Farewell to billions of USD liquidity, the stockbroking profession returns to “ground”

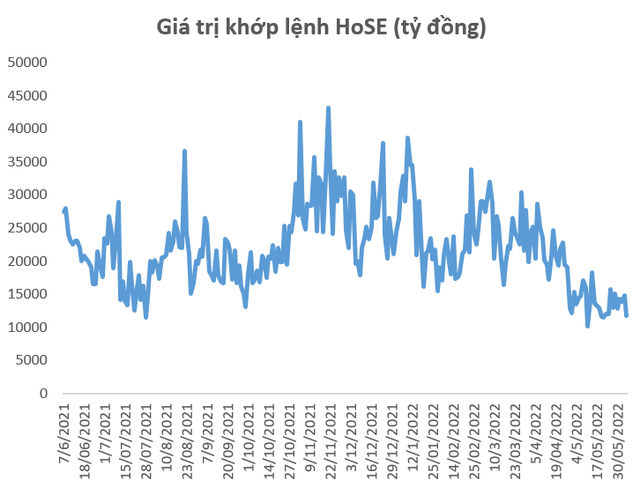

The era of cheap money has come to an end when a series of banks recently raced to raise interest rates. SaigonBank has raised the 12-month interest rate to exceed 7.3%, equal to the level before the Covid-19 epidemic. In the short term, the market has experienced a correction and the VN-Index has decreased by 16% from the peak, the liquidity has also decreased, ranging from 11,000-17,000 billion VND/session, significantly lower than the level. VND 30,000-40,000 billion/session by the end of 2021. With such unfavorable developments, the securities brokerage profession is more or less affected.

The year 2020-2021 is the peak period of the brokerage profession when many longtime stockbrokers or fresh graduates all earn “huge” income thanks to the wave of F0 investors joining and cheap cash flow from the down payment. interest rates of banks rushed into the stock market. Vietnam securities in turn conquered the billion USD liquidity milestone, with more than 2 billion USD session. This was the golden age of the brokerage profession.

At that time, a stockbroker director of a securities company in the top 4 of the market told us that many young people who had just graduated from high school but were active and caught up with the market had earned an income of 50-100. million VND/month, even some excellent people earn 100-200 million VND/month.

“The heyday of liquidity boomed, a broker under the company had an income of 500 million dong/month despite his very young age. Brokerage profession doesn’t matter seniority, age, salary and bonus depend on Therefore, there are many young people who take advantage of the liquidity boom to make a lot of money,” the brokerage director shared.

Good income, career life is getting younger and younger. By the end of 2021, the stockbroking profession will become an extremely hot profession, easy to make money, with a good position. The wave of showing off houses, showing off cars, brands, showing off buying land… of a part of the stock brokerage class bloomed. The easy money made the stockbroker create a glittering cover for society to look at and marvel at.

“From 2021 to now, everyone has witnessed a fever about stocks, stockbrokers have also benefited a lot, so a very high income of over 100 million VND/month is something many brokers have achieved. Since then many brokers used the method of “getting physical assets” to create a position for themselves, which is not bad at all, especially when many brokers have had to work very hard and pressure to get it. It’s also natural to reward yourself with luxury items,” shared Mr. Truong Thanh Toan, Director of Investment Consulting Division, VPS Securities Company.

Market liquidity dropped sharply compared to the end of 2021

Securities in the first days of June after a deep decline of 16% compared to the peak, the liquidity was quite meager. Previously, according to HOSE statistics, the trading value of HOSE shares reached 14,950 billion dong in May 2022, down 32.4% compared to April 2022.

In May, HOSE recorded an average trading value and volume of more than 14.95 trillion dong and 540.22 million shares, respectively, down 32.4% in value and 20.98% in volume compared to May. with April.

The peak of the stock market is gradually over, the brokerage profession is also affected, and the income is somewhat reduced. Now, stockbrokers are returning to the ground with a variety of pressures to face.

The first, income decreased significantly. Many brokers said that brokerage income has recently halved compared to the end of 2021. And if liquidity continues to decline, earnings are likely to continue to decline. The reason is that the market has no waves, investors have few transactions.

Monday, great pressure comes from customers at a loss. When the market is up, the brokerage profession is respected because it helps customers make money, but when the market is down, most of them lose. At this time, in many cases, brokers were blamed by customers for losing money, and the pressure from the profession was great.

Tuesday, the pressure comes from the loss itself. Most stockbrokers invest in securities, and income from the profession, after covering the family’s living expenses, is invested in securities. Therefore, the pressure of losing and clamping their own goods is also very large.

“Earnings halved compared to the end of 2021 because liquidity is very low this time, everyone knows. But, I don’t feel pressured by seeing customers’ accounts lose money every day. Many When it’s just a small loss, I recommend cutting it, but a lot of customers don’t have the habit of cutting their losses, so they keep trying, until the loss is too big, they can’t cut their losses anymore, so they have to hold their losses, but it’s extremely stressful. for both me and my clients. Brokerage is like that. When a client gets money, I’m happy, when they lose money, I’m also sad. Any broker who keeps showing off his profits while the market is down is polishing his name, the market. Everyone loses more or less important,” said Ms. Hoang Lan, a stockbroker in Hanoi.

A broker with 15 years of experience in the industry shared: “It took 20 years to have the explosive liquidity of 2021, which is the peak of the brokerage profession that will take many years to return. , I also don’t know exactly when, just know that the golden age of the brokerage profession with good income and easy money has passed.Last year, many young brokers, besides income from brokerage sales, also took advantage of selling. books, selling courses, opening a vip room, charging each member 5-10 million dong/year, trusting customers to share with customers… make full use of money, so the income of this group is really terrible. However, when the market goes up, everyone is right – everyone becomes an expert, when the market goes down, they know the real capacity of the broker.

Mr. Phan Dung Khanh, Investment Consultant Director of Maybank Investment Bank also said that the brokerage profession has passed the period of easy money. He said that in 2020-2021, many stockbrokers were quick to make extremely good money from the massively joining of F0 investors, the sudden increase in commission sales. Along with the upward momentum of the market, many brokers take advantage of the good earnings from selling courses, selling books, opening VIP rooms to earn billions. However, the market is in a difficult period, the brokerage profession is also under pressure to reduce income, selling courses and opening VIP rooms at this time is much more difficult to make money than in 2021.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here