The soaring USD affects every corner of the global economy

More than 50 years on, the relentless rise of the greenback has once again caused the “power of destruction”.

The U.S. currency hit a two-decade high this past week, and its strength is causing financial conditions to tighten gradually and the world economy at the same time. with the prospect of a recession.

“This increase threatens to “destroy the environment in the broad market and expose economic and financial cracks in the system,” said Samy Chaar, chief economist at Lombard Odier.

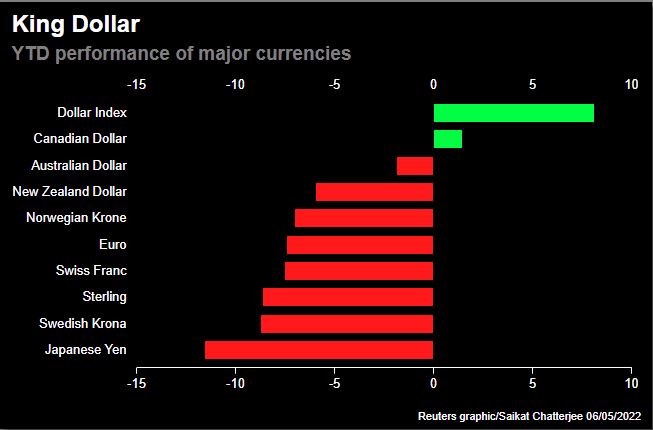

The 8% gain in the dollar index (DXY) – the dollar’s value against a basket of major US partner currencies) this year is unlikely to reverse for the foreseeable future.

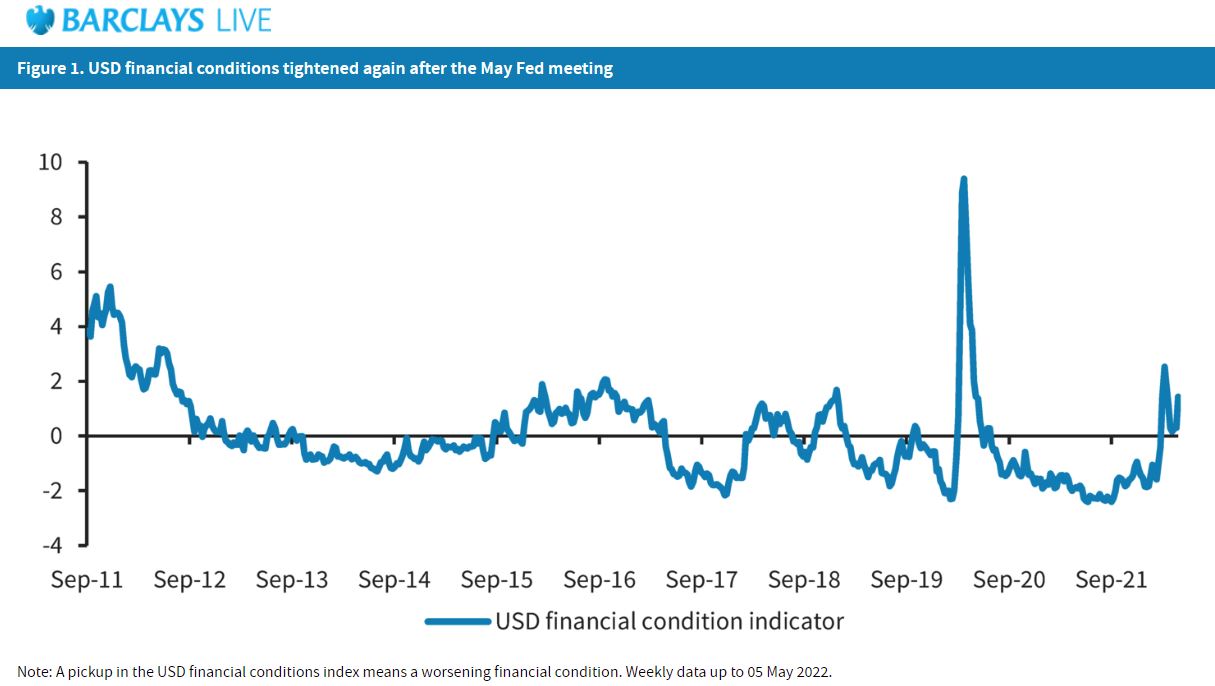

The greenback’s safe-haven appeal remains intact, with the Barclays calculator’s USD financial stress indicator near a seven-year high. And analysis of past peak-to-trough ranges suggests the dollar index could see another 2% to 3% rise, Barclays said.

Here are some areas affected by the strengthening of the USD:

The price increase of USD against other major currencies from the beginning of the year to now.

Import price inflation

The latest rally in the dollar has affected other G10 currencies, from the British pound to the New Zealand dollar, as well as currencies from developing countries with large balance of payments deficits.

Even the Swiss franc – a ‘quintessential’ safe-haven – was not spared, as the franc traded near its lowest level since March 2020 against the greenback.

While a depreciating local currency has often benefited Europe and Japan, which are highly dependent on exports, this may not be the case now that inflation is high and rising due to the rise in prices of imported food and fuel. as input costs of firms become more expensive.

Euro zone inflation hit a record 7.5% last month, and Japanese lawmakers are also worried that the yen, which is at a 20-year low, will take a toll on households. family. A recent survey found that half of Japanese businesses think higher costs will affect their earnings.

But growth concerns could prevent central banks, particularly in Europe and Japan, from tightening policy in line with moves by the US Federal Reserve. Many think that could push the euro down to par with the dollar, a level not seen since 2002.

