Chairman Tran Dinh Long declared “tragic business results because the steel industry is not favorable”, but why does Hoa Phat still invest in new projects Dung Quat 2, even Dung Quat 3?

As a leading steel enterprise, Hoa Phat has attracted great attention from business and investors in recent years, when the steel industry flourished. The 2022 Annual General Meeting of Shareholders of this Group held in Hanoi yesterday 24/5 took place extremely excitingly, shareholders came to attend directly despite the unfavorable weather and booked a lot of questions for the company’s management board.

Leader of Hoa Phat – Chairman of the Board of Directors Tran Dinh Long is the person who directly answered these questions. Notably, when asked by shareholders about the profit target of VND 25,000 – 30,000 billion in 2022, a significant decrease compared to 2021, Mr. Long explained:We are just a cell in the economy, everyone is waiting for the second quarter, third quarter and fourth quarter business results, I think this year’s business plan will be difficult. Everyone will see how dire business results because the steel industry is not favorable. Of course, in any circumstances, Hoa Phat will try to do the best.

In any difficulty, Hoa Phat must be the best company in the steel industry, but shareholders are requested to be very sympathetic. In this common economy, I can’t be different“.

Let’s clarify why the “Southeast Asian steel king” declared that the steel industry was not favorable and this year’s business plan would be difficult?

World steel prices have peaked and are falling?

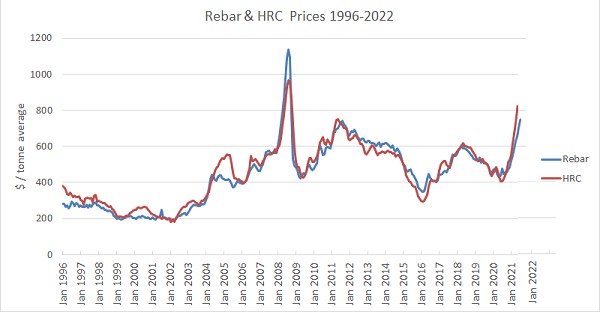

If you have been a commodity and macro market for many years, you will understand that Steel is a highly cyclical industry. Observed in the period from 1996 to now, there was a time when the world steel price climbed to more than 1,100 USD/ton, but also sometimes back to 200-300 USD/ton.

The chart below shows the prices of two typical steel grades, HRC bar and hot rolled coil.

Price chart of bar steel (Rebar) and hot rolled coil (HRC) (unit: USD/ton) – Source: www.steelonthenet.com

As can be seen in the chart above, the price of steel fluctuates up and down in a cyclical manner, that is, every few years it will move from top to bottom, and then from bottom to top again. The most recent prominent peaks occurred in August 2011, April 2018 and September 2021; along with price bottoms that occurred in May 2009, February 2016 and June 2020.

The chart above also shows the cyclical fluctuation of steel prices over the past 25 years, with an estimated frequency of 3-4 years. In our view, the next price bottom will happen in mid-2023, and the next top is expected around the third or fourth quarter of 2025.

In view of MCI (Metals Consulting International Limited) in January 2022, international steel prices seem to be falling, from the peak in September 2021. More importantly, MCI said, steel prices will gradually decrease in 2022, falling to a bottom in mid-2023.

According to Fitch’s assessment, the world steel price is forecasted to recede in 2022 when the global price increase ends. Specifically: World steel price in 2021 ~ USD 920/ton will decrease to ~ USD 750/ton in 2022.

In line with the world steel price movement, the domestic steel price has started to decrease since April 2022

Regarding the domestic steel situation, many construction steel enterprises continued to reduce product prices from May 17 and this was the second consecutive adjustment within a week.

Hoa Phat, which accounts for 32.6% of the national construction steel market share in 2021, has reduced by 800 thousand dong/ton for CB240 coil in the northern market, to 17.83 million dong/ton. Also in this area, D10 CB300 steel lowered VND 460,000/ton to VND 18.28 million/ton.

Vietnam-Japan steel dropped the most with 1.01 million dong/ton for CB240 and D10 CB300. After the reduction, the price of the two steels above was 17.81 million dong/ton and 17.91 million dong/ton, respectively.

Also in Hoa Phat’s 2022 annual shareholder meeting, Chairman Tran Dinh Long cited many reasons for the decrease in steel prices. Initially, the Russian-Ukrainian war led to a shortage of steel, but the reality was not as expected.

