Interbank money transfer and 4 issues you need to know?

What is interbank money transfer?

Interbank transfer is understood as the fact that banks allow the transfer of money in that bank’s account, to another bank’s account, with fast and safe money transfer time.

Currently, banks all apply interbank money transfer via ATM, at transaction counters, transfer by CCCD…

The interbank money transfer service has the following advantages:

– Customers everywhere, through internet banking, mobile banking, can transfer money to other banks quickly, no need to go to the counter to check in.

– Money transfer can be done outside office hours, weekends, and holidays.

– Large money transfer limit, suitable for customers with frequent remittance needs.

– Stable money transfer fee, even many banks free interbank money transfer.

– If using express transfer, the recipient can receive the money almost immediately.

– Interbank money transfer service has high security, because to complete the transfer procedure, you must have an OTP code sent to your phone.

If the transaction fails, will the customer’s account be refunded?

If the transfer is unsuccessful, the banking system will automatically refund your account. Therefore, to be sure when making a transfer, please carefully check the account number, account holder name, and bank so that the transaction process is not interrupted.

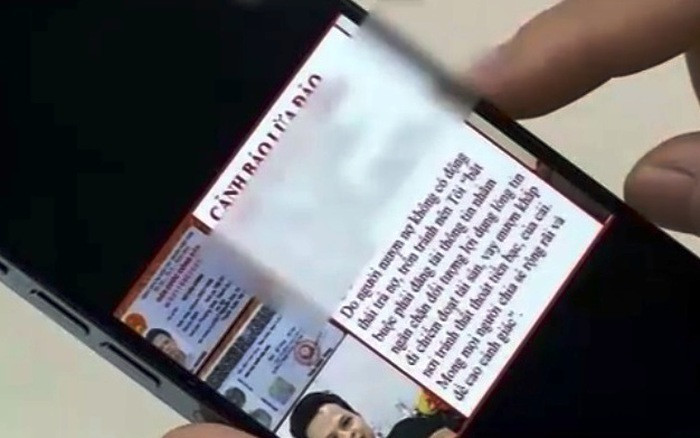

Interbank money transfer wrong account number, other people’s card numbers can get money back?

Many people when transferring money, because they entered the wrong account number and did not check the information before confirming the transfer, they mistakenly transferred money to someone else’s account number.

Will the money be transferred by mistake, can I get my money back? If you fall into the above situation, to get your money back as quickly as possible, please actively contact the bank for support and resolution.

How long does it take to send/receive an interbank money transfer?

Normally, if you choose the fast money transfer method, the beneficiary account will receive the money in just a few minutes. If you choose the normal method of money transfer, the time to receive money when transferring money between banks will depend on the time of money transfer.

Banks are free to transfer money between banks today

Currently, there are many banks that offer free inter-bank money transfer such as: TPbank, MBbank, VPbank, VIB, PVBank, Techcombank…

Accordingly, you can transfer money by ATM, transfer via transaction counters or via the bank’s app via Mobile…

(According to Labor)

The recipient must absolutely not use this money, ask the bank to provide a statement to compare and transfer, do not provide OTP code, username, account password…

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here