Compare the profitability between Vinhomes and Novaland of the two richest real estate billionaires in Vietnam

In the Vietnamese real estate market, Vinhomes and Novaland can be considered as two leading enterprises. These are also the two listed real estate companies with the largest market capitalization on the stock exchange.

Vinhomes’ business strategy is to develop mega-projects with a scale of thousands of hectares after the success of megacities such as Times City, Vinhomes Ocean Park. Meanwhile, Novaland proactively and flexibly adjusted its business plan according to the market situation, launched mid- and high-end product lines with appropriate financial packages, meeting the needs and affordability. customer payment. The founders of these two businesses are the two richest real estate billionaires in Vietnam – Mr. Pham Nhat Vuong and Mr. Bui Thanh Nhon.

How are the two different business strategies between these two giants reflected in business results over the years? Let’s try to put Vinhomes and Novaland on the scale for basic profitability like Profit Margin.

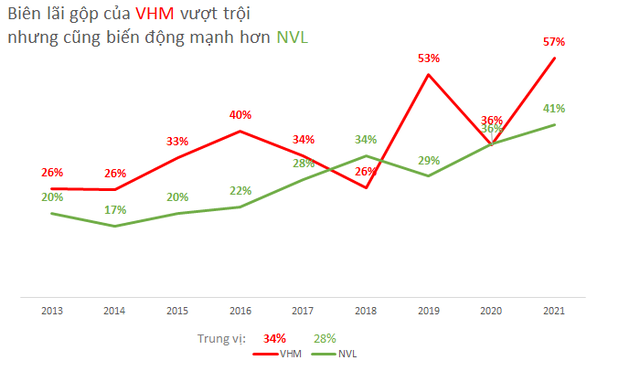

Gross profit margin

Gross profit margin is the first and most important level of measuring the profitability of a business. This indicator shows how much gross profit the enterprise earns for each dollar of revenue generated, after deducting the cost of goods sold.

The higher the gross profit margin, the more profitable and efficient the business is. But it also does not mean that the low gross profit margin means that the business is inefficient. Therefore, to evaluate how much this indicator is good, we need to put it in the context of each business and each industry.

In general, businesses tend to maintain a stable gross profit margin over time. An enterprise with this index increasing over time is a positive signal.

Considering the period from 2013-2021, the gross profit margin of Vinhomes and Novaland has doubled. This index of Vinhomes increased from 26% to 57%, Novaland increased from 20% to 41%. However, Vinhomes’ gross profit margin is more volatile, while Novaland’s is quite stable and has a steady upward trend.

As a general rule (and there are exceptions) companies with gross margins of 40% or higher tend to have a sustainable competitive advantage. Companies with margins below 40% are often in highly competitive industries. This index is lower than or equal to 20%, indicating that the industry is highly competitive, when no company can create a sustainable competitive advantage over its competitors.

The median gross profit margin of Vinhomes and Novaland at 34% and 28%, respectively, also shows that the real estate industry has a high level of competition, but not to the extreme.

Volatility also reflects the cyclical nature of the real estate industry. For example, in 2018 and 2020, when the real estate market faced difficulties, Vinhomes’ gross profit margin also decreased.

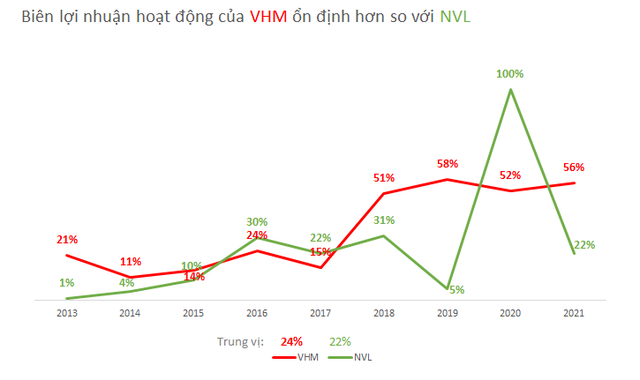

Operating profit margin

Operating margin is a financial indicator that shows how much operating profit a business can earn, after deducting all costs for production activities. This index gives us a broader view when it comes to operating costs such as selling expenses, general and administrative expenses, etc.

