Having trouble because of the purchase declaration

In a recent conversation with a reporter Labor Newspaper, Mr. Le Viet Dung (living in Phu Nhuan District, Ho Chi Minh City) lamented that he was having trouble transferring the name of the house he had just sold. The reason is that the tax office and the land registration office returned the dossier asking him to re-declare the house purchase and sale price because they thought it was not close to the actual price.

Pay tens of thousands of records

Mr. Dung wondered if he declared the actual transaction value of 5 billion dong, the amount of personal income tax he had to pay up to 100 million dong (2% of the selling price) was too much because his family was not well-off. fake. Even the buyer does not want to declare at the true value, and threatens that if the price is correct, they will not buy anymore.

From Mr. Dung’s story, on the afternoon of May 19, we went to a number of real estate management agencies in Ho Chi Minh City to find out the problem of declaring the transfer price of real estate. At the Land Registration Office of Thu Duc City, there are about 50 people waiting for their turn to submit and receive results of real estate procedures. Many of these people have had their records returned by the competent authority because they declared the purchase and sale prices lower than the market prices.

Talking to us, Mr. Tran Van Sinh, who is waiting to submit a completed application to transfer the name of a house in Thu Duc City, said that earlier this year, because he declared the house’s selling price too low, he was banned by Van. Land Registration Office of Thu Duc City returned the dossier and requested to re-declare a more reasonable transaction value. After that, he and the home buyer must sign an addendum to the notarized house sale and purchase contract with the actual price.

“After that, my application was accepted by the Land Registration Office of Thu Duc City and the tax agency. Up to now, I have finished paying taxes to carry out the procedures to transfer the name to the homebuyer” – Mr. Sinh said and warned. Notify us if the declaration of the purchase – sale price of real estate is not close to the actual price, it will definitely be returned by the housing authority.

Similarly, at the Go Vap District Land Registration Office, there are about 100 people waiting for procedures to transfer real estate. Many of these people said that they took a lot of time to go back and forth to complete the procedures because the authorities told them that “the purchase and sale price declaration was not reasonable”.

When we asked “what is a reasonable price?”, Mr. Viet – a person specializing in buying and selling real estate – said that he had to declare the transaction price of at least 80% of the actual selling price, the tax authorities would accept it. received for tax purposes. After that, the new seller will pay taxes and complete the transfer procedure. And if the price is too low, it will be forced to declare it, declare it many times, when the tax agency and the housing management office find it “reasonable”.

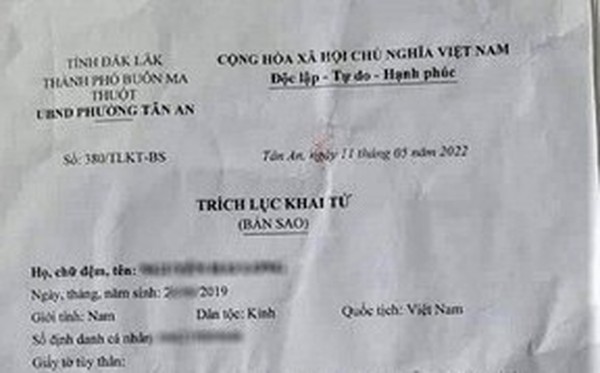

According to the HCM City Tax Department, in the first three months of 2022, the unit fought and handled 10,876 real estate transfer documents, collecting more than 180 billion VND for the budget, including personal income tax. 147 billion VND, registration fee 33 billion VND. In particular, out of a total of more than 48,300 real estate purchase and sale documents, the number of returned documents asking for a re-declaration of the selling price was nearly 10,900 records, accounting for 22%, or about 5 submissions, with 1 returned to be returned. price correction, because the declared selling price is too low.

Quite a lot of people come to the Land Registration Office of Thu Duc City to re-declare the price of buying and selling real estate

Need more convincing

Talking to reporters Newspapers Workers, leaders of some tax departments in Ho Chi Minh City said that for a long time people have transferred real estate at a very high price, but when declaring it to the tax office at a very low price in order to reduce the amount of tax payable. Therefore, tax officials must survey the actual housing prices of each area and then establish the average price to have a basis to consider the purchase and sale prices that people self-declared, from which to consider appropriate handling measures. fit. However, many financial experts believe that the method of determining house prices that the tax authorities are applying is not convincing to taxpayers. Because, the tax industry and its officials do not have the profession and the function of real estate appraisal.

Some questions that real estate buyers and sellers ask are why does the state not update housing prices according to market prices as a basis for tax calculation? At that time, it will limit the situation of declaring low prices to reduce the amount of tax payable.

According to MSc-LS Nguyen Duc Nghia, General Director of Viet Tin Nghia Law Firm, currently the tax rate for individuals doing real estate business is 2%. This is a tax calculation method that is easy to implement but not completely fair, especially when people doing business at a loss still have to pay tax.

Therefore, the state should have a plan to gradually apply the cost-deductible tax method to create a more progressive and fair tax policy. “On the other hand, the Ministry of Finance needs to set up a Real Estate Valuation Center to have a plan to collect data on the average selling price of houses and real estate in each area to use as a tax base. Only then will it be more convincing. for taxpayers” – Mr. Nghia suggested.

LS Luong Van Trung (VIAC – Vietnam International Arbitration Center) quoted information in Canada, when people declared the property purchase price too low compared to the market price, the government immediately recognized the buyer had income and temporarily collect taxes on property buyers. Next, when the buyer sells the property to another person, the government will redefine that person’s income for tax purposes.

“We can learn how to calculate Canada’s real estate transfer tax. At that time, the buyer is forced to ask the seller to declare the true price, or the state soon establishes the market price and regularly updates the level. real estate price fluctuations in each area as a basis for tax calculation” – Mr. Trung said.

Unforeseen risks

Referring to the declaration of real estate purchase and sale prices, Mr. Tran Minh, owner of a small business specializing in real estate, said that he always requires the seller to declare at a notarized contract with a price of about 70%. -80% real price. Because according to Mr. Minh, if the seller declares at a too low price, it will be rejected by the tax agency and land registration authority, requiring a re-notarization of the contract, which is very complicated.

“At that time, the buyer will be disadvantaged because it takes a lot of time to go through real estate procedures. On the other hand, when signing the first notarized contract, the buyer has paid to the seller 99% of the actual purchase and sale value. When re-signing the contract, if unfortunately the seller “backs up” and doesn’t sign anymore, the buyer will receive enough” – Mr. Minh warned.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here