“Long-term investment in Hoa Phat stock can’t lose”

On the morning of May 24, 2022, it was pouring rain in Hanoi. In previous years, Hoa Phat Group often held shareholders’ meeting at Hilton Hotel, in the early days when the scale of the group had not yet expanded, it was held at Nguyen Du or Nguyen Dinh Chieu branches, and this year Hoa Phat hold a general meeting of shareholders in Melia.

Melia’s meeting room is twice the size of the Hilton and nearly a dozen times larger than the branch meeting room, but by 9pm, the seats are almost full. This year, Hoa Phat’s shareholders amount to 161,000 people, the largest number of stock exchanges.

Mr. Tran Dinh Long, Chairman of Hoa Phat Group appeared at the General Meeting of Shareholders with an unhappy mood. A set of reports was submitted by the media and investor relations department with negative comments about the corporation, stating that a dividend yield of 35% of which 30% in shares and 5% in cash is too low. , the payment of stock dividends is “issuing paper rolls”, requiring Mr. Long to increase the cash dividend ratio.

The roller coaster goes slowly but surely

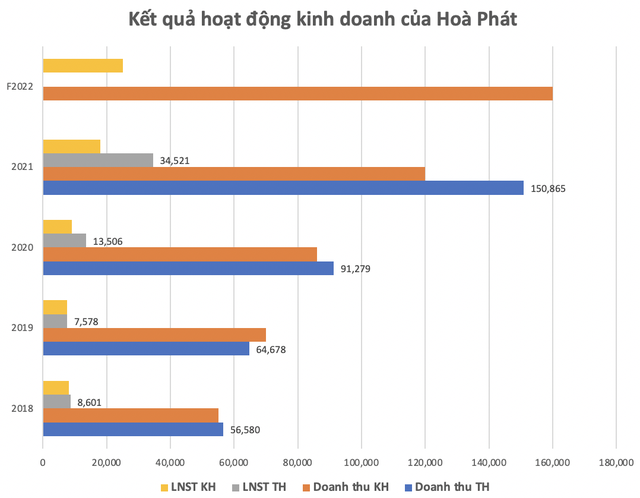

In 2021, Hoa Phat’s profit after tax is VND 37,000 billion, exceeding 92% of the plan. This year, the group sets an expected revenue of 160,000 billion dong, profit after tax in the range of 25,000 to 30,000 billion dong, down from last year. Most retail investors wonder why the corporation has planned to go backwards like that, while in the past 3 years, “rollers” (Mr. Long often likened Hoa Phat to a roller, go slowly but surely) growth rate is equal to times.

Since Dung Quat 1 Steel Factory officially went into operation at the end of 2019, Hoa Phat has turned a historical page with. Revenue has tripled from 56 trillion in 2018 to 150,800 billion in 2021, and EAT increases from 8,600 billion to 34,500 billion. What Mr. Long promised to shareholders at the general meeting was fulfilled. Of course, the steel billionaire’s style remains the same: extremely cautious.

Looking at the plan set out at the general meeting of shareholders, almost every year Hoa Phat achieves and exceeds the plan, especially in 2021, it exceeds the plan by more than 90%. Perhaps they are used to Hoa Phat’s momentum, so shareholders who are loyal to Mr. Long when holding HPG shares from the peak of 58,000 VND/share to 34,000 VND/share (a decrease of more than 40%) will feel feeling shocked when Mr. Long stated frankly in front of the congress: “Hoa Phat is just a cell in the economy, everyone waiting for the business results of the second, third and fourth quarters of the steel industry in particular and the industries in general will understand why I am cautious, I think the business plan This year will be difficult. Everyone will see how miserable the business results are because the steel industry is not favorable at the moment. Of course, under any circumstances, Hoa Phat will try to do the best in the steel industry. But I still ask shareholders to be very understanding. No matter how good he is, he’s good but In the industry with the average profit margin of the industry, I cannot be different from the industry”.

