A bank in the Big 4 group has just increased its deposit interest rate from June

Today (June 1), BIDV has announced a new deposit interest rate schedule to apply from June 2022. BIDV’s latest deposit rate adjustment was nearly a year ago (from August 2021).

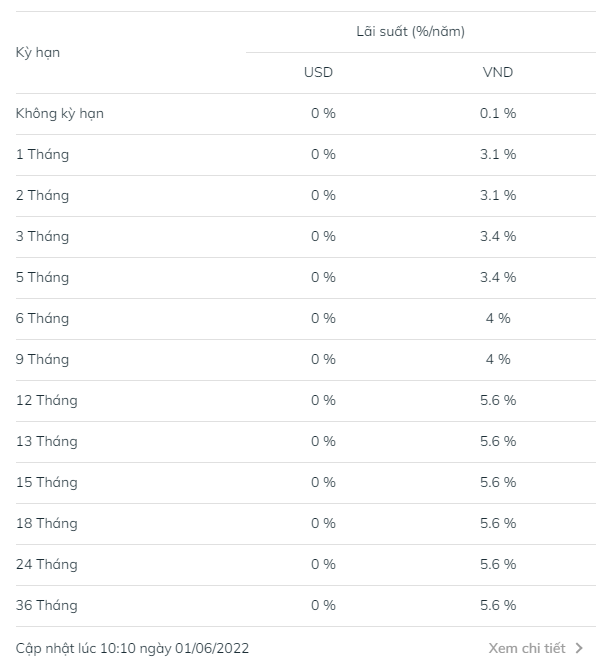

Notably, BIDV has increased interest rates for long terms (from 12 months or more) by 0.1 percentage point to 5.6%/year. Meanwhile, the bank kept the interest rates for short terms unchanged, currently 4%/year for 6-month – 9-month term, 3 – 5-month term is 3.4%/year, 1-2 months is 3, one year.

Despite the upward adjustment, BIDV’s interest rate is still among the lowest in the market, along with Vietcombank, VietinBank has the highest interest rate of only 5.6%/year. Agribank also has a lower interest rate of only 5.5%/year.

BIDV’s new interest rate chart

While BIDV increased the deposit interest rate, Vietcombank recently announced the deposit interest rate table for online depositing on its website, plus 0.1%/year compared to over-the-counter deposit.

Over the past half year, despite the significant increase in deposit interest rates at private banks, the Big 4 group is still “active”, staying out of the race. Most large private banks have raised interest rates, even Techcombank – the bank that maintains the lowest interest rate in the market in 2020-2021 has also increased sharply. In 2021, interest rates at Techcombank in many terms are lower than those of the Big 4 but have now increased to the highest at 6.9%/year.

In fact, despite listing deposit interest rates at the lowest level in the market for many years, the deposit growth of the Big 4 is still very good. In 2021, customer deposits at VietinBank increased by 17.3% to more than 1.16 million billion VND. The remaining 3 banks also had very strong growth: Agribank (9%), BIDV (12.5%), Vietcombank (10%).

State-owned banks have always had the advantage of mobilizing capital and are not too dependent on interest rate increases due to their nationwide network of transaction offices. Moreover, unlike private banks, the state-owned banking group also performs the task of contributing to regulating the money market, keeping the lending interest rate at a low level to support businesses to recover after they recover. Translate. Historical developments show that the move of this group of banks has a strong impact on the interest rate level as they hold a very large market share (accounting for nearly 50% of the whole system).

According to VNDirect securities, deposit interest rates will remain under increasing pressure from now until the end of the year because inflationary pressure may increase in the coming quarters. However, the expert group believes that the increase will not be too large, only about 30-50 basis points for the whole year of 2022. Accordingly, the 12-month deposit interest rate of commercial banks may increase to 5 .9-6.1%/year at the end of 2022 (currently at 5.5-5.7%/year), still lower than the pre-pandemic level of 7.0%/year.

Meanwhile, VCBS forecast a stronger increase. An expert of this securities company said that the volatility of deposit interest rates will continue to depend heavily on the abundance of capital flows in the interbank market. Along with that, credit growth and inflation in the coming quarters will also be factors affecting the increase in deposit interest rates. With inflation pressure forecasted to continue in the coming months along with higher credit growth demand during the economic recovery period, deposit interest rates are forecasted to be under upward pressure of 100- 150 bps for the whole of 2022.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here