Trillions of billions poured into Vietnamese stocks through ETFs

Vietnam’s stock market is showing positive signals again after a turbulent period. VN-Index reversed up from the bottom in mid-May along with the timely return of foreign investors.

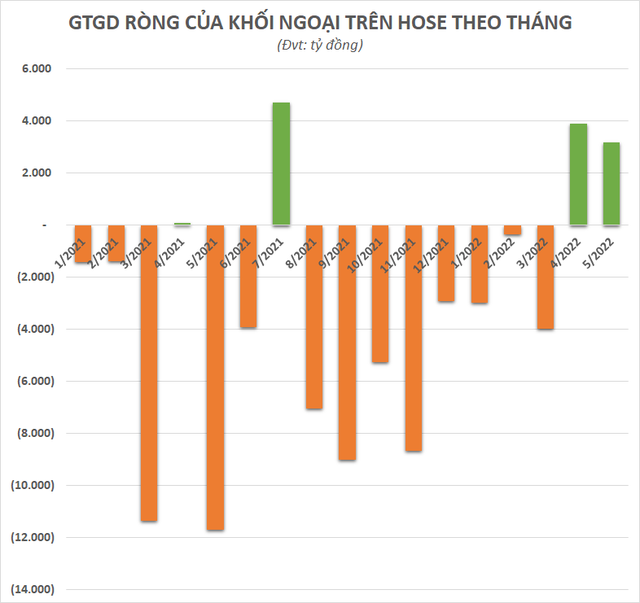

Statistics show that, in May, foreign investors had the 2nd consecutive month of net buying on HoSE with a transaction value of nearly 3,200 billion dong. Previously, foreign investors had net bought nearly 4,000 billion dong in April, thereby ending the chain of 8 consecutive months of net selling.

Foreign investors are returning to Vietnam’s stock market

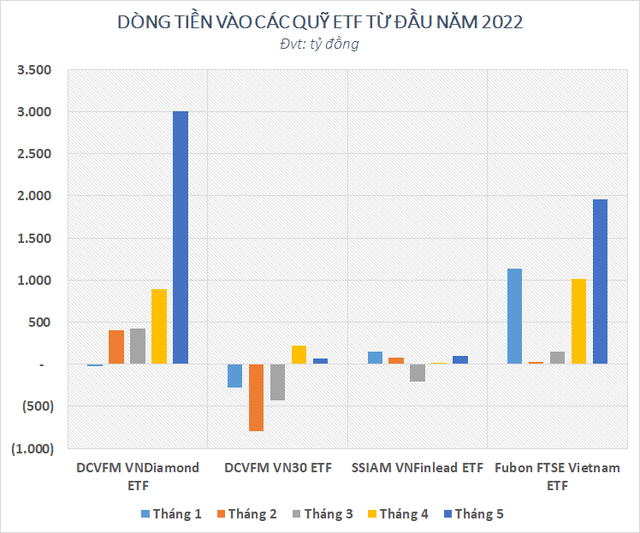

The driving force to pull foreign capital back into the market came mainly from ETFs. In the past May, 4 funds including DCVFM VNDiamond ETF, Fubon FTSE Vietnam ETF, DCVFM VN30 ETF and SSIAM VNFinlead ETF have net withdrawn a total of 5,100 billion dong. Diamond ETF is a highlight with cash inflow of more than 3,000 billion, of which the last day of May alone, this ETF has a net withdrawal of more than 1,200 billion.

Since the beginning of the year, Diamond ETF is also the name that keeps the best performance when the cash inflow continuously increases month by month after a slight net withdrawal in January 2022. Accumulating 5 months, this ETF has a net withdrawal of up to 4,700 billion dong, followed by Fubon ETF with a value of more than 4,200 billion dong. In contrast, DCVFM VN30 ETF and SSIAM VNFinlead ETF were still net withdrawn from the beginning of the year but the value was not large.

Capital flow through ETF is leading foreign investors

Obviously, capital flows through ETFs are leading the return of foreign investors in the Vietnamese market because of the fact that active funds are still net selling quite strongly recently. The foreign ownership limit is part of the barrier that makes it difficult for foreign funds to access quality stocks that run out of room, leading to a situation of “secret” in disbursement despite abundant cash. Typically, Vietnam Enterprise Investments Limited (VEIL) – the largest fund managed by Dragon Capital, has raised its cash level to 8.71% (~$184.6 million), a record high in recent years. this.

However, basically, many active foreign funds such as Dragon Capital, PYN Elite Fun, etc. still highly appreciate Vietnam’s stock market thanks to stable macro factors, business growth continues to be forecasted. at 20-25% compared to 2022 is the driving force for the market to grow in the medium and long term.

In addition, the story of market upgrading is also expected to promote the return of foreign investors in the Vietnamese market. Mr. Nguyen Quang Thuan, Chairman and CEO of FiinGroup, said that upgrading the market will be an inevitable process in the development and integration of the stock market in the long term. Currently, the size of capital that funds can allocate to frontier markets is only about $ 95 billion, while the size of capital for emerging markets is about $ 6.8 trillion. If Vietnam is upgraded to Emerging Markets, it could also receive tens or even hundreds of billions of dollars into the market.

On May 26, S&P Global Ratings (“S&P”) upgraded Vietnam’s long-term national credit rating to BB+ with a Stable outlook. In the context of not so bright prospects for the world economy after Covid-19 and the impact of the Russian-Ukrainian conflict, the upgrade of Vietnam by a leading prestigious credit rating agency in the world shows that the positive view of Vietnam in the international capital market. This assessment is an important step forward for Vietnam’s economy and capital market for many reasons.

Firstly, upgrading the national credit rating in a time of global economic uncertainty shows the recognition of Vietnam’s economic position in the international and regional arena. After the Covid-19 pandemic, Vietnam was the only country in the 8 ASEAN countries to be upgraded in 2022, while most countries remained the same, Malaysia and Laos alone were downgraded by Fitch Ratings by 1 rank to BBB+ and CCC respectively. .

Secondly, the BB+ score is already close to the S&P Investment grade group, which means that if it reaches the BBB- score, Vietnam will be included in the investment criteria of many financial institutions in the world.

As for the stock market, the stable prospect of Vietnam will also become more attractive to foreign capital inflows, so it is expected that this capital flow into the Vietnamese market will be more positive in the near future.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here