After the announcement of Chairman Hoa Phat, HPG’s stock price plummeted in the afternoon, even being sold at the floor price to 34,200 dong/share.

In fact, the sentence “dismal business results” is not what Mr. Long said about Hoa Phat. The King of Steel wants to convey a message to shareholders and the market that: “I’m cautious, so I think the situation will be difficult, but don’t look at Hoa Phat, in general, in the steel industry, it will only show business results in 4-6 months, so I have to be cautious.”

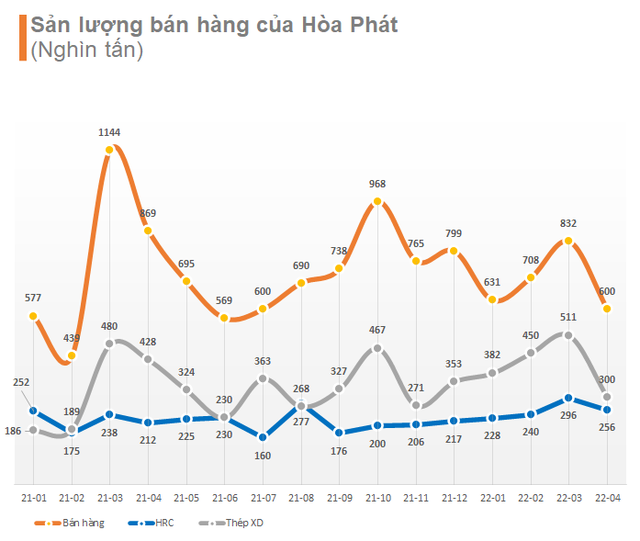

Sales volume of construction steel decreased compared to the same period in 2021

Just started Dung Quat 2, I thought of Dung Quat 3: Hoa Phat will not stop

In 2022, 90% of development investment capital will be for the steel segment. Hoa Phat started construction of Dung Quat 2 Project in May 2022, has now signed key packages and contractors have started sending workers to Dung Quat. This is a big battle of Mr. Tran Dinh Long, to be able to bring Hoa Phat beyond the border of Vietnam and into the top 30 largest steel enterprises in the world.

According to statistics of the Steel Association, currently, Hoa Phat’s construction steel market share accounts for nearly 36% of the total market output, HRC’s market share has only reached 1 million tons in the first 4 months, accounting for 40% of the market share. still behind Formosa Ha Tinh (1.5 million tons). Dung Quat 2, when completed at the end of 2024, will supply 6 million tons of HRC to the market, almost covering the domestic hot-rolled coil market demand when currently Vietnam still has to spend several billion USD each year. to import HRC.

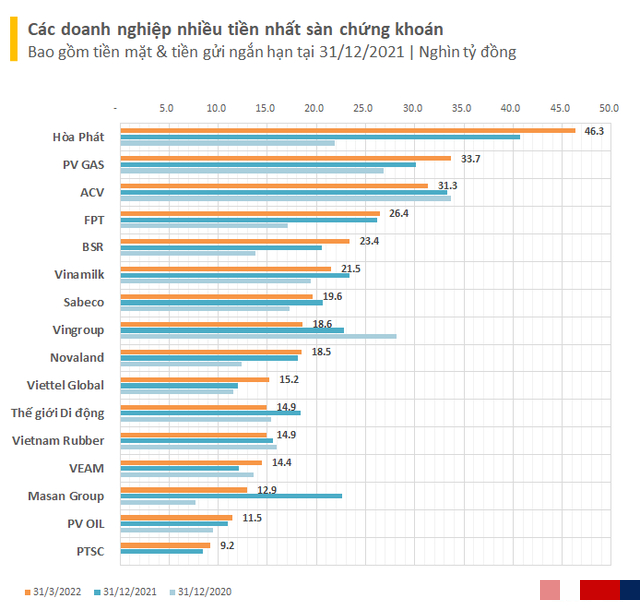

“Dung Quat 2 has a huge weight, can’t be slow“, Mr. Long is putting all his energy and capital for this project to be completed on time. The capital need for Dung Quat 2 is nearly 80,000 billion, domestic banks lent 35,000 billion, still missing somewhere 45 trillion.

