Suspending the status of auditors who sign audit reports for the company related to Tan Hoang Minh

On May 19, the State Securities Commission issued Decisions 324 and 325 suspending the status of auditors approved to audit for entities with public interests in the securities sector for audits. Member Nguyen Thi Le Hong Thu and auditor Nguyen Tran Hang Phuong of Hanoi Auditing and Accounting Company Limited (CPA Hanoi) and suspending the status of an approved audit firm to audit the entity with interests to the public in the securities sector for Hanoi Accounting and Auditing Company Limited.

The period of suspension decisions is from May 19, 2022 to the end of December 31, 2022.

It is known that Hanoi Auditing and Accounting Company Limited is the entity that audited the 2021 financial statements of General Bach Hoa Joint Stock Company (stock code: TBH), in which two auditors were suspended stating that above is the signatory of the audit reports of TBH.

On April 28, the State Securities Commission had a meeting with Hanoi CPA on the audit file of TBH’s 2021 financial statements. After that, the State Securities Commission sent a document to the TBH, which concluded that the audit report on the 2021 financial statements of Bach Hoa Corporation had unsatisfactory quality because the audit company had not followed the procedures properly. and have not obtained sufficient appropriate audit evidence to express an unmodified opinion on the consolidated financial statements and the separate financial statements for 2021 in accordance with the accounting, auditing, and disclosure regulations. believe.

The State Securities Commission requires Bach Hoa Corporation to re-audit the separate and consolidated financial statements for 2021 in accordance with the provisions of the law on accounting, auditing and information disclosure in accordance with regulations and at the same time to disclose information. information about the reason for the re-audit.

According to the 2021 financial statements audited by CPA Hanoi, TBH’s net revenue reached VND 4.51 billion, down 79.5% compared to 2020. Deducting cost of goods sold, TBH grossed a loss of nearly VND 2.4 billion, while in 2020 gross profit is 12.4 billion dong.

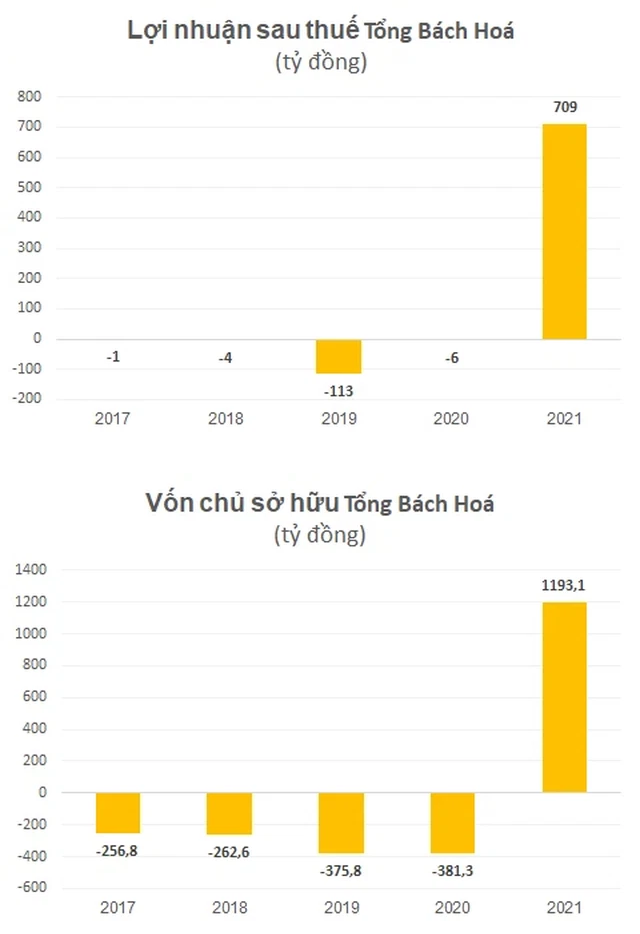

However, the company’s revenue from financial activities suddenly increased sharply by VND 791 billion along with significantly reduced expenses. As a result, TBH reported a profit after tax of up to VND 709 billion in 2021 compared to a loss of more than VND 40 billion in 2020.

