The truth about the “3-zero bond”, how to see it right?

Catching the right “sickness”

According to experts, besides properly recognizing the role of the corporate bond market, at the present time, it is even more necessary to catch the right “disease” to make appropriate recommendations and solutions to help the market develop. healthy development, becoming a medium and long-term capital conduit for the economy.

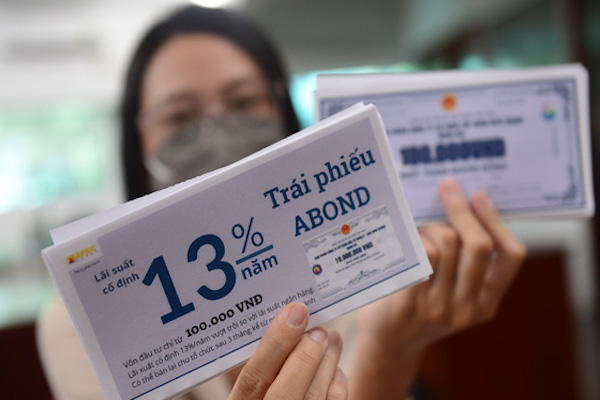

According to experts, in the past time, there have been many views about the “3-no” bond, which sounds very offensive (photo: Tuoi Tre).

Dr. Can Van Luc, a member of the National Financial – Monetary Policy Advisory Council, said that in the past time, there have been many views about “3-no” bonds (no credit rating, no payment guarantee). payment, no collateral), this sounds very offensive. Because of the fact, it is true that there are cases where there is no collateral, but only about 18%, the rest are secured assets but in other forms such as stocks, assets formed in the future, or possibly part of other assets.

In this regard, a representative of the Finance Department of banks and financial institutions under the Ministry of Finance said that in 2020, the percentage of enterprises that issue corporate bonds in the market with collateral is in the number of statistics are 45%, in the first 9 months of 2021, 48% of bonds are issued with collateral. Among these, commercial banks and securities companies are the subjects that often issue unsecured assets because their financial capacity is very good, they can prove to investors about their business performance. his movement. The subject with the most collateral belongs to the real estate business, usually the assets formed in the future from the project, or the shares of that real estate business.

As can be seen, the criteria set forth do not fully reflect the essence of an issued bond, but also depend on the quality of the issuer, and truthfully disclosed information in the market.

Looking at it from another angle, Master Nguyen Anh Vu, Banking University of Ho Chi Minh City at a seminar also said that there are many things that are more worrisome than the “three nos”, because the principle of lending in general and When investing in bonds in particular, collateral is not the only or most important factor to consider buying bonds. The most important thing is to assess the financial and operational status of the business.

“I am concerned that in addition to “3 nos”, there are other 4th and 5th “nos”, such as not having good financial capacity, cash flow, unfeasible business plan, capital flow not for the right purpose… These things are sometimes more worrisome than not having collateral.

In 2021, corporate bond issuance is equal to the period 2011-2018, of which 95% is private placement, 5% is issued to the public. I wonder about the sudden increase in the number of corporate bonds, but the ability to distribute and sell bonds of businesses and banks is still very good. The current law stipulates that the conditions for a private placement are always lower than for a public offering. In the past, individual investors did not pay much attention to the corporate bond channel, but only to the stock channel. The problem is, why do businesses issue so many individual releases? While individual investors buy only less than 9% of bonds issued.

In addition, there is also the reason that we broaden the definition of professional securities investor, not only institutions but also other businesses, individual investors owning a portfolio of stocks. Therefore, investors must have a high responsibility in analyzing and assessing the risks of the issuer”, emphasized Mr. Nguyen Anh Vu.

Enhance information transparency

Recommending solutions to help the corporate bond market develop stably, Dr. Nguyen Duc Do, Institute of Economics and Finance, Academy of Finance said that regulators need to improve the level of publicity and transparency for issuers. Due to the asymmetric information situation, the issuer may hide adverse information, making the buyer unable to fully assess the risks of the business, as well as of the bond.

Investors must have a high responsibility in the analysis and risk assessment of the issuer

Although it is necessary to improve the level of information disclosure, it is also necessary to have a specific, clear and reasonable roadmap, taking into account the speed of mobilization and capital needs of the economy. Raising standards too quickly can cause many businesses to fail to respond, affecting their ability to develop. However, if the requirements on information disclosure are not improved, the corporate bond market will be exposed to many risks and if accumulated for a long time, it can lead to collapse.

In addition, regulatory agencies also need to issue regulations on financial safety for bond issuers. Financial safety regulations need to be promulgated soon, to avoid the situation when most bond issuers fall into too much debt before issuing regulations. At that time, lowering financial leverage could lead to failures like the case of China’s Evergrande.

“In order to reduce risks for the banking system in buying or underwriting corporate bonds, it is necessary to create many products from which to attract individual investors to participate on the basis of diversification and minimizing risks. ro. In order to attract these subjects to participate in the market, while still ensuring risk control, the development of financial products with both attractive interest rates and a reasonable level of risk plays an important role. very important. If financial institutions can combine single bonds of many businesses in many different industries to aggregate into a single bond, that is, a synthetic bond, the level of risk will be greatly reduced. much, while the yield remains attractive.

However, in order to develop the above products, a prerequisite is that the regulatory agencies must have a clear view, keep up with developments in the market to issue appropriate and timely management regulations. , to avoid unmanageable situation is forbidden. For example, restrictions on participation in private placement of bonds for individual investors, although they may limit risks for investors, also hinder their participation in particular and their development of the market in general”, Dr. Nguyen Duc Do analysis.

The expert further recommended that putting corporate bonds on the exchange is also a solution to sustainably develop the corporate bond market. Exchanges will make bonds more attractive thanks to high liquidity, investors will have more choices in decisions to buy, sell or hold bonds. Furthermore, in the event of a bond failure, the losses could be shared among many people.

Business Forum

at Blogtuan.info – Source: cafebiz.vn – Read the original article here