More importantly, China’s “Zero – Covid” policy contributed to the decrease in steel demand in this market. China accounts for more than 60% of consumption, so when implementing a strict blockade policy, demand decreases.

Besides, the world’s largest economy is the US recession, high inflation will also directly affect steel prices.

While output prices fell, input material prices increased sharply

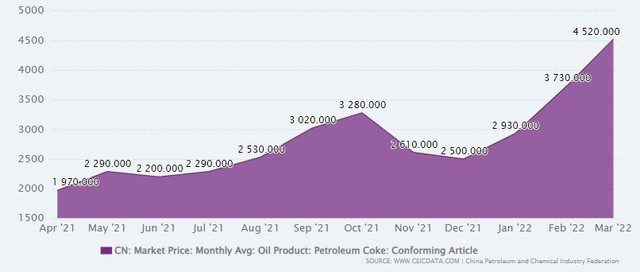

The most important raw materials in steel production are iron ore and coke. Over the past few months, prices of these two raw materials – fuels have increased, especially coal.

From the end of 2021, the coal consumption demand of the world economy will increase gradually; Especially since March 2022, when the Russia-Ukraine tensions broke out, the coal supply was not enough to meet the demand, and coal prices continuously increased to record milestones.

Coke price chart in the past 1 year

Why is the general situation of the steel industry “catastrophic”, Hoa Phat still deploys new projects, even super projects?

During the 2022 General Meeting of Shareholders, Chairman Tran Dinh Long emphasized that the corporation’s determination is “Hoa Phat will not stop moving forward“.

According to the steel billionaire’s share, the enterprise can currently produce 8.5 million tons of steel, ranking first in Vietnam as well as in Southeast Asia, but factories have reached the limit, output can only grow about approx. 3%.

Therefore, Hoa Phat has built Dung Quat 2 factory with a capacity of 6.5 million tons of HRC (hot-rolled steel coil), bringing the total output to about 14 -15 million tons of steel products. Currently, the project is on track with the schedule, when Hoa Phat has signed all major contracts in May. The total investment capital for the project is about 80,000 billion VND.

After Dung Quat 2, the company is studying to build Dung Quat 3 steel factory with a capacity of 6 million tons/year, maybe not located in Dung Quat. Thus, Hoa Phat’s total capacity will increase to 21 million tons, equivalent to Vietnam’s current steel consumption demand. Hoa Phat will produce part of HRC here, in addition to U steel, Y steel. The project will be implemented after 2025.

The problem is continuously implementing large projects, increasing capacity, but admitting that the steel industry is facing difficulties, how do Hoa Phat’s management calculate?

Although the steel industry faces many difficulties in the short term, as forecasted by international experts, after hitting the bottom, the world steel price may set a new peak in the mid to late 2025 period.

On the other hand, Vietnam is still in the period of strong infrastructure development. According to calculations by Dr. Can Van Luc – Chief Economist of BIDV, in the period of 2022-2025, Vietnam needs 3.15 million billion VND/year of social investment capital. Thus, it can be seen that public investment and civil construction, factories… in the coming years will be a large number.

Therefore, Hoa Phat’s new investment in Dung Quat 2 and even Dung Quat 3 factories is considered by many to be to anticipate the wave of steel price increases in the new cycle as well as the wave of “public investment”. .

Another angle, billionaire Tran Dinh Long has great ambitions with “child” Hoa Phat, not only the leading scale in Vietnam but also wants to reach further. From a business perspective, when a business is at the top with a large enough market share, they not only take the initiative in selling prices but also “squeeze” the best possible price of input materials.

Currently, steel consumption in Vietnam is still relatively low, about 240 kg/capita. Hoa Phat leaders forecast that this number may increase to 350-400kg/capita, so the increase in output will not cause oversupply, the problem is whether Hoa Phat has good competition or not.

According to Mr. Nguyen Viet Thang, General Director of Hoa Phat, Vietnam’s HRC demand is about 12 million tons/year, domestic production reaches 11 million tons. Therefore, Hoa Phat’s main market is still domestic.

In addition to dominating the domestic market, Mr. Long shared Hoa Phat’s vision towards further internationalization, wanting to open factories abroad. The company has invested in buying ore mines purchased in South Australia, is completing procedures with the government, and expects to have the first shipment of ore by the end of the year.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here