GAS “shines”, VN-Index still couldn’t stop falling under the pressure of “king” stocks.

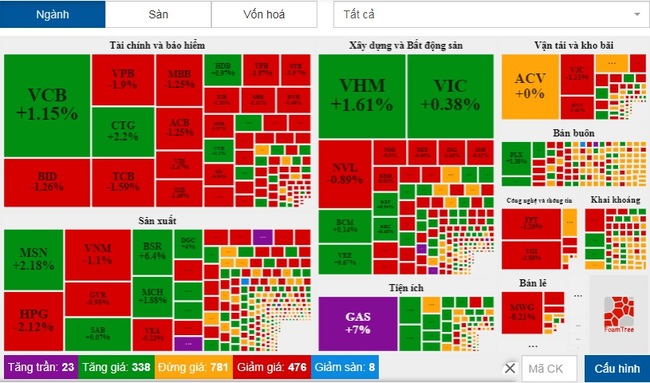

Market breadth still belongs to the sellers today, May 31.

VN-Index still couldn’t stop the falling momentum under the pressure of “king” stocks.

Closing today’s session (May 31), VN-Index decreased slightly by 1.24 points (-0.1%) to 1,292.68 points and broke the chain of gains in the previous 5 sessions. While HNX-Index suddenly jumped nearly 1% to reach 315.76 points.

UPCoM-Index also tried to recover from the low of the session, closing down 0.285, stopping at 95.45 points. The total trading volume of all 3 exchanges reached nearly 735 million units, equivalent to 19,444 billion dong.

The divergence was quite clear when petroleum and fertilizer stocks led the uptrend, while banking and steel stocks led the pressure group. In the VN30 basket, there are 20/30 discount codes.

However, the most prominent point in the VN30 group was PV Gas’s petroleum stock GAS when it hit the ceiling price to 117,700 dong, becoming the largest contributor to the overall market. In addition, there is also the contribution of Petrolimex’s PLX code when the price increased by 1.4% to 44,000 dong.

Cash flow was very strong in oil and gas stocks, helping a series of codes with impressive gains, such as PXI with a ceiling increase of 13.2%, BSR up 6.8% to 26,700 dong, PVS breaking through 5.9% to reach 30,700 copper, PVC increased by 4.5% to 25,300 dong….

Fertilizer and chemical groups also participated in pulling the index’s gain. In which, DCM of Ca Mau Fertilizer increased to the ceiling at VND 37,250, DPM of Phu My Fertilizer increased by 5.5% to VND 59,600, DGC of Duc Giang Chemical increased by 4% to VND 223,600…

While oil, gas and fertilizer stocks were the support of the market, the “king stocks” were mostly in the red after the news that the Banking Inspection and Supervision Agency had unexpectedly inspected their activities. investment in corporate bonds of credit institutions at 8 joint-stock commercial banks.

Stock codes strongly influenced the market today.

A series of banking codes had a deep decline, such as TPBank’s TPB lost 2% to VND 32,350, Techcombank’s TCB fell 1.6% to VND 37,150, VPBank’s VPB dropped 1.9% to VND 31,000, SHB dropped 2.3% to 14,800 dong…

In addition, the market was also affected by the decline of some key stocks such as HPG losing another 2.1% to 34,700 dong, FPT down 1.3% to 109,900 dong, PNJ down 4.6% to 114,900 dong. , Vietjet’s VJC decreased by 1.2% to 130,900 VND…

On the HNX, today’s focus was on THD stock having the most negative impact on the HNX. Closing the session, THD fell 8.4%, back to 44,500 dong, the lowest level since December 10, 2020.

Compared to the peak reached on December 31, 2021 at VND 277,000/share, THD has plummeted so far. In such a downturn, Mr. Nguyen Duc Thuy (or Bau Thuy) registered to sell more than 87 million shares (24.97%) owned at Thaiholdings Joint Stock Company (HNX: THD), which means that will divest its capital from this unit. The transaction period lasts from June 1-30.

In today’s session, market liquidity improved with the matched value of 17,328 billion dong, of which the matched value on HoSE was 14,287 billion dong, up 12% compared to yesterday.

Regarding foreign trade, today, foreign investors are still actively trading when they bought 2,017 billion worth of shares and sold 1,633 billion VND, equivalent to a net buying of about 384 billion dong on HoSE.

at Blogtuan.info – Source: danviet.vn – Read the original article here