What should be prepared when the US economy faces the risk of recession?

Undoubtedly, the US economy has made an impressive recovery after the Covid-19 pandemic.

The labor market has added millions of new jobs and people’s wages have thus increased, even for the lowest-paid jobs.

However, high inflation, along with the drastic process of raising interest rates by the US Federal Reserve (Fed), made most people in this country worry that those good times will soon be over. end.

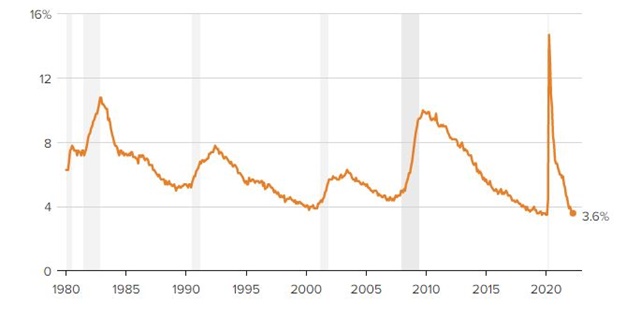

Unemployment rate in the US (gray columns represent recession periods). Photo: CNBC.

“Will the US economy fall into a recession? It’s possible,” said Larry Harris, a professor at the Marshall School of Economics, University of Southern California.

“Pull down inflation without pushing the economy into recession is a very difficult task,” he said.

In order to curb the rise of inflation, the Fed has confirmed that it will continue to raise interest rates.

When interest rates rise, consumers will benefit more from their deposits in banks, however, borrowing costs will also increase, negatively impacting their borrowing needs.

“High interest rates will drag down spending through the burden of financial costs,” Harris said.

That means there’s less money circulating in the economy and growth begins to slow.

The worry that the Fed’s drastic policy tightening process will push the economy into recession has triggered a wave of sell-offs in many markets, especially the US stock market. Stock indexes such as Nasdaq, Dow Jones and S&P 500 are all experiencing consecutive weeks of declines.

The Ukraine conflict, labor shortages and the wave of Covid-19 infections are additional challenges, Harris said.

“There’s a lot of problems with the economy and huge government spending,” he said.

“There will be a day when we will have to suffer the consequences, the question here is when?”,

The last recession occurred in 2020, and it was also the first recession for many millennials of Generations Y and Z.

But, in fact, recessions were quite common in the pre-Covid period. After the Great Depression broke out, there were 13 different recessions, and all stemmed from a multi-month slump in economic activity, according to data from the National Bureau of Economic Research.

Professor Larry Harris. Photo: marshall.usc.edu. |

Be prepared for when your wallet “falls down,” says Harris. As for consumers, they will “dine out less often, they will replace furniture less often, they will travel less, they will buy hamburgers instead of beef”.

While the impact from the recession will be felt across the economy, the magnitude of the impact on individual households will be quite different, based on their income, savings and financial position.

However, there are some common preparation options for such periods, Harris said.

Reasonable expenses

Cut down on expenses you don’t need, such as the service accounts you signed up for during the pandemic.

Avoid debt with floating interest rates

Most credit cards charge different interest rates, and they are directly related to the Fed’s interest rates. This interest rate will change before any interest rate changes from the Fed. Homebuyers using prime-rate mortgage loans will also be affected.

You should review the debts you have and refinance if necessary. “This is your chance to switch to a fixed-rate loan before rates go higher,” Harris said.

Invest in I Bond

This type of inflation hedge, backed by the US federal government, carries very little risk and pays holders a high, fixed rate of interest. While it’s not widely offered and you won’t be able to get your money out for at least a year, its yield is definitely much better than a 1-year certificate of deposit, which yields less than a year. 1.5%/year.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here