TOP 5 ratios CASA named which banks?

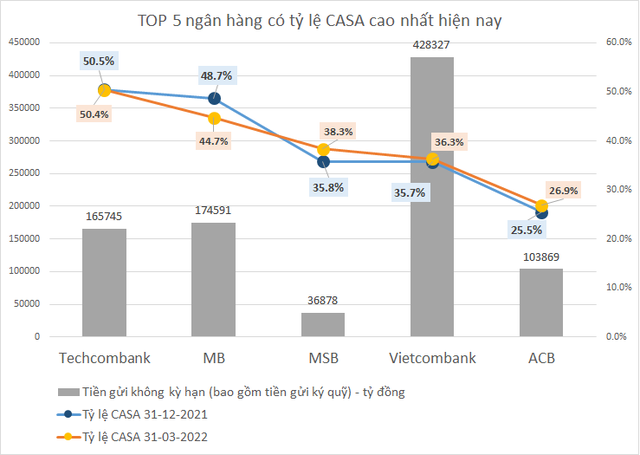

The TOP 5 banks with the highest CASA ratio at the end of March 2022 are still Techcombank, MB, MSB, Vietcombank, ACB, unchanged compared to the end of 2021. However, not all banks can maintain the momentum. increase of CASA in the first quarter of the year.

Techcombank is still the “champion” in terms of demand deposits. According to the financial statements, demand deposits and margin deposits at Techcombank on March 31, 2022 were VND 165,745 billion, up 4.3% compared to the beginning of the year. Accordingly, the demand deposit ratio (CASA) reached 50.4%, almost unchanged compared to the end of 2021. It is known that the driving force for CASA growth in the first quarter of Techcombank came from individual customers, contributed 107.8 trillion dong, up 24.8%. The title “champion” of CASA has been maintained by Techcombank continuously for the past 3 years. Not stopping at more than 50%, Techcombank is targeting that by 2025, the bank’s CASA ratio will reach 55%.

Although MB had a decrease in the CASA ratio, it still stood at the 2nd position. Total customer deposits at MB at the end of the first quarter of 2022 was more than 390 trillion VND, up 1.4% compared to the beginning of the year and motivation. mainly through term deposits. Meanwhile, demand deposits at MB decreased by nearly 13,000 billion dong in 3 months to 174,591 billion dong. The rate of CASA decreased from 48.7% to 44.7%.

MSB continued to impress when the CASA ratio increased sharply from 35.8% at the end of 2021 to 38.3% in the first quarter of 2022. The balance of demand deposits at this bank at the end of March was VND 36,878 billion, an increase of nearly 3,000 billion compared to the end of 2021, equivalent to an increase of 8.7%. Previously, MSB surprised the market when demand deposits increased by 33% in 2021, bringing the CASA ratio to 35.8% from 29.4%. Thanks to that, MSB surpassed Vietcombank in the CASA ratio ranking and ranked 3rd in the system.

At Vietcombank, the amount of demand deposits at the end of the first quarter of 2022 reached more than 428.3 trillion dong, an increase of more than 23 trillion dong compared to the end of 2021. The bank’s CASA ratio improved from 35.7% in at the beginning of the year increased to 36.3% at the end of March. Accordingly, Vietcombank ranked 4th in the system in terms of CASA ratio.

2022 is the first year Vietcombank implements a free policy of all service fees on digital banks. This is expected to help Vietcombank increase demand deposits even more in the near future, when the financial transaction needs of customers increase sharply, especially transfer transactions and online payments. Currently, Vietcombank is also the bank with the largest demand deposit in the system. This is a distinct advantage that helps Vietcombank get low capital costs for many years.

The 5th bank is ACB. ACB’s demand deposit increased by more than 7,100 billion dong in 3 months to over 103.8 trillion dong. CASA rate increased from 25.4% to 26.9%.

At the Annual General Meeting of Shareholders, ACB leaders said that in order to grow CASA, ACB’s advantage at this time is the digital banking system, and the bank is expected to launch a closed digital experience journey. new for customers. ACB also organizes roadshows and links with many Fintech organizations. Therefore, management expects Casa to be higher, to 28-29% by the end of 2022.

In addition to the above banks, there are a number of other banks that also have a CASA ratio of over 20% by the end of March 2022 such as Sacombank, VPBank, VietinBank, BIDV, Kienlongbank.

In which, the most notable is Kienlongbank when it is a small bank but has a CASA ratio of up to 24.8%, ranking 6th in the system. Demand deposits and deposits at Kienlongbank increased by 63% in 3 months to more than VND 13,000 billion. CASA rate jumped from 15.5% at the end of 2021 to 24.8% at the end of March 2022. Previously, Kienlongbank also surprised the market when the CASA ratio increased sharply from 3.3% at the end of 2020 to 15.5% at the end of 2021.

Increasing CASA is one of the important goals of banks today in order to reduce capital mobilization costs and improve competitiveness in the market. To increase CASA, banks not only waive transaction fees, but also constantly improve service quality and apply technology to provide a better customer experience.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here