A series of businesses have lost billions of dollars in market capitalization

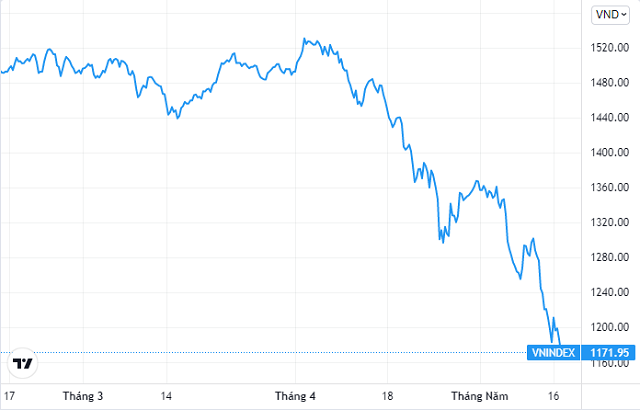

Vietnam’s stock market is witnessing the worst drop in history. VN-Index lost 354 points from April 5 to May 16, falling from 1,526 points to 1,172 points. HNX-Index lost 152 points to 307 points, UPCoM-Index dropped 24 points to 93.2 points. The whole market capitalization “evaporated” more than 22.3% to 6.2 million billion dong.

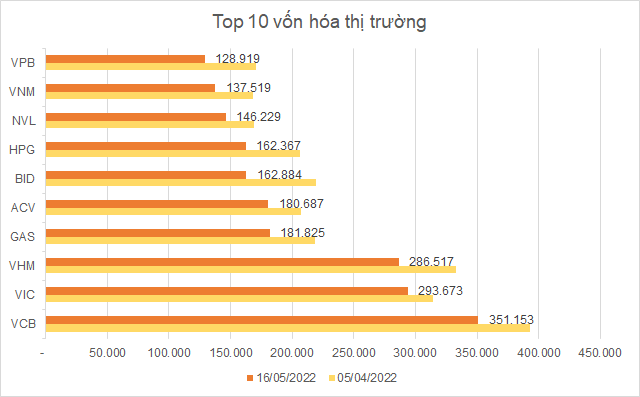

Accordingly, if on April 5, the whole market had 62 billion-dollar enterprises, now there are only 55 enterprises. The largest capitalization is still Vietcombank (HoSE: VCB) with 351,153 billion dong, recording a decrease of 10.6% in the past month and a half. Following is Vingroup (HoSE: VIC) with VND 293,673 billion, down 6.4%; Vinhome (HoSE: VHM) dropped nearly 14% to VND286,517 billion.

Vinamilk (HoSE: VNM) and Novaland (HoSE: NVL) returned to the top 10 market capitalization enterprises instead of Masan Group (HoSE: MSN) and Techcombank (HoSE: TCB).

|

Unit: billion VND |

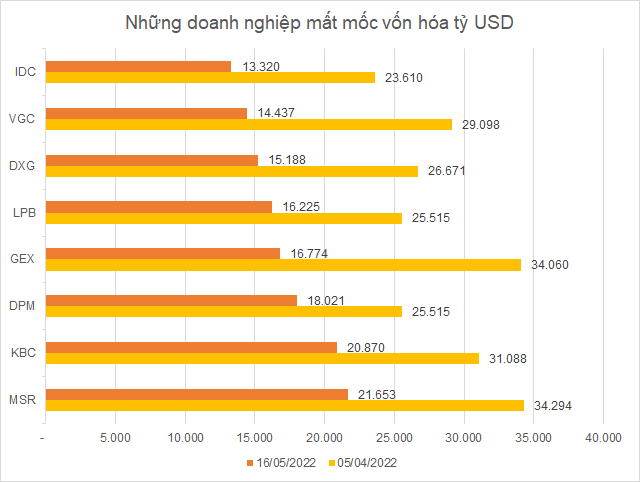

such as Masan High-Tech Materials (UPCoM: MSR), Kinh Bac Urban Area (HoSE: KBC), Phu My Fertilizer (HoSE: DPM), Gelex (HoSE: GEX), Dat Xanh Group (HoSE: DXG)…

|

Unit: billion VND |

The strongest “volatile” capitalization among billion-dollar enterprises is Thaiholdings (HNX: THD). THD stock price decreased from 171,000 VND/share to 81,000 VND/share, capitalization decreased from 59,850 billion VND to 28,350 VND/share. Market capitalization of Gelex Group halved to VND 16,774 billion, the stock fell from VND 40,000/share to VND 19,700/share – a 1-year low.

In contrast, the company that was barely affected by the general market was KSFinance Group (HNX: KSF), whose capitalization decreased by less than 2% to VND31,800 billion. KSF stock has been moving sideways around 106,000 dong/share since the beginning of March until now, the trading volume reached several tens of thousands of units per session.

Sabeco (HoSE: SAB), Sunshine Homes (UPCoM: SSH), Vingroup (HoSE: VIC), Masan MEATLife (UPCoM: MML), REE (HoSE: REE) and Becamex (HoSE: BCM) are capital-capitalized enterprises. Commodities fell below double digits in this historic stock market correction.

Vietnam’s stock market witnessed the strongest drop in history, a representative of the State Securities Commission (UBCK) said that the cause was a combination of domestic psychological factors and especially risks from the market. in international markets such as: Fed raised interest rates sharply, unresolved geopolitical tensions, inflationary pressures, sharp increase in input prices, especially energy prices,…

A leader of the Securities and Exchange Commission said that the regulator is giving special priority to short-term solutions to help stabilize the market and reassure investor sentiment. The State Securities Commission, the Stock Exchanges, and the Vietnam Securities Depository Center also met with 23 securities companies to assess the current situation of the market, as well as discuss both short and medium-term solutions to The market overcame difficulties and stabilized again. This year, there will be positive changes, which are expected to support the market to increase liquidity, as well as transparent information in the market.

Meanwhile, leaders of the Ministry of Finance affirmed that the adjustment is only short-term, and that Vietnam’s stock market still has intact supporting factors from the macro economy and the internal market. Therefore, in the future, Vietnam’s stock market will develop more and more complete and quality, affirming its role as the main and important medium and long-term capital mobilization channel of the economy and enterprises; At the same time, it is an attractive, safe and effective investment channel.

According to SSI Research, macro data is continuing to show positive signals. Manufacturing activity extended its recovery in April as the industrial production index rose 9.4% year-on-year and 9.1% year-on-year, while exports recovered at a brisk pace. Double digits (25.3% YoY and 17.1% YoY), retail and services revenue for the first time since April 2021 recorded double-digit growth, exchange rate and profit Loan interest rate remained stable, deposit interest rate almost did not increase…

SSI Research’s May Market Strategy Report estimates Vietnam’s stock market PE in 2022 at 13 times, a relatively attractive level even considering the context that monetary easing has ended. In the medium term, two main fundamental factors supporting the market, including macro variables, can be kept stable, demand recovers and profit growth of enterprises in the second half of the year returns to a high level compared to the previous year. with a low base in the same period last year.

Right in the first quarter, the profit of enterprises listed on HoSE increased by 31.52% in the first quarter after the fourth quarter of 2021 barely grew. The general growth driver comes from the group of industries recovering from the pandemic such as tourism and entertainment, food and beverage, electricity, water, petroleum and gas, personal and household goods, industry, and chemicals.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here