A family of 3 living in the capital every month spends 14.5 million VND

The story of spending in each family is forever still hot because of the specificity of each tree, each flower, each family, each income.

Therefore, it is difficult to balance reasonable spending in the existing budget. Especially for families living in the capital, where the cost of living is expensive, people are more concerned about this.

Thien Luong’s family (born in 1992) has 3 members, currently living in Hanoi as well. This is her family’s monthly spending plan.

Thien Luong (born in 1992) currently lives in Hanoi. Family consists of 2 husband and wife and 1 small child.

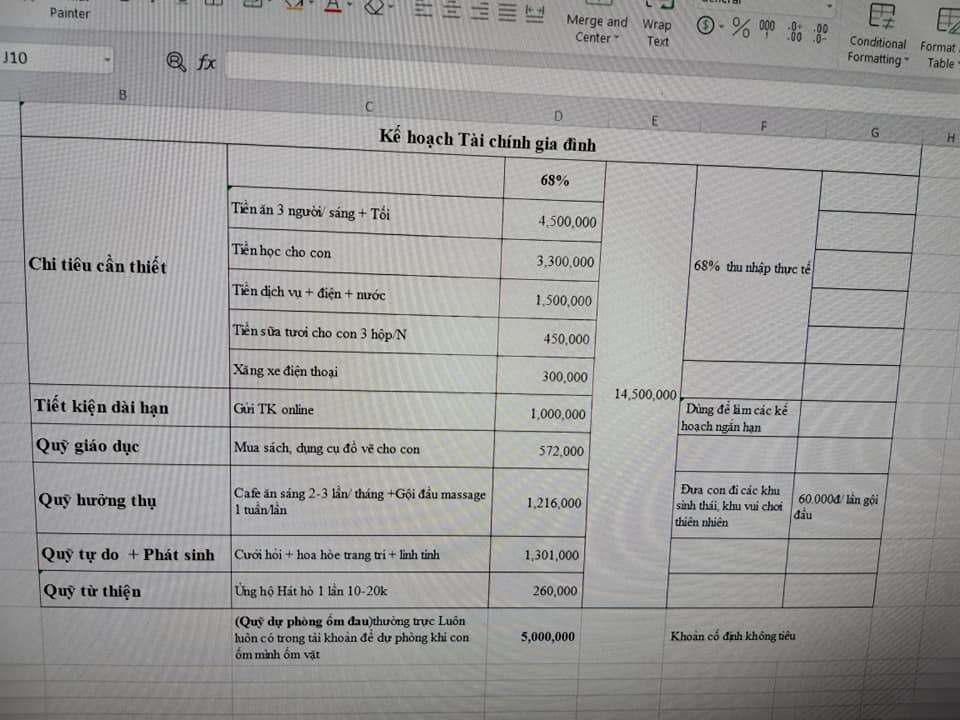

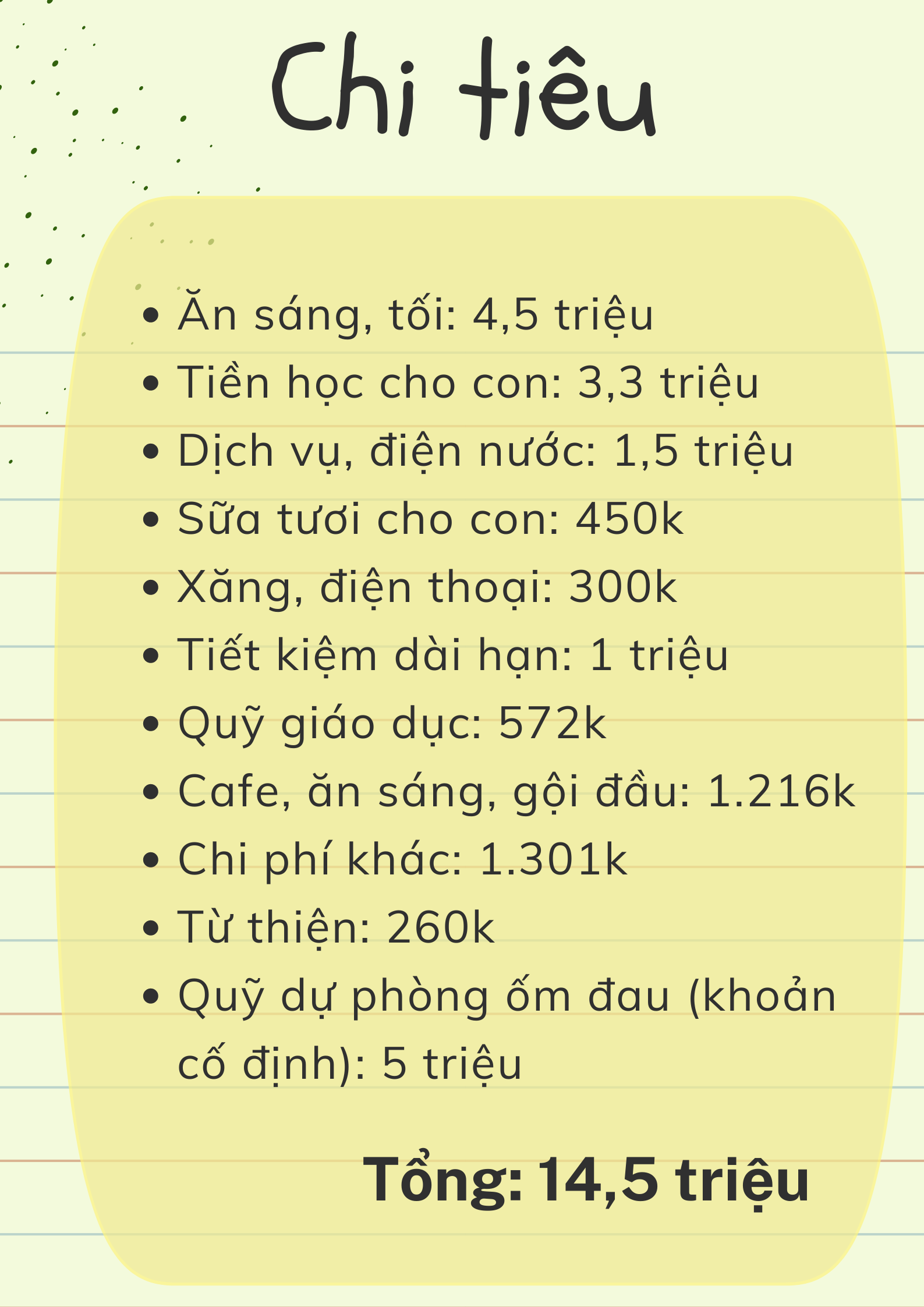

In 1 month, Thien Luong’s family will spend 32% of their income on savings. The remaining 68% is to spend. Expenditures for 1 month are recorded in detail in this table by the young mother.

We have noted Thien Luong’s spending table for your convenience.

It can be seen that the family’s monthly expenditure allocation is done very well by Thien Luong. In which, the savings is deposited into the account as soon as the salary is received, the rest will be for necessary expenses.

“I also strain my brain to calculate how to spend appropriately because I want a better life because one dollar when healed is equal to 3 dong when sick. My life motto is also to accumulate gradually. Everything must be suitable for the family’s ability and economic conditions.

My way is to save before spending. Especially never touch your savings if it’s not a big deal. I will divide the savings deposit into different small amounts. For example, long-term deposit is 1 year, medium term is 6 months and the risk reserve is only 2-3 months.

Even though I save money, I also leave an amount just enough for the whole family to enjoy. Specifically, the family will go on a trip away once a year in a week. If you go near and around Hanoi for 2-3 days, you will go twice a year, each time costs about 5 million.“.

The family will go on a long trip once a year in a week. If you go near and around Hanoi for 2-3 days, you will go twice a year. Travel costs are about 5 million.