The company’s high operating profit margin and long-term growth should give us a very positive signal. When not only the cost of goods sold, but also the operating costs of the business are well controlled.

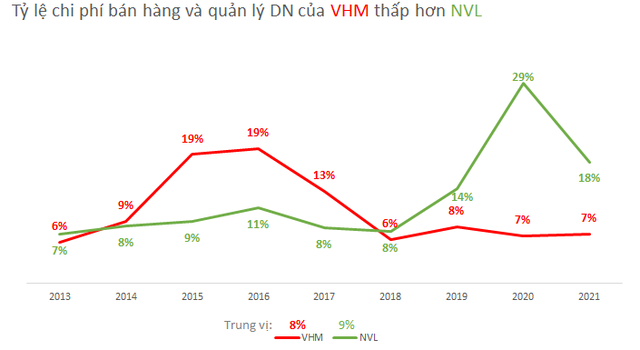

This indicator has a significant difference between Vinhomes and Novaland. Considering the period from 2018-2021, Vinhomes’ gross profit margin has always maintained at more than 50%. Meanwhile, this figure of Novaland fell to 5% in 2019 then bounced back to 100% in 2020.

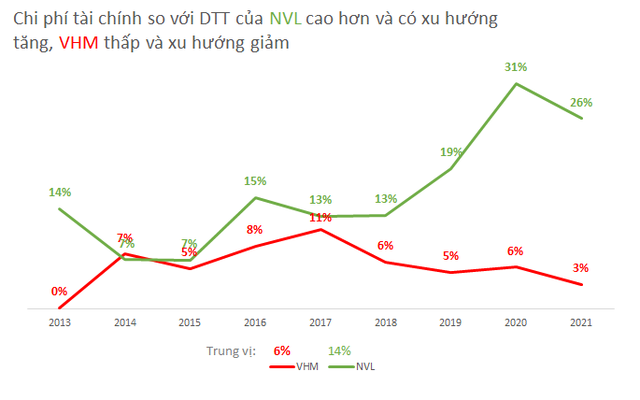

The difference here from 2018 Vinhomes significantly reduced selling and administrative expenses when it was only 6-8% compared to net revenue while Novaland cost 8-29%. In addition, Novaland also has higher financial costs than Vinhomes. In the median period 2013-2021, Novaland had financial expenses accounting for about 14% of net revenue, while Vinhomes was at only 6%.

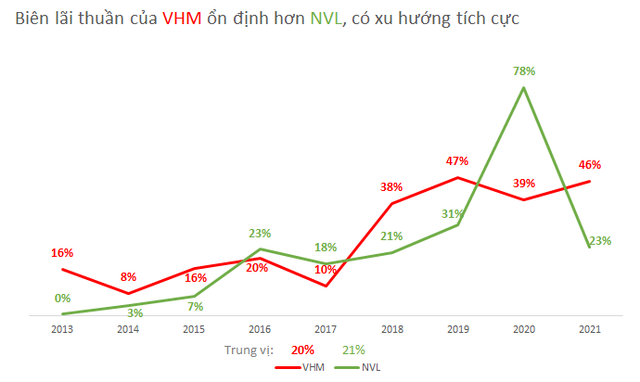

Net profit margin

Net Profit Margin (Net Profit Margin) is the percentage of profit after tax that a company earns from each dollar of sales. That is, with 1 dollar of revenue, how much profit after tax does the company get.

Net profit margin shows the profitability of the business after eliminating all costs incurred in the period. A business with a high net profit margin and year-over-year growth is a good sign.

Similar to operating profit margin, Vinhomes has maintained this index at a high level of over 38% in recent years. Meanwhile, Novaland’s net profit margin fluctuates strongly in the range of 0-78%. With a median of over 20%, it can be seen that real estate is a very good money-making industry for both billionaires Pham Nhat Vuong and Bui Thanh Nhon.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here