The first time to pay dividends after 8 years of not dividing, the Chairman confirmed that there was no more infighting

On the morning of May 27, Vietnam Export-Import Commercial Joint Stock Bank (Eximbank) held the 2nd annual general meeting of shareholders.

As of 10:30 a.m., there were 159 shareholders attending, equivalent to more than 1.16 million shares, accounting for 99.96% of the total number of voting shares of shareholders attending the meeting.

The presiding delegation included Ms. Luong Thi Cam Tu – Chairman of the Board of Directors, Mr. Ngo Tony – Head of the Supervisory Board, Mr. Tran Tan Loc – General Director of the bank.

Profit plan 2,500 billion VND

In 2022, the bank plans to make pre-tax profit of VND2,500 billion, up 107.5% over the previous year; total assets are expected to be 179,000 billion, up 7.9%; Capital mobilization from economic organizations and residents was 147,600, up 7.4%; credit balance of 127.149 billion, up 10% over the same period last year; Bad debt is controlled below 1.7%.

Increase capital through paying 20% stock dividend

The General Meeting of Shareholders approved the plan to increase capital by issuing shares to pay dividends from retained earnings for 5 years from 2017 to 2021.

Accordingly, the bank plans to issue more than 245 million shares to pay a dividend of 20%, shareholders owning 10 EIB shares will receive 2 new shares. The payment of stock dividends is expected to be made in 2022 after the approval of the competent State agencies.

The additional capital will be used in the bank’s business activities with the expected investment in physical facilities, technology infrastructure, working offices, technology investment,… and business expansion. business of Eximbank.

Thus, this will be the first time Eximbank has paid dividends to shareholders since 2014. Before that, at the 2021 Annual General Meeting, former chairman of the bank, Mr. Yasuhiro Saitohcho, said that in 2022, Eximbank had agreed satisfy the final condition for the dividend. The most recent dividend was 4% for 2013. The Bank could not pay dividends in the past years because it could not hold the AGM.

Report on transfer results of more than 165 million Sacombank shares

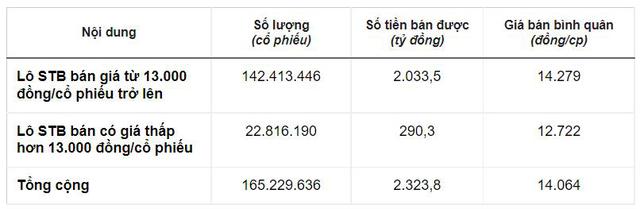

Explaining the sale of Sacombank shares in the 2017-2018 period, Eximbank’s management said that before November 2017, the bank owned more than 165 million STB shares, equivalent to 8.76% of Sacombank’s charter capital. To ensure compliance with the State Bank’s regulations on share ownership ratio in credit institutions, Eximbank had to sell STB shares to reduce its ownership to less than 5%.

According to the transfer plan approved by the Banking Inspection and Supervision Department of Ho Chi Minh City, the minimum selling price of each STB share owned by Eximbank must be VND 13,000.

As a result, the bank sold 142.4 million STB shares at a price above the minimum price (13,000 dong), earning 2,033 billion dong, equivalent to the average price of 14,279 dong/share.

In addition, Eximbank also sold 22.8 million STB shares below the minimum price (13,000 dong) and earned more than 290 billion dong, equivalent to the average price of 12,722 dong/share.

According to the management’s explanation, in 2015 and 2016, the bank recorded accumulated losses of 817.4 billion and 463.1 billion respectively. The divestment also contributed 647.6 billion in profit and helped the bank not fall into the category of delisting due to accumulated losses for 2 consecutive years.

Conference discussion section

Shareholders: How will the bank pay dividends?

Ms. Luong Thi Cam Tu: This year, the bank will pay a stock dividend at the rate of 20%.

Shareholder:Is there still infighting?

According to Ms. Luong Thi Cam Tu, the issues mentioned by shareholders ended in the sixth term. In term VII, the current term, the Board of Directors set the goal of putting the interests of shareholders and developing the bank first.

Shareholder:What is the basis for setting double profit target?

Mr. Tran Tan Loc – General Director: The Bank is confident to achieve this goal. Currently, the bank has been restructuring capital sources. Simultaneously promoting other activities, along with striving to cut costs. In addition, the bank also accelerated the handling of outstanding bad debts and expected to reverse profits in the near future

Shareholders: How will SMBC divest capital?

Ms. Luong Thi Cam Tu: Strategic shareholder SMBC just announced the termination of the strategic agreement. Currently, SMBC is still a major shareholder of Eximbank. The Board of Directors has not yet received information about the divestment from SMBC.

Shareholders: What is a competitive advantage when Bank seems to be falling behind?

Mr. Tran Tan Loc: With the name and reputation and the drastic management of the leadership, Eximbank will soon be able to close the gap with the banks ahead.

Is there a mix of interests among groups of shareholders?

Ms. Luong Thi Cam Tu: There is no interest group dominating Eximbank’s activities. The spirit of term VII is to develop the best interests of shareholders. If ecosystem shareholders want to participate in support, the bank is very welcome but must always ensure compliance with the law.

At the end of the meeting, all proposals were approved.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here