If the risk tolerance is high, investors can still “turn the trend” with real estate stocks when the price has been heavily discounted.

In the newly released report, Rong Viet Securities (VDSC) said that the market went against the company’s expectations in April, despite the good business results in the first quarter of 2022, information from The 2022 General Meeting of Shareholders of listed companies as well as positive macro data were released.

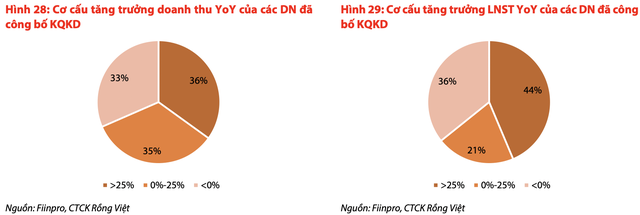

Specifically, as of May 4, 2022, nearly 600 out of 771 listed companies on the HSX and HOSE announced their first quarter business results. The growth in NPAT was quite good compared to the same period last year. is 33%. VDSC found that more than 56% of the total number of enterprises that announced results had positive growth results in NPAT over the same period last year. In which, the number of enterprises with negative profit after tax accounted for about 9%, a slight improvement compared to the rate of 11% in the same period in 2021. In addition, about 6% of enterprises with negative profit in the first quarter of the previous year were in business. profitable in the same period this year.

“58 businesses in our watchlist have recorded a growth rate of total NPAT of 30% over the same period”VDSC said.

The report pointed out that the reason why Vietnam’s stock market recorded the recent correction came from internal factors (less positive investment sentiment when a series of arrests took place when the Government controlled the situation). strictly control financial markets) in the context of increasing external macro risks.

Accordingly, the pressure on world inflation in the coming time will still be very great associated with the fact that the price of raw materials will continue to increase globally due to supply chain disruptions due to prolonged tensions between Russia-Ukraine and China. The country continues to apply the “zero covid and strict social distancing” policy.

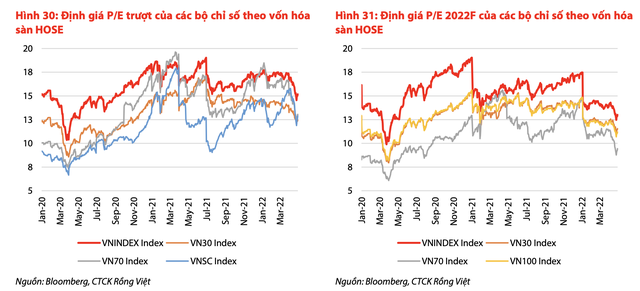

On the other hand, consumer demand is tending to recover after the gap. This has led to the expectation that developed markets will implement a faster and stronger tightening of monetary policy than previously forecast, thereby increasing the pressure of negative impacts on the central bank. global investment management. As a result, the VN-Index’s P/E valuation has dropped to the lowest since September 2020 at 15.1 times while the current P/E valuation of 2022 is only 13 times.

Making recommendations to investors, in the context that the market is expected to continue to face pressure from risks, VDSC still believes that these factors will not significantly affect the growth prospect of the company. Vietnam this year when solid macro data are still supporting the recovery of the economy and it is likely that inflation for the whole year is still under control. In addition, the fact that China is making moves to ease the distance in Shanghai, and the decision of the Fed to raise interest rates can help relieve some pressure on investment sentiment.

Tracking these factors together with their impacts on the global supply chain and the ability to control inflation in the world is quite important in the near future, helping investors make clear assessments. about the prospects of these systemic risks.

According to VDSC, if in the period of 2020-2021, the market increases on a large scale thanks to “easy” cash flow, then in the coming period, the cash flow will be very differentiated between industry groups and stocks in the context of psychology. overall risk aversion of the market.

In particular, VDSC expects that the price increase is only really sustainable in stocks with positive growth stories, or capital raising issues, etc. in the coming quarters. On the other hand, the first-quarter business results statistics also show that stocks with stronger price movements while the general market dropped sharply in April were supported by positive growth in revenue and profit; stocks in the seafood, logistics, technology, and retail sectors are some typical examples. The above trends will continue to dominate the movement of the stock market in 2022.

Investors should choose good growth stocks; You can use a “countertrend” strategy if your risk tolerance is high

At this time, VDSC recommends that investors focus on industry groups with positive Q2 business results such as seafood (VHC, ANV), gas thermal power (NT2), technology (FPT), and banking. (TCB, MBB, ACB, VCB, CTG).

At the same time, the “counter-trend” investment strategy for value investors with high risk tolerance and long investment time frame can still be applied to stocks in this group. the real estate industry when the valuation ground of this group has now been heavily discounted. Real estate businesses with many projects ready for sale (NLG, KDH, HDG) can be good investment choices in the current period. Last but not least, it is necessary to be more cautious with stocks related to the basic NVL group that has increased sharply recently.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here