Gold price is at risk of falling below 1,800 USD/oz

The world gold market closed the trading week on May 13, down about 4% to the lowest level since mid-June 2021. After 4 consecutive weeks of decline, the spot gold price on Comex floor is currently only at 1,812 USD/oz; The price of gold for June futures is also at 1,809 USD/oz, down more than 70 USD/oz in just 1 trading week.

Gold price has been strongly affected by the selling pressure of the market after falling below the level of 1,830 USD/oz in the middle of the week. Precious metals also suffered a great deal when the dollar appreciated higher after the decision of the US Federal Reserve to raise interest rates and the US inflation index increased hotter than expected. Many comments show that, with the current decline, there is a high risk that gold will continue to be sold off, causing this precious metal to lose value in the near future.

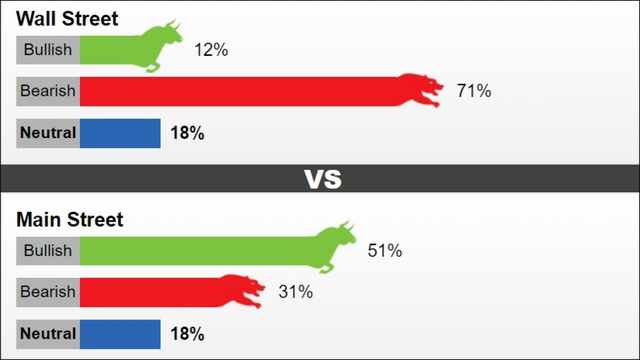

Results from the Kitco News gold survey recently conducted with 17 participating Wall Street analysts show that only 2 of them think that the gold price will increase again next week (accounting for 12%). Meanwhile, 12 analysts (equivalent to 71%) gave the view that gold price will continue to decrease in the near future. The remaining 3 comments (equivalent to 18%) expressed neutral views on the price.

Rate of opinion on gold price next week. Chart: Kitco News.

Meanwhile, 932 online survey votes of Kitco News gave the opposite results. 481/932 respondents (accounting for 51%) said that the gold price will rise again in the next week. Another 286 respondents (equivalent to 31%) said that gold prices will continue to fall lower. The remaining 165 comments (equivalent to 18%) believe that the gold price will not change in the near future.

It can be seen that although retail investors are still optimistic about gold prices in the short term, the positive sentiment seems to have dropped sharply compared to last week when there were 61% of the opinions that gold will increase in price. Along with the rise of the dollar, many analysts believe that rising bond yields will also be a negative factor weighing on the price of precious metals.

“Real bond yields have been pushed to pre-pandemic levels and the uptrend is just beginning,” said Chris Vecchio, senior market analyst at DailyFX.com. Meanwhile, the US consumer price index showed annual inflation increased by 8.3% in April, down from 8.5% in March and this is a sign that US inflation has peaked. .

“Inflation will remain high forcing the US Federal Reserve to continue to raise interest rates aggressively, eventually real interest rates will rise higher than expected and that is bad news for gold. Gold price will continue to fall below the $ 1,800 / ounce mark and it is likely that the gold price can drop below the $ 1,700 / ounce mark by the end of the year,” Chris Vecchio said.

Darin Newsom, Chairman of Darin Newsom also said that in the past, gold investors spent too much energy to increase buying volume, so far it is difficult for the market to break out again when the selling force is too strong and sustained for a while. too long time. Meanwhile, the USD index is still increasing, causing gold prices to not show any signs of recovery.

Similarly, Managing Director at Bannockburn Global Forex – Mr. Marc Chandler also noted that, on the basis of technical analysis, we have not seen any short-term dynamics in the price of gold. If exactly according to the analysis, gold price is likely to drop to 1,780 USD/oz in the next week. “The rising exchange rate makes gold always on the defensive, even though the US inflation indicators will remain stable,” he said.

For the past 4 weeks in a row, a major factor driving the gold price down is the recovery of the dollar’s strength. The USD has increased in value for the last 6 consecutive weeks. Particularly in the past four trading weeks, the USD has increased by 4.15% in value. This means that the strength of the dollar accounts for less than half of the decline in gold prices.

“U.S. CPI rose more than expected this past week and hit 8.3% in April is problematic, especially after the market was expecting just 8.1%, which This means that it is unlikely that inflation will drop sharply any time soon and the FED will not stop raising interest rates in the near future. This outlook will weigh on gold and precious metals causing prices to drop significantly,” said TD Securities, head of global investment strategy at Bart Melek.

World gold price fluctuations in the last 3 sessions of the past week.

Gold has also been used for liquidity over the past week, amid a sharp sell-off in US equities, with the S&P 500 index down 18% since the end of December. Precious metals expert Everett Millman of Gainesville Coins The decline in gold prices was due to investors covering losses in other markets, especially the large losses seen in the stock market, said the report.

“Gold is one of the easiest things to convert to cash during tough stock market times. Looking ahead to next week, gold prices could fall even further and if gold prices fall to break $1,800/oz, there is a risk of a stronger sell-off. However, investors should widen their trading range for gold in the short term due to continued price volatility across all investment markets.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here