Experts talk about the biggest risks and “difficult situations” of monetary policy

The Government report sent to the 15th National Assembly, the 3rd session opened on May 23, the Government emphasized that the inflation risk in the near future is real, stemming from many unfavorable factors in both countries. supply side and demand side.

On the supply side, production and logistics costs increased due to the sharp increase in the price of international input goods in the context of the global supply chain continuing to break, while food prices decreased, but the decline showed signs of slowing down. , creating cost pressure to push up domestic inflation.

Specifically, after reaching a record high in March 2022, FAO food prices in April 2022 showed signs of cooling down, down slightly by 0.77% over the previous month, up 18.5% over the previous month. with the end of the previous year and an increase of 29.8% over the same period in 2021; 4 months average increase 26.2%.

WTI oil price as of May 10, 2022 was at 103.56 USD/barrel, down 1.08% compared to the end of last month, up 37.5% compared to the end of last year; the average from the beginning of the year to May 10 was 97.39 USD/barrel, up 63.9% over the same period in 2021.

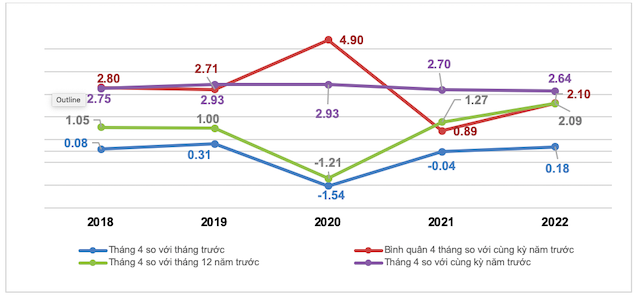

the first 4 months of 2022, inflationary still under control. (Source: GSO)

On the demand side, the economy continued to recover, fully opening up services and tourism activities, thereby improving employment and incomes combined with the positive impact of economic support packages. economy causes aggregate demand to increase, putting pressure on the price level.

In the context that the world commodity market continues to be complicated, the Government said that many international organizations have adjusted their forecasts to increase. inflationary of Vietnam in 2022.

Citing data at the Vietnam Economic Forecast Forum 2022-2023, Dr. Nguyen Bich Lam, former Director of the General Statistics Office, assessed that although core inflation was under control in the first four months of the year, there was a lot of pressure on prices in 2022-2023.

In which, supply chain inflation is the group of factors that put the biggest pressure on the economy’s inflation in the coming time.

Based on the impact factors from supply chain inflation; supply shortage; aggregate demand spiked sharply; labor shortage and expected increase in regional minimum wages. Besides, petrol price is forecasted to increase due to increased production and consumption demand in the coming time; food prices increase according to world food prices; Food prices, especially meat prices, are expected to increase because the price of animal feed increases due to supply chain disruptions and increased consumer demand at the end of the year, Mr. Lam forecasts Vietnam’s inflation in 2022 to be in the range of 4% – 4 ,5%.

However, with the delay of the socio-economic development and recovery package and the forecast in 2023, inflation is still high compared to the target inflation of economies that are important partners of Vietnam’s economy. , our country’s inflation may surpass 5% this year (about 5%-5.5%).

Inflation is the biggest risk and the “difficult position” of monetary policy

Affirming that inflation is currently the world’s biggest risk, Dr. Can Van Luc, a member of the National Financial and Monetary Policy Advisory Council, cited that 60% of US businesses surveyed expressed concern about inflation risks.

This year’s global average inflation is forecast to be about 6.2%, compared with last year’s only 4.2%, a “terrible” increase, so most central banks are forced to raise interest rates, huge consequences.

For Vietnam, Mr. Luc believes that this year’s inflation must be double that of last year or more, about over 4%. If interest rates are raised to curb inflation, it may affect the economic recovery process (to recover one of the solutions is to lower interest rates).

“The difficulty of the current regulator is whether to raise interest rates or not (?). Increasing interest rates to tighten cash flow will control inflation, but increasing interest rates will restrain the overall growth of the economy because capital for businesses is tightened, affecting the recovery process,” said Dr. Can Van Luc said.

The difficulty of the current regulator is to raise interest rates or not? (Photo: Vietnamnet)

In fact, Mr. Luc said, currently, about 68-70% of central banks have raised interest rates and Vietnam has also been increasing input deposit interest rates. However, he expects output interest rates to remain stable.

“Keeping the basic investment interest rate stable is a success this year. As for the output interest rate, the Government and the Governor of the State Bank both require stability, it is extremely difficult to reduce it because the whole world increases, Vietnam’s input also increases, how can output decrease,” said Mr. Luc.

Agreeing, Mr. Francois Painchaud – IMF’s Resident Representative in Vietnam and Laos noted that Vietnam does not have much room for further monetary easing due to risks. rising inflation. According to IMF forecasts, Vietnam’s inflation will increase in the short term, and inflation in 2022 is expected to be “slightly” lower than the State Bank’s target of 4.0%.

at Blogtuan.info – Source: danviet.vn – Read the original article here