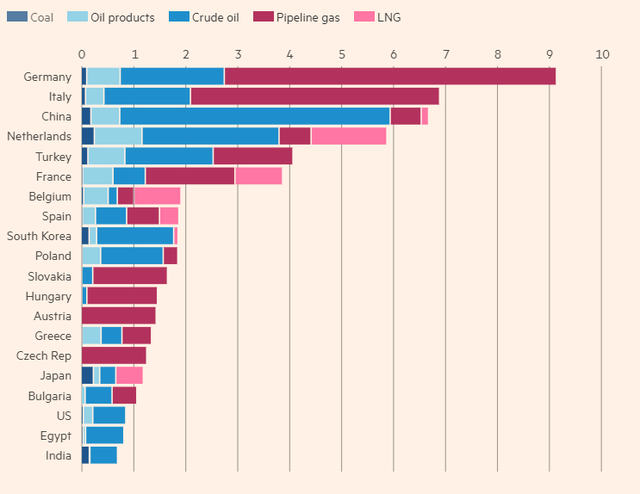

China is in the top 3 of Russia’s energy import markets, mainly crude oil.

Blockade orders in China due to Covid-19, logistical and financial challenges caused by sanctions against Russia have prevented China’s state-owned refineries from buying crude oil from Russia. Shipping activities are showing that China’s buying volume is at a modest level. With a discount of $35 per barrel against Brent crude, China’s refiners will have an incentive to buy.

Shipbrokers and operators say at least six super-surface vessels – each capable of carrying up to 2 million barrels of crude oil – have reached agreements to pool Russian Urals crude in Europe for shipping to Europe, according to vessel operators and brokers. Asia, mainly to China and India.

Chinese refiners prefer Russian ESPO crude, which is produced in eastern Siberia, imported via pipelines and cargo ships at Kozmino near Vladivostok. The number of Aframax midsize vessels expected to load oil from Kozmino has increased from an average of six a week last year to seven since the conflict escalated, according to Gibsons, a shipbroker.

China’s purchases of crude oil and petroleum products are about 86,000 bpd higher this month than last year’s average, according to Kpler, a commodity data analytics firm.

A slight increase in Chinese purchases suggests that finding alternative markets for Russian oil and crude products may be more difficult than Moscow anticipates, analysts said.

“It’s a natural assumption to think that China will buy more Russian crude but China is under much more scrutiny than India,” said Jane Xie, senior oil analyst at Kpler. Officials at the Shandong refinery said they were being cautious when purchasing Russian supplies because the imposition of sanctions by the US on third parties that trade with Russia could lead to closing Singapore commercial branch.

Source: Financial Times

at Blogtuan.info – Source: cafebiz.vn – Read the original article here