After a year of record profits, the only salvage business on the stock exchange plans to collect hundreds of billions in 2022

Vietnam’s stock market has many unique business lines with only a few or even only one enterprise operating. The field of salvage is a typical example with the sole representative of Vietnam Salvation and Rescue JSC (VISAL – code SAL).

VISAL, formerly known as the salvage company under the Southern Maritime Division, was established in June 1976 under the Southern Department of Land Transport. Experiencing many changes, the company equitized and held the first auction at the end of December 2014. The enterprise officially operated under the model of a joint stock company from March 6, 2015 with a charter capital of VND 83.1 billion.

In June 2016, VISAL was approved as a public company by the State Securities Commission and then listed its shares on UpCOM from October 2017. Since going public, this salvage business has never increased its charter capital.

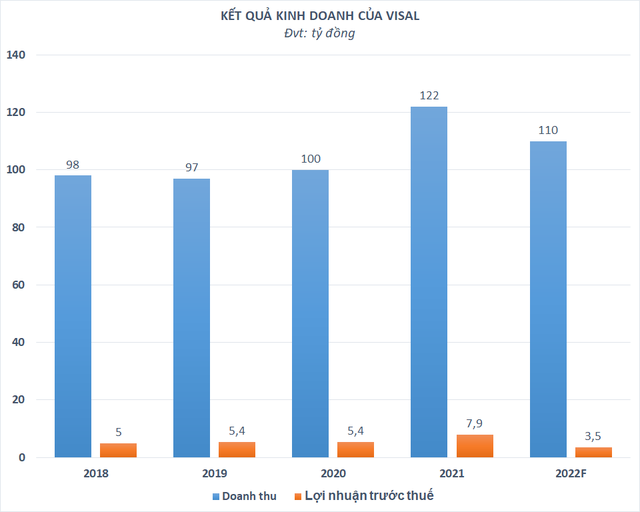

VISAL currently owns a fleet of tug, supply and anchor handling vessels with a total capacity of nearly 20,000 HP, and is operating 03 dry docks that can receive ships with a tonnage of 3,000 DWT. The scale is somewhat modest, but the business situation of VISAL is quite prosperous with a steady revenue of over one hundred billion per year and continuously growing profit.

In 2021, VISAL recorded a record high business result since going public with revenue of 122 billion dong and pre-tax profit of 7.9 billion dong, up 22% and 46% respectively over the same period. Net profit was 6.3 billion dong, also increased by 37% compared to the previous year. With the results achieved, the salvage business has far exceeded the whole year plan set forth.

VISAL maintains a revenue of over one hundred billion per year

VISAL forecasts that 2022 will still face many difficulties due to the Covid-19 epidemic, the world’s unstable situation, commodity prices tend to increase and become unstable, which will continue to affect domestic businesses. . Therefore, VISAL targets revenue of 110 billion dong and pre-tax profit of 3.5 billion dong, down 8% and 56% respectively compared to the previous year.

Consistently profitable business helps VISAL maintain its annual dividend policy, but the ratio is not high, usually less than 5%. With unexpected results last year, this business is looking to “break the rules” with its 2021 dividend payment plan at the rate of 6.02% in cash. Most of the annual dividends go to the largest shareholder of Vietnam Maritime Safety Corporation with an annual holding rate of 49%.

Since going to the floor, SAL has almost turned off liquidity and if there is, only a few hundred units have been traded. The dividend rate is also not really attractive, making this stock not “hot” like some other strange names on the stock exchange such as Hai Phong Funeral Joint Stock Company, Tim Tam Duc TTD.

SAL stock is almost out of liquidity

at Blogtuan.info – Source: cafebiz.vn – Read the original article here