Revealing a weak bank in the hands of “big man” Vietcombank and MB?

Gradually revealing weak banks Vietcombank and MB receive compulsory transfer

In the additional assessment report on the results of the implementation of the socio-economic development plan in 2021; According to the Government, in 2021, the Government has actively implemented the task of restructuring public investment, state-owned enterprises and the system of credit institutions. (CI), especially the development and issuance of many documents and policies with clear regulations, promoting decentralization and decentralization, creating a unified legal corridor in investment implementation, management, supervise credit institutions, arrange and renovate state-owned enterprises.

In which, the organization reviewed and evaluated the implementation of the Project on restructuring the system of credit institutions in association with bad debt settlement in the 2016-2020 period and developing and completing the Scheme for the 2021-2025 period.

At the same time, continue to direct credit institutions to develop plans to deal with bad debts in accordance with the epidemic situation; actively improve asset quality, control credit quality to limit the arising of new bad debts; handle bad debts by themselves by urging customers to pay debts; sale and sale of security assets of the debt; selling debt according to the market mechanism; use hedging…

Banks are bought by the State Bank for 0 dong. (Photo: LT)

In particular, the Government has proactively and actively implemented many solutions to handle 3 banks with compulsory purchase and Dong A Commercial Joint Stock Bank (DongABank).

Specifically, looking for partners, negotiating with domestic and foreign investors who wish to participate in bank restructuring; rearrange the operation network, reduce costs, deploy safe business activities… on the principle of drastic, prudent and strict.

At the same time, review and finalize the restructuring plan according to new orientations, including a plan to deal with Construction Bank (CBBank) and Ocean Bank (OceanBank).

Coincidentally, the recent annual shareholders’ meeting of Vietcombank and MB both approved participating in the restructuring of two weak banks in the form of forced transfer.

Specifically, at the 2022 Annual General Meeting of Shareholders, Mr. Pham Quang Dung, Chairman of Vietcombank, said that Vietcombank plans to receive a compulsory transfer of a weak bank under the direction of the Government, the State Bank and the State Bank of Vietnam. laws.

“Currently, Vietcombank is still carrying out necessary procedures with state management agencies and has not yet been able to answer which specific credit institution Vietcombank will receive. This weak credit institution is under special control. of the State Bank”, Mr. Dung said and said that if Vietcombank receives a compulsory transfer, it will take up to 10 years to restructure the transferred credit institution.

Previously, Mr. Luu Trung Thai, General Director of MB shared, MB will receive a compulsory transfer of a weak joint-stock commercial bank but cannot disclose the identity of the weak bank that MB receives because this is a information on the list of state secrets.

However, according to Mr. Thai, this weak bank has an asset size 10% lower than MB’s total assets and the accumulated loss does not exceed VND 20,000 billion.

Mr. Thai added that with the mandatory transfer of 0 dong to the bank, MB does not have to spend money to buy this bank, but MB is also supported in terms of license, supported by an amount of money from the State with half the negative part. current capital of this organization.

After implementing the restructuring, MB has 3 solutions: merging with MB, IPO converting into a joint stock bank or selling the bank completely.

The two transferred banks will not contribute capital to the credit institution while the credit institution has accumulated losses, and shall not be responsible for the liquidity and financial obligations of the credit institution during the implementation of the compulsory transfer plan.

In addition to MB and Vietcombank, it is known that VPBank and HDBank also have authorization documents for the Board of Directors to consider participating in the commercial bank restructuring program according to the policy of the State Bank, but detailed information has not been released. announced. However, according to the above information, it is possible that VPBank and HDBank will be the candidates to participate in the restructuring of the remaining two banks, GPBank and DongABank?

Big challenge from bad debt?

Remember in 2015, when the State Bank of Vietnam respectively issued a decision to buy back CBBank, GPBank and OceanBank respectively at the price of 0 dong in order to restructure, ensure the safety and stability of the banking system. credit institutions, and at the same time contribute to maintaining political security and social order and safety.

However, the audit results 2 years later by the State Audit assessed that the restructuring of these banks was slow and not thorough; The financial situation of banks has not improved, business activities continue to suffer big losses, and bad debt recovery is difficult.

Specifically, GPBank’s bad debt is VND 2,800 billion, accounting for 59.32% of outstanding loans; OceanBank is 14,234 billion VND, accounting for 72.25% of outstanding loans. For CBBank, bad debt of customers (excluding financial institutions and credit institutions) is 18,073 billion VND, accounting for 95% of outstanding loans (19,024 billion VND). The audit also estimated that the annual losses of these three banks amounted to trillions of dong.

Of course, after being bought for 0 dong, with the participation of big banks like Vietcombank, VietinBank and the close supervision of the State Bank as the owner in governance, bad debt of These banks are initially processed and withdrawn.

Summary of financial statements for the first quarter of 2022. (Photo: LT)

However, in the context that the Covid-19 pandemic has affected all aspects of the economy over the past two years, some experts fear that restructuring weak banks during this period will be more difficult than in the past two years. with before. Because bad debts of banks tend to “bulge” while the progress of bad debt settlement of the credit institution system is slow, the backlog is prolonged.

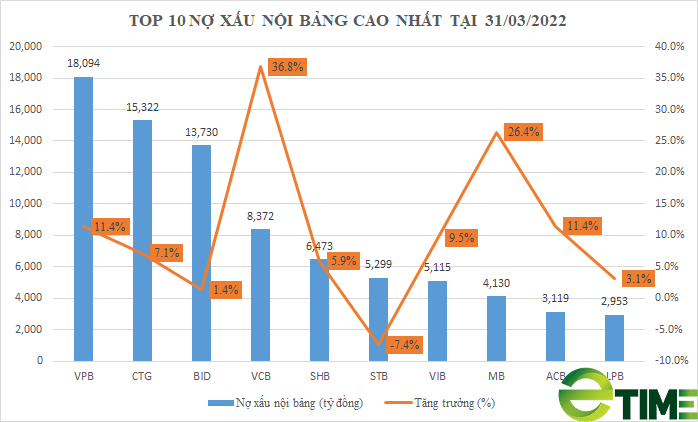

According to statistics at nearly 30 commercial banks, the total number of bad debts by the end of the first quarter of 2022 reached nearly VND 110,000 billion, an increase of nearly VND 10,500 billion compared to the beginning of the year.

The two banks involved in restructuring weak credit institutions through forced transfer, Vietcombank or MB, had their bad debt balances increased by 36.8% and 26.4% respectively compared to the beginning of the year.

at Blogtuan.info – Source: danviet.vn – Read the original article here