What does the European ban on Russian oil mean for oil and gas markets?

Crude oil prices rose on May 4 after the European Union (EU) proposed a ban on oil imports from Russia as part of a new round of sanctions against the country after a conflict with Ukraine. The details of the plan are still being discussed and the proposal needs to be agreed upon by the 27 members of the bloc before it can take effect.

Oil prices have spiked by around 5%, currently trading at around $110 a barrel amid market concerns that oil supplies will tighten further as EU countries have to look for suitable alternatives. for crude oil.

Oil prices have risen steadily over the past two months after Russia carried out a “special operation” in Ukraine. So far, the EU has been reluctant to completely cut off Russian oil and gas imports, and its plans still do not propose an outright ban for all EU members.

Europe imports about 3.5 million barrels of Russian oil and oil products per day, and is also dependent on Moscow’s gas supplies.

What is the latest EU embargo plan like?

European Commission President Ursula von der Leyen on Wednesday proposed a phased oil embargo against Russia, as well as sanctions on Russia’s top bank.

The Committee’s measures include phasing out Russian supplies of crude oil over six months and refined products by the end of 2022. However, Hungary and Slovakia will be able to continue to buy Russian crude until the end of 2022. until the end of 2023 under existing contracts.

Ms. Ursula von der Leyen also pledged to minimize the impact of this move on European economies.

Russia can make up for the loss of one of its main customers by selling oil to other importers including India and China. These two markets have never stopped buying from Moscow.

The Organization of the Petroleum Exporting Countries and its allies (OPEC) is not expected to meet the increased demand for supply, but is expected to stick to its plan to gradually increase monthly output.

Phil Flynn, senior analyst at Price Futures Group, said: “Reserves are so scarce, so when you’re talking about this ban, there’s a lot of question about how (Europe) will make up’. hole ‘ Russian oil like?”

And not only for the EU market, what does the EU’s proposed ban on Russian oil imports mean for the global oil market as well as for gasoline prices in the US?

How much impact will there be on the oil market?

Crude oil prices are likely to rise even further, having been rising for the past few months, since Russia launched a “special operation” in Ukraine.

Europe is heavily dependent on Russian oil imports. The region absorbs about a quarter of its oil from Russia – by far the largest source of oil imports to the region.

Although Russia may find other customers to sell its crude oil to, like India, it is unlikely that Russia will be able to sell off all of its conventional oil it sells to Europe.

Heavy sanctions have made some traditional buyers reluctant to trade with Russia. And as part of its latest proposal, the EU is also seeking to ban European ships from transporting Russian oil.

In short, it is expected that the EU oil import ban will cost Russia about 2 million barrels of crude oil per day.

|

European Commission President Ursula von der Leyen made a statement in Brussels on April 27 following the decision by Russian energy group Gazprom to suspend gas exports to Poland and Bulgaria. |

In fact, the US has urged Europe to be cautious as the region is considering a ban on imports of Russian oil, which could make up for the loss of revenue from oil sales to the EU thanks to higher crude prices.

However, besides Russia there are other factors that can affect oil prices.

The blockades in China in response to the outbreak of Covid-19 infections are expected to reduce global demand for crude oil, although it is difficult to say how long these measures will last.

What does the EU ban mean for gas prices?

European citizens will certainly be hit hard, but even in the US it’s hard to see a drop in gas prices.

After all, what consumers pay at the gas station is most directly affected by global crude oil prices.

According to data from the American Automobile Association, when oil prices spiked after the conflict between Russia and Ukraine, the average gasoline price in the United States rose above $4 a gallon and has remained high since. there.

The United States is also about to enter summer, the season when traditionally there will be more people on the road.

|

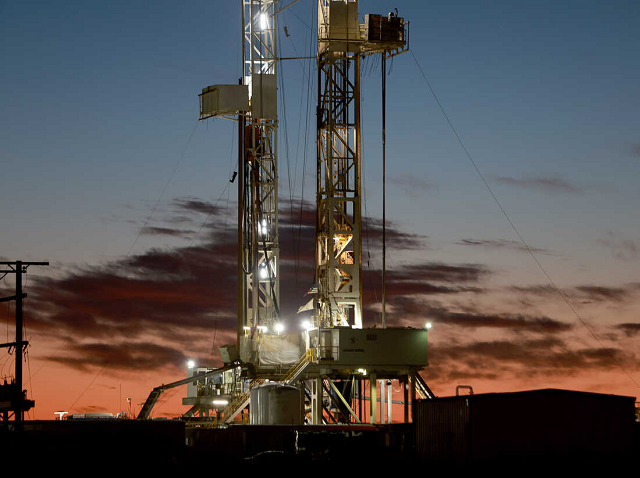

Image of a rig in the Permian Basin oil field in Midland, Texas. |

One move, however, has brought down gas prices. That is the Biden administration’s emergency release of oil from the strategic oil reserve. The US is releasing about a million barrels of oil reserves per day and will extract up to 180 million barrels from its strategic reserves.

Without that emergency release oil, gasoline prices would have even gone higher than they are now, said Al Salazar, senior vice president of Enverus Intelligence.

“Basically, any risk of unreasonably high oil prices over the summer has been mitigated,” Salazar said.

But there are clearly big question marks about what will happen after the US reaches its planned release limit of 180 million barrels of oil reserves. A lot will depend on the crude oil market conditions right now.

Can other oil producers increase output?

This problem is very complicated.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies (called OPEC) are in the best position to make up for the lost supply, but that is unlikely, for a number of reasons: this.

First of all, Russia is a member of OPEC. Any move against Russia risks jeopardizing an alliance that has long been crucial to stabilizing global oil prices.

|

Saudi Arabia’s Energy Minister, Prince Abdulaziz bin Salman, at the OPEC meeting in Vienna, Austria, on December 5, 2019. |

The bigger concern is that some members of OPEC are struggling to meet current quotas due to political conflicts and investment shortages.

OPEC countries have gradually increased production by about 430,000 barrels per day since last summer, in a bid to gradually return to pre-pandemic production levels.

OPEC will meet again on Thursday (May 5) and most market analysts and traders expect the group to maintain its current plans to only gradually increase output.

What about American manufacturers?

The United States is the world’s largest oil producer, but most of that oil is consumed domestically.

Drilling for more oil is not an easy thing. Even the fastest producers take months to build a new well. And labor challenges and supply chain problems are prolonging that time.

Oil companies are still proceeding to increase production cautiously. These companies are owned by their investors, and those investors don’t want to invest too much in drilling a lot of oil.

They lost tons of money in the oil price crash at the start of the pandemic, and growing concerns about the environmental impact made them hesitant to invest further.

That said, the US oil producers cannot be fully expected.

The US Energy Information Administration forecasts that US producers will increase production by an average of 800,000 bpd this year.

But it’s hard to grow faster than that, and that simply shows it’s impossible to make up for the expected loss from Russian oil supplies.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here