Especially, by the end of 2020, the company has accumulated losses of 452 billion dong, negative equity of 416 billion dong. Thanks to the profit in 2021, as of December 31, 2021, TBH has wiped out its accumulated loss and its equity is also positive at 1,193 billion dong.

According to the notes, TBH’s financial revenue in 2021 mainly comes from investments in two companies Ngoc Vien Dong Real Estate Investment JSC and Winter Palace JSC – both of which are member companies of the Group. Tan Hoang Minh.

In the audit report of Bach Hoa Corporation, the auditor of Hanoi CPA also emphasized the above abnormal financial revenue, but the conclusion still accepted the entire report.

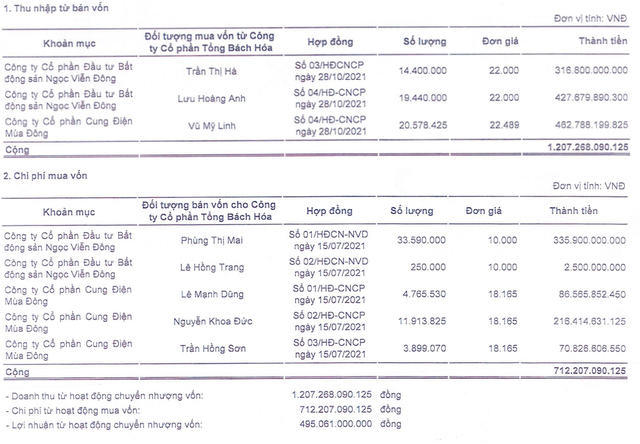

At the same time, in 2021, TBH bought back 33.84 million Ngoc Vien Dong shares from Ms. Phung Thi Mai and Ms. Le Hong Trang for 10,000 VND/share, total value of 338.4 billion VND. Then TBH sold the above shares to two individuals Tran Thi Ha and Luu Hoang Anh for 22,000 VND/share, earning 744.5 billion VND.

Similarly, TBH also bought more than 20.58 million shares of Winter Palace from Mr. Le Manh Dung, Mr. Nguyen Khoa Duc, Mr. Tran Hong Son at the price of 18,165 VND/share, total value 373.8 billion VND and resold it. at a higher price of 22,489 billion dong/share, earning 462.8 billion dong.

In addition, Winter Palace Joint Stock Company has paid dividends in 2021 at the rate of 125.11%/par value, which means that shareholders owning 1 common share will receive 12,511 dong. With the number of shares held holds more than 20.58 million shares, thus TBH collects 257.46 billion dong of Winter Palace dividend.

The total benefit that TBH has received from investing in Jade Vien Dong and the Winter Palace is up to 752.5 billion VND, compared to the capital spent is 712.2 billion VND, TBH has made 105.6% profit in 3 years. investment month.

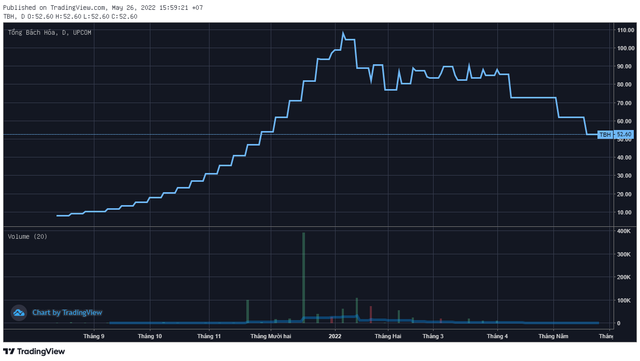

Another remarkable point is that TBH stock once surprised investors when it increased “shock”. Specifically, on UPCoM from August 2021, although liquidity was very meager, the market price of TBH suddenly increased rapidly, from 7,900 VND/share to a peak of 108,000 VND/share (session 7/1/2022). , equivalent to 14 times increase after less than 5 months of listing. Up to now, TBH has almost frozen liquidity, the market price closed May 26 at 52,600 dong/share, down 51% since the peak.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here