Real estate corporate bonds were absent in April, banks returned to the race track

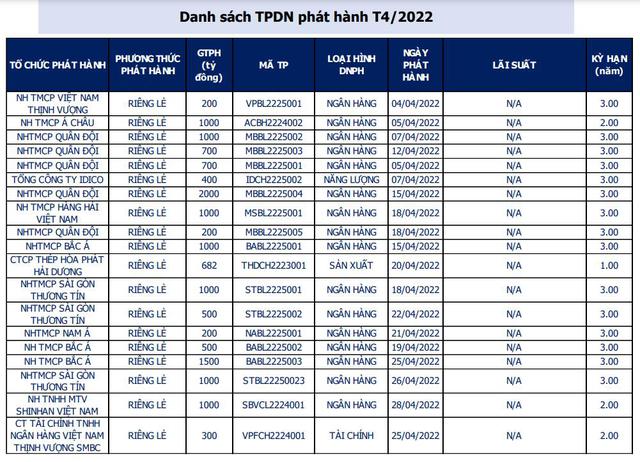

According to the latest monthly report on bond issuance of the Vietnam Bond Market Association (VBMA), the total value of corporate bonds issued in April was 16,472 billion dong, of which 23 individually and no corporate bond issuance to the public.

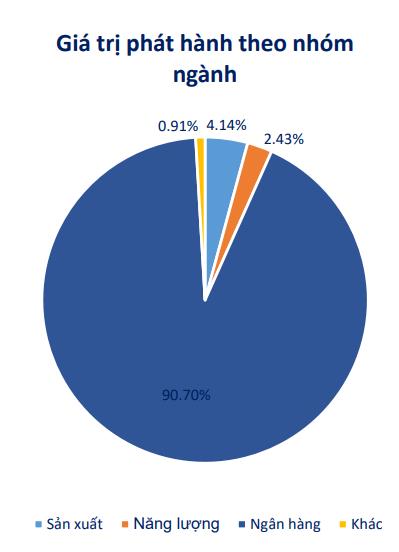

The ranking changed when the majority of issuers in April came from commercial banks with VND 14,940 billion, accounting for 90.7% of the total issuance value. Before that in the first months of the year, real estate was always in the leading position in the group of issuing corporate bonds.

In the group of corporate bonds of commercial banks, MB Bank is the largest bond issuer with VND 4,600 billion for 3-year term. Sacombank is behind at 2,500 billion dong also for 3-year term.

The list of private bond issuers in April has absolutely no real estate businesses. Recently, information from the cancellation of 9 bond lots of Tan Hoang Minh Group and the move to tighten real estate and corporate bonds has partly caused the disturbance of this debt market.

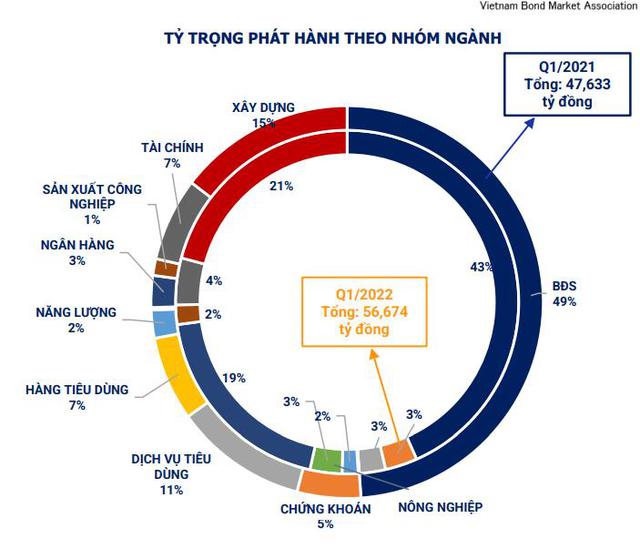

Before the above events happened, real estate was still the field with the leading volume of corporate bonds. In the first quarter of 2022, the total volume of corporate bonds issued by the real estate group increased by 22% over the same period last year, reaching VND 28,581 billion.

Therefore, if considering the volume of corporate bonds issued from the beginning of 2022 until now, temporarily the first position still belongs to the real estate group with the accumulated issuance value of VND 28,856 billion, accounting for 37.35%. Term from 1 to 3 years accounted for the majority of the issuance value in this group with VND 21,559 billion, equivalent to 74.71%.

Banking group ranked second with VND 24,393 billion, accounting for 31.57% of total issuance value. The average issuance term of commercial banks is 4.03 years, the issuing interest rate is usually floating according to the savings interest rate of state-owned banks. In this group, Military Commercial Joint Stock Bank issued the most with VND 4,600 billion, followed by Vietnam International Commercial Joint Stock Bank with VND 3,948 billion.

In fact, from the beginning of the year until now, the banking group has also “moved” to return to the race to issue corporate bonds. According to statistics in the VBMA’s report for the first quarter of 2022, bond issuance of commercial banks in the first 3 months increased 7 times over the same period. The promotion of capital mobilization activities in the debt market shows that banks are still trying to increase capital to improve capital adequacy ratio (CAR). This is also the target to be granted a credit limit and to ensure the early completion of Basel II and III targets.

In addition, if HDBank’s upcoming issuance plan with a total volume of 18,000 billion dong and BIDV’s 35,000 billion dong is successful, the current champion position of the real estate group is expected to change.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here