Women often spend the most on cosmetics and clothes. With Luong, the opposite is true. These expenses she does not spend too much money, because the working environment does not require makeup. When buying clothes for the whole family, Luong will buy it once. For example, in the summer, when Luong needs to buy 5 dresses to wear at home, he will buy enough, no more. If you can make use of it, then wear it next year, each time you buy it, it costs about 200-300k / piece.

Toys are also renewed once a year by buying 3-4 pieces, if needed, invest more. Shoes also only need 1 pair of sandals, 1 pair of sports, 1 pair of high heels, 1 pair of winter boots, 1 pair of high heels.

The same goes for husband and children. She planned to buy as many as possible, if she had the money, she would buy it in one batch to save time. If not, then divide into the month to buy pants and the month to buy a shirt. Price range 500k-700k / shirt to wear durable. When you buy enough according to the plan, you will stop buying anything more.

Household appliances need to buy, Luong will have an early plan to save. Luong’s way of buying will be to choose standard items, although a little more expensive, but durable, safe and energy-saving.

If you are not rich and have money, you can also learn according to Thien Luong’s spending method, which will help reduce financial pressure much more.

“For example, buying a high-frequency rice cooker for 5 million, instead of receiving a salary, I will buy it and save it for 5 months. I also plan the dishwasher next year when I save enough money so I don’t have a financial deficit“.

By buying quality electronics and saving electricity, the summer month the family costs about 600k-700k, and in the winter it’s about 300k-400k for the bill. If you are not rich and have enough money, you can also learn in Thien Luong’s way, which will help reduce financial pressure much more.

“In my opinion, everything needs to be suitable for the best. For example, a person with income of 5 million cannot be compared with a person with income of 50 million. Balanced and satisfied but always striving, everything will be in place, long-term and short-term plans will be achieved. Fortunately, I don’t spend too much, I don’t have debt to invest because I don’t dare to go out of my comfort zone, so my finances are always under control.“, Thien Luong added.

Recorded according to the character’s narration – Photo: NVCC

at Blogtuan.info – Source: Afamily.vn – Read the original article here