Societe Generale strategist Kit Juckes said: “With the risk of a recession looming, who cares how hawkish the ECB (European Central Bank) is or what is defined. price into the yield curve?”.

Financial conditions tightened

A stronger dollar tightens financial conditions, which reflects the availability of capital in the economy.

Goldman Sachs, the most widely used aggregator of financial condition indexes (FCI), said a 100 basis point contraction in the DCI could slow economic growth by one percentage point for the year. after.

The FCI, which includes factors affecting the dollar, the commonly used currency in commerce, now shows that global conditions are at their tightest since 2009. FCI has tightened by 104 points. basically from April 1 to present. While the sale of stocks and bonds has a larger impact, a rise of the dollar above 5% during this period will also contribute significantly to the tightening of economic conditions.

Financial conditions continued to tighten significantly after the Fed’s May meeting.

Market ‘urgent’ problems

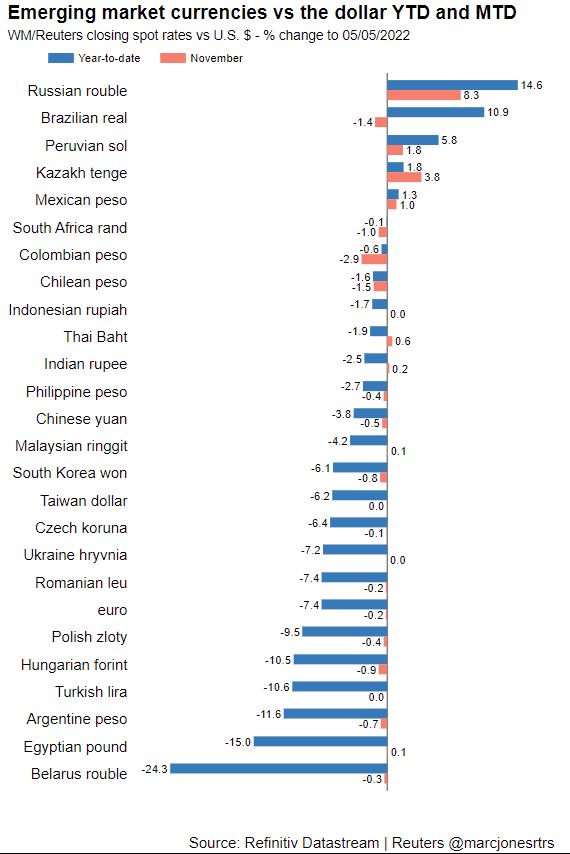

Almost all past emerging market crises have been linked to dollar strength. As the dollar appreciates, developing countries have to tighten monetary policy to depreciate their currencies. Failure to do so would exacerbate inflation and increase the cost of debt servicing in dollars.

In the past week, India unexpectedly raised interest rates, while Chile also raised interest rates by 125 basis points – much higher than expected.

Fitch estimates that the average foreign-currency government debt in emerging markets will be at a third of GDP by the end of 2021, compared with 18% in 2013. Several countries are seeking support from the Fund. International Monetary Fund and World Bank, and a stronger dollar could increase that rate.

Meanwhile, investors are becoming increasingly wary. Emerging market currencies are currently at their lowest value as of November 2020, in the plus dollar-denominated bond market in emerging economies compared to US Treasury bonds. has increased by about 100 basis points this year

The volatility of USD exchange rate against currencies of emerging countries from the beginning of the year to now and from the beginning of the month to now.

Commodity prices skyrocket and the consequences

As a rule of thumb, a stronger greenback makes dollar-denominated goods more expensive for non-dollar consumers, ultimately reducing demand and prices.

That has yet to happen at this point as issues such as the war in Ukraine and China’s anti-COVID blockade have hampered the production and trade of key commodities.

A stronger US dollar generally means increased sales for commodity exporters such as Chile, Australia and Russia, although they have also been affected by the increased cost of importing machinery and equipment.

But as US yields rise and a stronger dollar threatens global growth, commodity prices are starting to take a hit. JPMorgan in a report just released this week said it is reducing its exposure to the Chilean peso, the Peruvian sol and others pending “trial times”.

US inflation

The Fed may welcome a stronger greenback as it eases import price inflation – Societe Generale estimates a 10 percent dollar appreciation will drive US consumer inflation down 0.5 percentage points in a year.

However, in the case of record US gas prices, the dollar’s spike so far has not helped alleviate the fuel’s price.

Money markets bet that the US will raise interest rates by 200 basis points for the rest of this year, and expect the Fed’s policy rate to peak at around 3.5% by mid-2023.

However, if April US inflation data – due to be released soon – shows that price pressures have peaked, those bets could be voided.

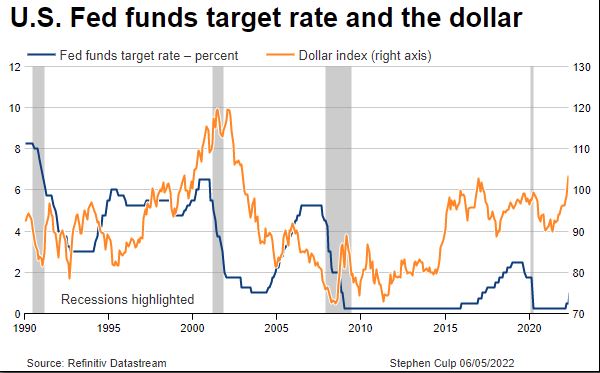

US Federal Fund interest rate and USD exchange rate.

Reference: Refinitiv

at Blogtuan.info – Source: danviet.vn – Read the original article here