How many corporate bonds do banks under inspection hold?

Recently, the State Bank of Vietnam has directed the Banking Inspection and Supervision Agency to strengthen the inspection and examination of the situation and investment activities of corporate bonds (Corporate bonds) of credit institutions. in the system. The above activity is aimed at implementing the Prime Minister’s direction in the official dispatches on strengthening management, supervision, inspection and examination of the stock market and corporate bond market.

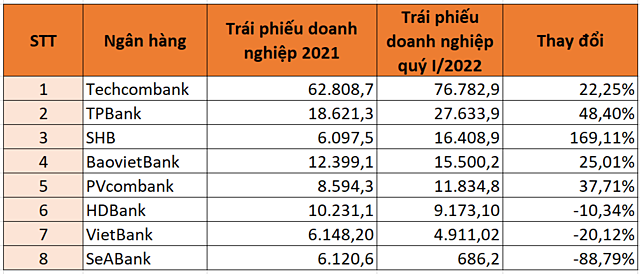

The Banking Supervision Agency has planned to inspect 8 commercial banks including Techcombank, HDBank, TPBank, SHB, PVComBank, VietBank, SeABank and Baoviet Bank.

By April, the inspection agency had conducted an inspection at 7 banks, except Baoviet Bank, because the Ministry of Finance had checked with this bank.

According to Fiinpro’s statistics on the financial statements of the first quarter of the inspected banks, 5/8 banks had an increase in the value of bonds held by economic organizations in the first quarter.

As of March 31, Techcombank is holding VND 76,782 billion of debt securities of the financial institutions, up 22.2% compared to the end of 2021 and leading among the inspected banks. Following, TPBank owns 27,633 billion dong, up 48.4%. Third place is SHB with 16,408 billion dong, up 169%. Ranked 4th, Baoviet Bank kept VND 15,500 billion, up more than 25%. The 5th place belongs to PVcombank with 11,834 billion VND of bonds of economic organizations, up 37.7%.

Total amount of corporate bonds held by banks by the end of the first quarter of 2022. Source: Summary of financial statements for the first quarter, unit: billion dong

The next positions are HDBank and VietBank, respectively, with 9,173.1 billion and 4,911 billion dong, down 10.3% and 20.1% respectively compared to the beginning of the year. The last position in the list of inspected banks is SeABank, holding 686.2 billion VND, down 88.7%.

According to the statistics of PartnerAlthough not under inspection, MB and VPBank are the two largest holders of corporate bonds in the market after Techcombank. By the end of the first quarter, MB owned VND 50,620 billion, up 20% compared to the beginning of the year. Meanwhile, VPBank holds VND 41,593 billion, up nearly 50%.

According to the Economic Commission’s report on the situation of the corporate bond market, by the end of March, the total investment balance of corporate bonds of credit institutions was VND 326,500 billion, up 19% compared to the end of 2021. The number of commercial banks increased bond investment in the period from December 2021 to January 14 before the date of Circular 16, 2021 stipulating the purchase and sale of corporate bonds by credit institutions to avoid strict regulations. than in the Circular.

According to the report, investment in corporate bonds for the purpose of construction and real estate business was VND 121,200 billion, up 25.3% compared to the end of 2021, accounting for 37% of the total balance. If including bond investment for the purpose of increasing capital size and debt restructuring of an issuer operating in the field of construction and real estate business, the total balance of related corporate bond investment of The whole credit institution system was VND 160,600 billion, an increase of 24% compared to the end of 2021, accounting for 49% of the total investment in corporate bonds of the entire credit institution system.

Meanwhile, investment in corporate bonds with the aim of increasing the capital size of the issuing company accounted for 31.6% of the total investment balance of corporate bonds of the whole system, an increase of 9.1% compared to the end of 2021. It is difficult to determine and monitor the purpose of using capital of the issuing enterprise.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here