For the first time since August 2020, the capital flow recorded a net withdrawal in the stock market, two groups of industries have the opportunity to “suck” money in the near future.

The capital flow recorded net withdrawal in the stock market for the first time in nearly 2 years from August 2020

SSI Research has just released a global capital flow update report for April 2022, which emphasizes the reversal of stock cash flow into the developed market.

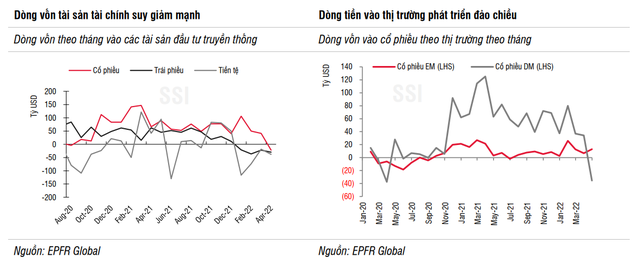

Specifically, the cash flow into financial assets continued to decline sharply when investors reduced the proportion of risky assets in the portfolio. Net cash outflows from all financial assetsfrom equity markets (net withdrawal of $22.4 billion, first time since August 2020), bond funds (-29.8 billion USD) and money funds (-37.9 billion USD) ).

Notably, equity inflows into the developed market reversed to a net withdrawal of 35.3 billion USD, this is the first net withdrawal since August 2021 due to pressure from the US market. In contrast, capital inflows into emerging market stocks increased sharply, to $12.9 billion – an increase of more than 90% compared to February and three times the same period in the same period. The reason assessed by SSI is mainly due to attractive valuation when in 2021, emerging market stocks recorded a growth rate lower than developed markets of 24.5% while this level was only 3.5%. in the first four months of this year. The P/E forward of EM stock is 12 times while that of DM stock is 17.2 times, showing that EM is currently being valued relatively cheaply.

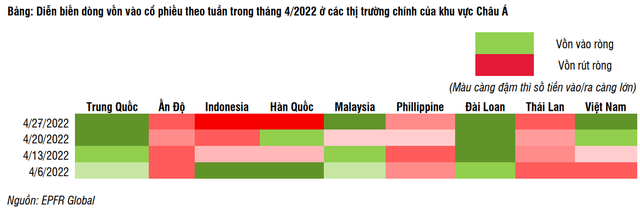

According to SSI Research, capital inflows into emerging markets are concentrated in markets with some specific stories such as China (+9.5 billion USD, monetary policy – fiscal divergence with the rest of the world). world) or can be strong in export and investment like Taiwan (+1.7 billion USD) and South Korea (+317 million USD). Especially, stock cash flow continued to remain a net buy in countries with strong exports of raw materials, typically ASEAN region such as Indonesia or Malaysia (net bought nearly 10 and 30 million USD respectively in April).

In the coming time, SSI Research believes that the allocation of capital flows to financial assets, especially stocks to developed markets, will not be very positive when risks are maintained with the conflict with Russia. -Ukraine lasts, the Central Bank tightens monetary policy and economic recession. In general, cash flow will be relatively diversified, focusing on basic stocks and not being affected much by interest rate hikes such as: Bank or Energy.

On the other hand, the bond market has reacted relatively strongly to the Fed’s move recently, so yields don’t have much room to increase sharply. SSI expects the cash flow into the bond market may improve as the need to allocate weight to less risky assets will increase in the context of global market uncertainty.

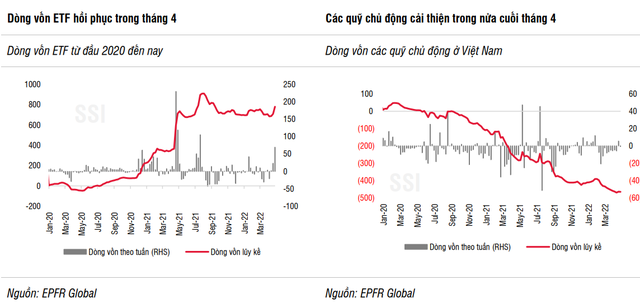

ETF capital flows on Vietnam stock market in April recorded the highest net buying in 9 months

Regarding the investment cash flow in the Vietnamese stock market, SSI Research said that the ETF capital flow reversed to prosper again in April 2022 after 2 months of net withdrawal, in the context of Vietnam’s market valuation becoming more volatile. should be more attractive after dropping by 9.9% in April. Buying power in the month mainly came from VFM VNDiamond fund (thanks to capital inflows from Thai investors through DR) and Fubon fund with net value. reached VND 886 billion and VND 953 billion, respectively. VFM VN30 fund also reversed to a net withdraw of +223 billion dong. In contrast, foreign ETFs including VanEck and FTSE continued to be withdrawn 146 billion dong and 308 billion dong.

In general, the total ETF capital inflow in April recorded a net buying with a total value of VND 1,690 billion, the highest level in the last 9 months. However, cumulatively for 4 months, ETF capital inflow still recorded a rather modest net entry, only 1,845 billion dong (compared to a record 13,200 billion dong in the first 4 months of 2021) with the buying force mainly coming from the Fubon Fund. and VFM VNDiamond.

Cash flow from active funds improved in the second half of April; In general, in 4 months, funds actively withdrew nearly 1.2 trillion dong. But thanks to the positive capital inflow from the ETF, the Vietnamese market still recorded a net inflow in the first 4 months of the year.

Foreign investors were net buyers on the stock market in April, with a total value of VND4,020 billion. Even if excluding sudden transactions (MSN and MWG), foreign investors still reversed to buy 706 billion dong. SSI observes that foreign investors tend to focus their disbursement on interest-sensitive stocks such as banks, or Vietnamese industries with long-term advantages such as retail and industrial real estate.

SSI Research continues to maintain its view that foreign capital flows will return to Vietnam in 2022. Although, pressure on emerging markets will appear more clearly in the next 1-2 quarters and Vietnam most likely will not be out of trend when the Fed raises interest rates and the dollar continues to strengthen. However, compared to other countries in the region, domestic dong liquidity does not depend much on foreign capital flows, as well as VND is actively supported by the current account surplus and buffer from foreign exchange reserves. .

at Blogtuan.info – Source: cafebiz.vn – Read the original article here