Responding to the import of the car in the form of gifts, gifts, customs said tax collection

This afternoon (May 25), the General Department of Customs held a press conference on the State management of customs for the import of cars in the form of gifts and presents after the press published a series of articles. reflects the anomalies surrounding this form.

The General Department of Customs said that for vehicles imported as gifts, according to Circular 143/2015/TT-BTC, vehicles imported as gifts must be licensed before carrying out import procedures and Each organization or individual is only allowed to import 1 vehicle/year.

The data of the General Department of Customs shows that from 2016 to the end of May 22, 2022, the number of cars with 9 seats or less imported in the form of gifts and gifts is only 3,979 cars out of a total of 464,183 cars (equivalent to 3,979 cars). accounts for 0.85%.

Regarding tax policy, the General Department of Customs said that according to the tax law, for cars imported as gifts, customs declarants must pay all taxes: import tax, consumption tax Special consumption tax and value added tax before the goods are cleared, for gift cars, extra income tax must be paid at the domestic tax office.

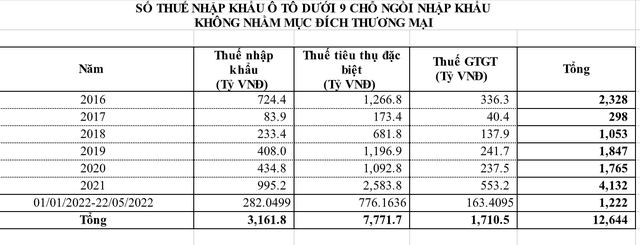

The data shows that the import tax on cars with less than 9 seats imported for non-commercial purposes from 2016 to the end of May 22, 2022 is VND 12,644 billion. Of which in 2020 alone is 4,132 billion VND; from January 1, 2022 to May 22, 2022 is 1,222 billion VND.

“For cars imported in the form of gifts or presents mentioned by the mass media recently, the customs authority has carried out procedures in accordance with current regulations and collected all kinds of goods. prescribed tax. At the same time, the customs authority shall send relevant documents to the domestic tax authority to collect irregular income tax”, the General Department of Customs informed.

For information such as an address where many businesses receive cars as gifts, or cars after customs clearance have been brought to a store for sale, the General Department of Customs said that the customs authority will issue permits. on the basis of valid documents as prescribed in Circular 143/2015/TT-BTC submitted by the gift recipient (including the business registration certificate), whereby the fact that an address has many businesses operation (granted a business registration certificate) is in accordance with the law on enterprise management.

“In case these are ghost addresses used to make false declarations, the customs authority will coordinate with relevant authorities to consider and handle them in accordance with regulations,” emphasized the General Department of Customs.

In addition, according to the provisions of subsection 3 of the Civil Code (regulations on the right to dispose), the right of disposition is the right to transfer property ownership, relinquish ownership, consume or destroy; The owner has the right to sell, exchange, give, lend, give up ownership, consume…

In order to strengthen the strict and lawful management of the import of gift cars, the General Department of Customs said that the Ministry of Finance has directed the customs authorities to take many solutions. Accordingly, if the application for a license is incomplete or detailed as prescribed, the import license will be refused.

In addition, reviewing the documents at the stage of granting the import license, specifically: must have documents to prove the relationship (for import-export relations, there must be declarations and documents for payment of goods, private relations, etc. If there is any doubt about the relationship between the donor and the donor, it is necessary to have a contract, email exchange before…), in case of doubt about the relationship between the donor and the donor, it should be reported to the General Department of Customs for information verification.

In the coming time, the Ministry of Finance will tighten the import of cars in the form of gifts and gifts (Artwork).

For businesses that regularly import as gifts in recent years, verification must be carried out.

The Customs Branch at the border gate (where customs procedures are done) will strengthen the management of customs value for imported cars: Determine the customs value for tax calculation at the time of customs clearance ; Registration checks must be compared as soon as the results are available on the National Single Window; Review all declarations of imported vehicles for non-commercial purposes in the last 2 years…

Notably, the General Department of Customs will organize the establishment of inspection and inspection teams at 4 Customs Departments of provinces and cities with a large number of imported cars in the form of gifts in the past time.

On May 24, the Government Office sent an official dispatch conveying the direction of Deputy Prime Minister Le Minh Khai, assigning the Ministry of Public Security and the Ministry of Finance to assume the prime responsibility for, and coordinate with relevant agencies in, urgently inspecting and verifying information on information security. press information about violations in importing cars as gifts and gifts. In case of detecting violations, they will be strictly handled according to the provisions of law.

* Invite readers to watch programs broadcast by Vietnam Television on TV Online and VTVGo!

at Blogtuan.info – Source: vtv.vn – Read the original article here