According to Ms. Pham Thi Kim Oanh, the Group’s financial director, the charter capital of Hoa Phat’s parent company is currently at VND 44,000 billion, while the parent company has invested in subsidiaries of VND 63,000 billion. The roadmap after completing Dung Quat 2 at the end of 2024, Hoa Phat Dung Quat’s own charter capital is 70,000 billion, so in the next 2-3 years, the parent company must continue to increase charter capital, the number depends on plan each year.

Mr. Long also announced that the group is continuing to study the Dung Quat 3 project, “Hoa Phat does not stop, Hoa Phat will continue to move forward, affirming to be one of the largest corporations in Vietnam, with regional stature”.

“Every day we generate 500 billion in revenue, if we do well this year, we can achieve 160,000 – 180,000 billion in revenue. There is no company in the territory of Vietnam that can match us. To rise to a For a new level, we need a lot of capital. This requires stable finance.” Mr. Long affirmed.

Answering a question from a foreign investment fund, currently, the capacity of Hoa Phat’s steel plants, if including Dung Quat 2, is about 15 million tons, if Dung Quat 3 continues to be built with a scale of 6 million tons, the total capacity is about 6 million tons. Hoa Phat’s capacity to 21 million tons, where does this supply go? Mr. Long confidently believes that all investment decisions are carefully evaluated by the Board of Directors and Executive Board. Currently, Vietnam’s steel consumption is still at a relatively low level (240 kg/capita) still lower than the world average. With developing and industrializing countries like Vietnam, consumption can increase significantly. 350-400 kg/capita, still assured about the output.

Mr. Long also did not hide his ambition to study the construction of factories abroad and internationalize the group’s activities after successfully buying ore mines in Australia.

Long-term investment in Hoa Phat stock will not result in loss

Mr. Tran Dinh Long revealed, Hoa Phat has 161,000 shareholders, the largest on the floor. Among the people who attended the meeting that day, there were many people holding hundreds of thousands of Hoa Phat shares bought at the peak of 56,000 – 58,000 VND/share, and they held until HPG shares fell to the 35,000 zone. VND/share, people in the profession call it a “state loss” of several tens of billions of dong.

Before the congress, Mr. Long twice mentioned the sentence: “I’m not saying if people don’t like it, sell the stock, I’m not saying that.”.

