Vietnamese goods have “faced” hundreds of cases of trade remedy investigation

The faster exports increase, the more risky trade defense greater

According to the Ministry of Industry and Trade, along with the process of extensive international economic integration, especially participation in free trade agreements (FTAs), Vietnam’s import and export turnover has increased sharply year by year.

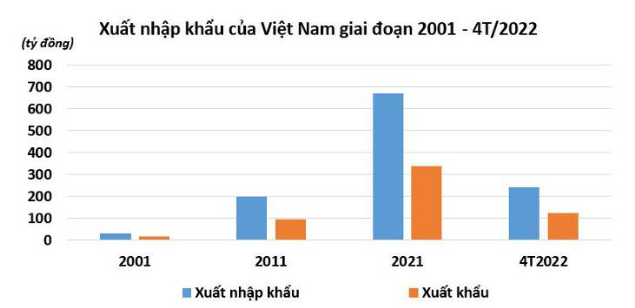

If in 2001 the import-export turnover of Vietnam only reached more than 30 billion USD, in 2011 it reached 200 billion USD; in 2021 will reach 668.5 billion USD. Our country’s exports have increased from 15 billion USD in 2001 to more than 96 billion USD in 2011, and reached 336 billion USD in 2021.

With this result, Vietnam has become one of the 20 economies with the largest commercial scale in the world. Exports have become an important engine of economic growth. The balance of trade in goods had a surplus, the following year was higher than the previous year.

Data: Ministry of Industry and Trade

The rapid growth of exports shows that the production capacity of Vietnamese enterprises in many industries has been higher, Vietnamese goods have penetrated and have a foothold in many markets. However, this also creates competitive pressure on manufacturing industries in the importing country, causing these manufacturing industries to require the government to use trade remedies such as anti-dumping, anti-subsidy. level, self-defense to protect themselves.

Therefore, along with high growth in export turnover, Vietnam’s export enterprises are increasingly likely to become the subject of investigation and application of trade remedies.

In fact, the number of trade remedies cases with our export goods has increased rapidly in recent years. By the end of the first quarter of 2022, Vietnam’s exports have been the subject of 212 foreign trade remedies investigation cases. Among them, the anti-circumvention investigation cases account for 25 cases and tend to increase in recent times, especially in the context of the US-China trade conflict and when Vietnam joins many new generation FTAs such as CPTPP, EVFTA.

Vietnamese honey was proposed to investigate trade remedies.

When exporting enterprises of one country are subject to trade remedies, these enterprises often find a way to overcome them by moving production to another country. Meanwhile, with favorable policies for foreign investment, Vietnam is one of the options of those enterprises to shift production.

However, this has resulted in a sudden increase in exports from Vietnam, making it easy for Vietnam to become the subject of monitoring, investigation, evasion of trade remedies, origin fraud and application of additional trade remedy measures or sanctions of the importing country.

For Vietnam’s export industries, being investigated by foreign countries for evading trade remedies, origin fraud and illegal transshipment will lead to negative impacts such as affecting related industries and related goods. genuine manufacturing/exporting enterprises, reducing the reputation of Vietnam’s export goods, but also negatively impacting the competitiveness of our whole economy in the long run, especially in the context that Vietnam is participating in the export market. a series of FTAs with high requirements on origin.

Step up early warning activities

With the determination to fight and prevent acts of evasion, origin fraud, and illegal transshipment, the Prime Minister issued Decision No. 824 from 2019 approving the Project on Strengthening State Management of combating evasion of trade remedies and origin fraud (Project 824) and the Government issued Resolution No. 119 on a number of urgent measures to strengthen state management of origin fraud prevention and transshipment. illegalization.

To implement Project 824, the Ministry of Industry and Trade has been monitoring export fluctuations of 36 commodities and periodically issues a warning list of 11 items. to inform authorities, associations, businesses and other stakeholders.

The verification results have found that a number of individual enterprises have violations on the origin of goods or only perform production stages with negligible value-added content in Vietnam, from which the authorities ability to take appropriate remedial action.

Since the first time the Ministry of Industry and Trade announced the warning list in July 2019, there have been 7 products on the warning list being investigated by foreign countries, namely plywood with raw materials. made from hardwood, foam padding, car tires, copper pipes, honey, anti-corrosion steel, ceramic tiles.

Anti-corrosion steel of Vietnam is proposed to investigate tax evasion.

In addition, in order to help authorities strengthen activities to combat evasion through origin fraud, illegal transshipment, and to support businesses to be more prepared and proactive in In handling and responding to foreign trade remedy investigation cases, the Prime Minister issued Decision No. 316 in 2020 approving the Scheme on building and effectively operating an early warning system on prevention Trade protection (Project 316).

The early warning system is built on the principle of monitoring export fluctuations of goods that have been applied by export markets with trade remedies or other trade-restrictive measures with a third country but have not yet applied such measures. The same law applies to Vietnam.

If there are risk factors such as exports from Vietnam with rapid growth, Vietnamese goods occupying a significant market share in the export market or there are signs that manufacturing enterprises in the export market are affected by competition from Vietnamese goods, the system will put these items on the warning list of the possibility of being investigated for trade remedies by foreign countries.

Enterprises can actively consider to adjust their business strategies in a reasonable way in order to avoid great influence in case export activities have undesirable results due to foreign trade remedies. cause.

Although early warning activities to support businesses have just been implemented, some initial positive results have been obtained. For example, in the case of the US anti-dumping investigation on tire products, the majority of Vietnamese enterprises accounted for 95.5% of the total export turnover of Vietnam’s tires to the US and were not subject to tax. anti-dumping. In the case of the US anti-dumping investigation on copper pipe products, the anti-dumping tax for Vietnamese enterprises is 8.35%, much lower than the level imposed by the domestic manufacturing industry of the US. accused 110%.

The Trade Remedies Department (Ministry of Industry and Trade) said that, to avoid the risks of trade remedy lawsuits, businesses need to improve their response capacity and have a solid understanding of trade remedies.

Specifically, businesses must equip themselves with basic knowledge of trade remedies laws and regulations in FTAs between Vietnam and partners to understand their obligations and rights; plan to hire a lawyer when necessary; building an advanced and modern management system, keeping complete and clear records and books.

In case an investigation is initiated, it is necessary to consider actively participating in the case by answering the questionnaire on time, cooperating with the foreign investigation agency, and avoiding being investigated by the foreign investigation agency. use available data when evaluating and analyzing in conclusion of the case.

The Ministry of Industry and Trade will continue to coordinate with relevant agencies to build and effectively operate the Early Warning System according to the roadmap in Project 316 and perform the tasks of Project 824 to further strengthen the management and supervision of origin fraud, illegal transshipment to ensure the reputation of Vietnam’s exported goods, prevent the origin fraud of a part from affecting the genuine production and export enterprises.

at Blogtuan.info – Source: danviet.vn – Read the original article here