The pressure of net selling increased strongly, VN-Index dropped by nearly 22 points in the first session of the week

Market liquidity is still weak, showing investors’ reticence. Photo: SSI

Following the positive developments in the previous week, the Vietnamese stock market opened the first session of the week on May 23, still relatively positive. The indices quickly turned green about 1 hour after opening.

However, at about 10am, selling pressure started to show signs of increasing in blue-chip stocks, making the market a bit more negative, red color gradually spread on the electronic board after almost the end of the morning session.

Pausing the morning session, the market’s main indexes continued their weakening momentum due to increased selling pressure. VN-Index is now down 10.77 points to 1,229.94 points; HNX-Index dropped 0.89 points to 306.13 points.

The whole market currently has 276 stocks increasing (16 stocks reaching the ceiling price), 920 stocks remaining unchanged, 406 stocks decreasing (7 stocks falling to the floor). Market liquidity reached 7,526.92 billion dong, of which HoSE only reached 6,241.8 billion dong, showing that investors’ cautious sentiment is still very large.

Entering the afternoon session, selling pressure once again appeared at the end of the afternoon and investors’ weak sentiment made the index drop very quickly. Before ATC session, the market sometimes lost nearly 33 points, then just recovered quickly in the ATC session.

However, at the end of the first session of the week, VN-Index dropped 21.9 points (-1.77%) to 1,218.81 points. While HNX-Index dropped 6.36 points (-2.07%) to 300.66 points.

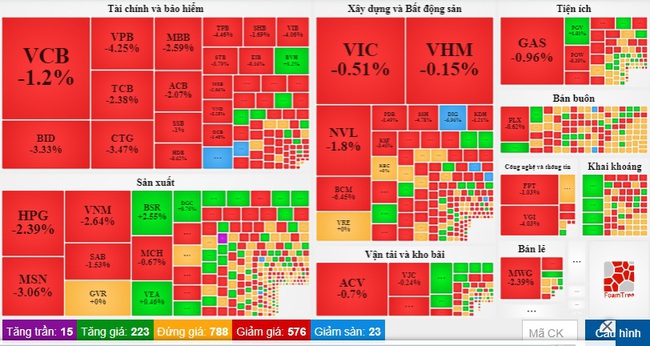

Red dominates in today’s session, May 23.

Blue-chips are still the “criminals” leading the general market’s downward momentum. In which, banking group had a great influence on the index when many codes dropped very deeply.

For example, STB sold off 5.8% to 20,3500 dong; TPB dropped 4.5% to 30,000 VND; VPB lost 4.2% to 29,300 dong, VIB lost 4.1% to 24,800 dong, BID and CTG dropped nearly 3.5%…

The VN30 basket alone lost 27.16 points (-2.12%) today with 27/30 stocks decreasing, only BVH gained 1.2% and GVR and VRE stood at reference.

Real estate and construction also dropped quite deeply such as: DIG fell to the floor, CEO fell 7.3%, the duo DXG and DXS fell around 6%, QCG lost 3.2%, HBC fell 4.3%, CTD fell 2 ,8%.

Securities stocks also dropped sharply with 22 losers (2 floor codes) and 1 reference code. Specifically, SSI and HCM were on the floor, MBS dropped 7%, VND fell 5.35%, VCI dropped 4.9%.

The group of stocks with the biggest influence on the market…

A rare bright spot in the market belongs to the seafood group when green color is present for the most part, benefiting from exports still skyrocketing. IDI codes even kept the ceiling price, ANV after a period of going up to the ceiling was also under selling pressure to retreat and gained 3.8%, CMX gained 2.9%, VHC gained 1.6%.

Oil and gas stocks gained strongly thanks to the high anchoring world oil price, along with the supportive information from the domestic gasoline price continuing to increase strongly in today’s correction session. PVDs gained 3%, BSR gained 2.8%, PVC gained 1.8%, PVS and OIL gained about 1.5%…

Market breadth shifted from buyers in the morning to sellers in the afternoon as the red color became more and more dense. The whole market had 238 gainers (15 stocks increased to the ceiling), 599 stocks decreased (23 stocks fell to the floor) and 788 stocks traded at the reference level.

Market liquidity still did not have many changes with a total trading value of 15,869 billion dong. Particularly, the matching value on HoSE today reached 13,332.6 billion dong.

Foreign investors today also traded quite bleakly when they bought 922 billion and sold 1,361 billion on HoSE, equivalent to a net selling of 439 billion dong. The codes that lost the most were SSI (-155 billion), VIC (-80 billion) and VNM (-50 billion).

On the HNX, foreign investors net sold 3.49 billion dong, in which THD was the most net sold stock.

at Blogtuan.info – Source: danviet.vn – Read the original article here

![[20h00, ngày 6/5] MONEYtalk #19: What is the Metaverse? 2 [20h00, ngày 6/5] MONEYtalk #19: What is the Metaverse?](https://vtv1.mediacdn.vn/fb_thumb_bn/2022/5/6/277823942321342160140824666061064803680611n-1651835234060635182449.jpg)