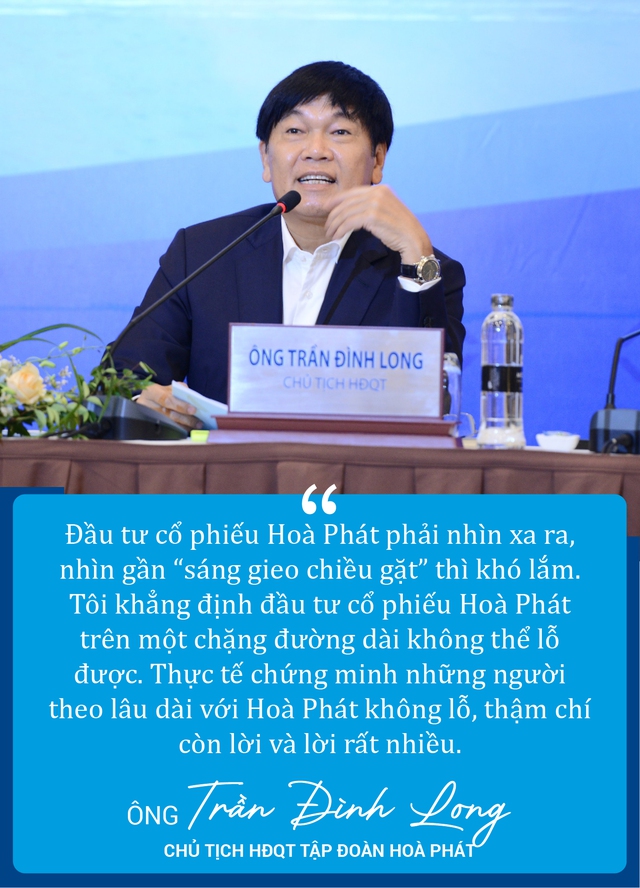

Before the expectations of shareholders, the steel billionaire only reminded that: “Investing and trading in Hoa Phat shares must look far away, looking at “early sowing in the morning and reaping” is difficult, long-term investment by year, in depth. If you buy the next morning, you will always make a profit, the rest will spend part of your valuable investment portfolio in Hoa Phat stock, you shouldn’t spend too much on Hoa Phat or you won’t be disappointed. buy shares at a loss” but I say that in a long way, Hoa Phat stock investment cannot lose. The fact proves that long-term followers with Hoa Phat do not lose, even gain and gain a lot.” .

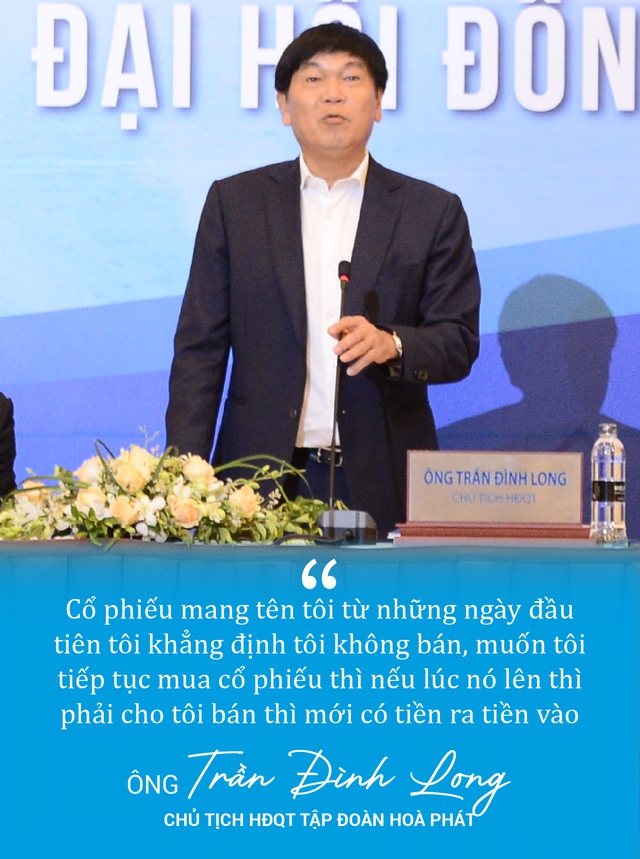

There have also been many proposals for Mr. Long to buy treasury shares to save the stock price, but the new Enterprise Law requires businesses to reduce their charter capital when buying treasury shares, which is contrary to the policy of increasing capital of the company. Coporation, group. As for buying with personal money, Mr. Long said: “CThe ballot box bears my name from the first days I asserted define me not for sale, still If you want me to continue buying stock, then if it goes up, I have to sell it Only then can money come in and out. If you don’t sell, you can’t have money to buy forever.”

As of the end of 2021, Mr. Tran Dinh Long’s family, including his wife Vu Thi Hien and son Tran Vu Minh, are holding more than 1.56 billion HPG shares, accounting for 34.97% of the Group’s shares. HPG’s share price has dropped 40% in the past 1 month, the value of shares held by Mr. Long’s family has decreased by nearly 36,000 billion VND (about 1.5 billion USD).

HPG stock has fallen vertically in the past 6 months

at Blogtuan.info – Source: cafebiz.vn – Read the original article here