Recently, VinFast Manufacturing and Trading Joint Stock Company announced that it has completed the issuance of 4 bonds with a term of 36 months, maturing in May 2025.

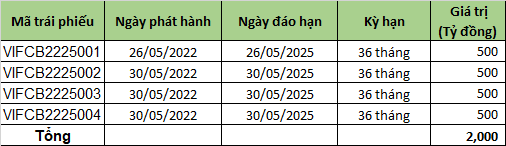

Specifically, all 4 bonds have a term of 36 months. Lot of bonds code VIFCB2225001 issued on May 26, 2022, matured on May 26, 2025, remaining 3 lots of bonds with code VIFCB2225002, VIFCB2225003, VIFCB225004 Co-issued on May 30, 2022 and matured on May 30, 2025.

With the issuance value of each lot is 500 billion dong, the total par value is 2,000 billion dong. Information about interest rates and bond buyers was not disclosed.

VinFast mobilizes VND 2,000 billion of bonds

Previously, on May 21, 2022, the Board of Directors of Vingroup Group (Code: VIC) – the parent company of VinFast announced a resolution approving the use of assets as security and providing payment guarantees for corporate bonds. published by VinFast in 2022.

According to the resolution, Vingroup’s Board of Directors has approved the Vingroup Group’s guarantee and use of its assets as security for the principal, interest and other payment obligations of VinFast, a subsidiary of VinFast. Vingroup is related to bonds issued by VinFast in 2022 with a maximum par value of VND 2,000 billion.

In May 2022, VinFast increased its charter capital from nearly VND 56,497 billion to nearly VND 57,380 billion through the issuance of more than 88 million dividend preferred shares. Previously in March 2022, VinFast issued 600 million dividend preferred shares and increased its charter capital from nearly 50,497 billion VND to nearly 56,497 billion VND.

Thus, after only the first 5 months of 2022, VinFast’s charter capital has increased by more than VND 7,000 billion, still the company with the largest capital scale in the Vingroup ecosystem and ranked above the enterprises with the largest capital in the market. securities markets such as BIDV, VietinBank, VPBank, Hoa Phat…

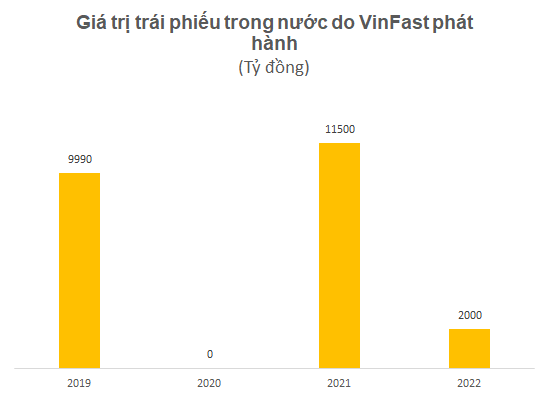

In 2021, VinFast also mobilized 11,500 billion VND of bonds through 4 issuances. These lots have a term of 36 months, of which 2 lots worth VND 1,500 billion and VND 5,000 billion have been completed ahead of time.

It is known that VinFast Trading & Investment Ptl.Ltd (VinFast Singapore) was established with the goal of receiving VinFast capital transfer from Vingroup and other shareholders, then proceeding to an IPO in the US market. The company has submitted an initial public offering (IPO) application to the US Securities and Exchange Commission (SEC).

The size and price of the offering have not been determined, but according to Bloomberg, the IPO is expected to raise about $2 billion.

During Vingroup’s 2022 Annual General Meeting of Shareholders, Vingroup Chairman Pham Nhat Vuong affirmed that he will sell 750,000 VinFast electric vehicles in the US by 2026, of which 600,000 will be exported from Vietnam.

Regarding Vingroup, this group currently has a market value of 300,538 billion VND, ranking third in Vietnam’s stock market. Vingroup sets a revenue target of VND 140,000 billion in 2022 and VND 6,000 billion in profit after tax.

at Blogtuan.info – Source: autopro.com.vn – Read the original article here