USD volatility, pressure on exchange rate management

Over the past week, the State Bank has adjusted many times exchange rate decrease to adapt to the context that the world dollar is on a deep decline. Since May 20, the State Bank of Vietnam has had 3 sessions of sharp decrease. In the session of May 23, the USD exchange rate was adjusted down by 28 dong, from 23,145 dong in the previous session to 23,117 dong. In particular, in two consecutive sessions on May 30 and May 31, the USD was sharply adjusted to decrease by 20 dong and 32 dong, respectively.

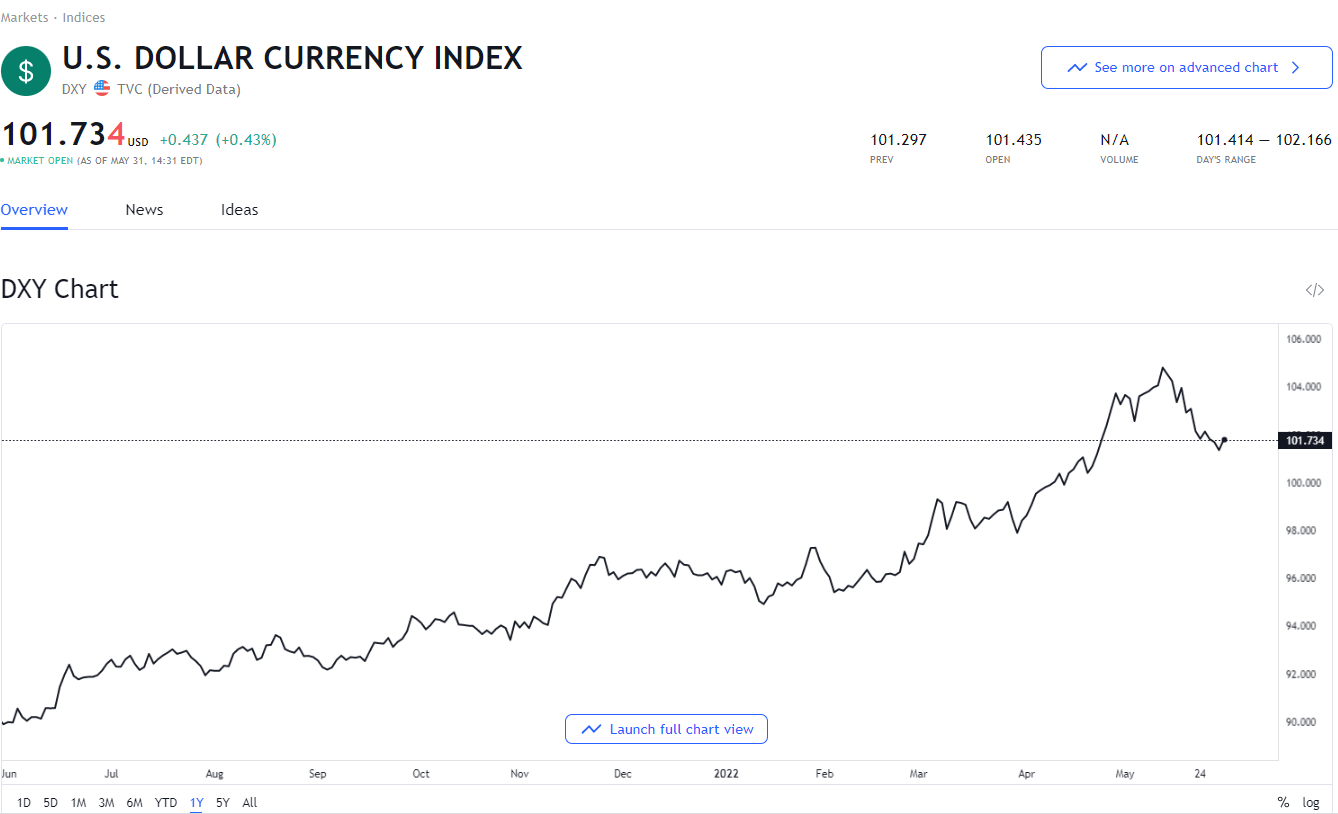

At the beginning of the session on June 1, the US Dollar Index (DXY), which measures the volatility of the greenback with 6 key currencies (EUR, JPY, GBP, CAD, SEK, CHF), stood at 101.750, down. 2.9% from the peak on May 12 of 104.84 points.

From May 20 to now, when the State Bank started to make strong reductions, the DXY index fell 1.22%, while the USD exchange rate decreased by 0.38%. At the same time, commercial banks flexibly adjusted the exchange rate at a slightly increased margin.

In general, the greenback’s strength is at a high level compared to many years ago, supported by the US Federal Reserve (Fed) raising interest rates to control inflation, in addition, investors have been boosted the buying of USD in the context of the unstable US economy. Fed Chairman Jerome Powell vowed to keep raising interest rates until inflation subsides. He also reaffirmed his commitment to bring inflation near the target threshold of 2%.

In another direction, analysts see, the data shows that the US economy has been positive, plus the market is not too worried about the possibility that the Fed will continue to raise interest rates, so the greenback has lost momentum.

With a series of economic data released this week, it can be seen that the global economy has many prospects for recovery, including the number of US jobs and the purchasing managers index of China. This will be the deciding factor for investors with risky assets.

The recent adjustment of the central exchange rate by the State Bank, for businesses, is considered flexible and appropriate. It is said that the increase in the central exchange rate in the past time has not affected the market, however, if it continues to increase according to the increasing momentum of the US dollar in the world, the “black market” USD price will certainly increase accordingly. .

Currently, VND is said to be one of the stable currencies in the region. In general, with the Vietnamese economy, the money is stable thanks to the supply of USD from remittances, the difference in trade balance or foreign investment sources. Specifically, in the first four months of 2022 alone, Vietnam continued to have a trade surplus of about 2.53 billion USD, helping to have an abundant source of foreign exchange.

However, regarding the exchange rate management policy from now until the end of the year, many people think that the State Bank still has a lot of pressure, because the complicated fluctuations of the world economy affect the dong value. USD. In which, one of the most obvious impacts is that the Fed has continuously adjusted interest rates to cope with the inflation situation in the US.

In Vietnam, with deep and wide impacts on industries and fields, in 2022, gasoline and commodity prices will continue to increase, causing inflationary pressure and creating a new price level for the economy. Experts said that the upcoming foreign exchange market will be more volatile. If the Russia-Ukraine tension does not ease, exchange rate fluctuations will place a heavy burden on the State Bank’s policy management.

Ngoc Cuong

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here