Gold price next week: Beware of ECB decision and US CPI

The monetary policy decision of the European Central Bank (ECB) and the US consumer price index (CPI) will be the two main factors that will strongly affect gold prices next week.

Gold trading is still quite quiet on Vietnam’s gold market (Photo: Quoc Tuan)

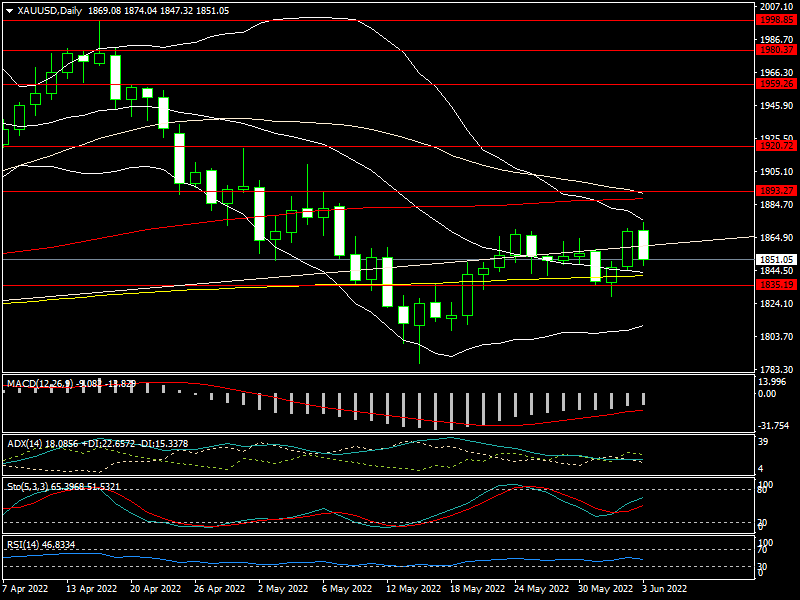

After opening at 1,852 USD/oz, international gold price fell to 1,828 USD/oz, then recovered to 1,874 USD/oz, then fell to 1,847 USD/oz and closed at 1,851 USD/oz.

In the Vietnamese gold market, the price of SJC gold bars also fell from 69.5 million dong/tael to 69 million dong/tael in the early sessions of the week, then recovered to 69.7 million dong/tael. In general, gold trading is still quite quiet.

The reason why the international gold price fell by more than 30 USD in the last session of this week was due to the better-than-expected US non-farm payrolls report (NFP) in May, specifically, NFP gained 390,000 jobs, compared with the expected level of 328,000. job. Although NFP is lower than the previous period (436,000 jobs), it is still at a relatively positive level. This combined with the low unemployment rate of 3.6%, makes experts and investors expect the FED will still raise interest rates by 50 percentage points and reduce the balance sheet. down to nearly 9,000 billion USD at the meeting on June 14 and July 26, although US inflation is said to have peaked.

In the context of the US economy’s decline (Q1 GDP was negative 1.4%), many experts forecast that at the next September meeting, the FED will probably only raise interest rates by 25 percentage points, then delay This plan is to continue monitoring the economic situation, and then there will be a next decision for tightening monetary policy.

However, the assessment of US inflation peaking is uncertain when the global supply chain is still broken due to the Russia-Ukraine war and China’s zero-Covid strategy. In particular, the EU has just decided to stop importing two-thirds of the oil transported at sea from Russia to pressure Russia to stop the hostilities in Ukraine and push oil prices higher. Therefore, inflation still has the potential to explode more strongly, especially when Russia still has a certain level of insistence that it will continue to pursue the goals set in the Russia-Ukraine war, and Ukraine declares its determination to defeat Russia. with active support from the US and the West.

Notably, now that the summer has entered, the demand for physical gold often enters a bearish cycle. Therefore, this factor will no longer be a positive support for gold price. Accordingly, it will be difficult for gold prices to have a strong breakthrough in this period, especially when the FED will maintain interest rate hikes in the next 2-3 meetings. However, in the long term, gold price is expected to increase even higher when trading firmly above 1,900 USD/oz.

The decision of the ECB and the US CPI will directly affect the gold price next week.

Mr. Everett Millman, Senior Analyst at Gainesville Coins Group, said that although the Russia-Ukraine war continues to contribute to the increase in gold’s role as a haven, the Fed’s continued interest rate hikes have a negative impact. pressure for the price of gold. Therefore, the gold price will still correct, around 1,800 USD/oz in the short term. “If we can’t overcome the psychological level of 1,900 USD/oz, it will continue to revolve around the 1,800 USD/oz zone. On the contrary, if the gold price surpasses 1,900 USD/oz, the gold price will have a stronger increase”, Mr. Everett Millman emphasized.

Next week, the ECB will have a monetary policy meeting on June 9. It is likely that the ECB will keep interest rates unchanged at current levels. However, if the ECB raises interest rates, it will put pressure on the USD, thereby pushing up gold prices next week. Conversely, if the ECB keeps rates unchanged, it will have little effect on gold prices next week. In addition, the US will publish the consumer price index (CPI) on June 10. If CPI rises stronger than expected, it will negatively affect gold prices next week, as this will increase market expectations about the Fed continuing to sharply raise interest rates. On the contrary, the price of gold will continue to rise.

According to technical analysis, the ADX, MACD, Stochastic… still show the correcting and accumulating trend of gold price next week. If gold price breaks through 1,891 USD/oz (MA50), it will move to challenge 1,900 USD/oz. Meanwhile, 1,841USD/oz (MA200) is an important support level, below this level will be 1,827USD/oz, followed by the 1,800USD/oz zone.

According to DDDN

at Blogtuan.info – Source: infonet.vietnamnet.vn – Read the original article here