Invite each other to “explode” debt when borrowing money through the app

That is also the reason for the increase in debt collection by phone, terrorism, and smearing on social networks. Sanctioning applications for loan sharking, debt-collecting terrorism, and at the same time should have a form of strict handling of even the behavior of borrowing money and then “swallowing” the borrower’s debt. It’s really “the thief meets the old woman”!

All kinds of “swallow” debt

Recently, the Hanoi Police Department has coordinated with the Criminal Police Department (Ministry of Public Security) and professional units of the City Public Security to dismantle a loan sharking line via the app and collect regulated debts. large scale, involving nearly 300 subjects, including foreigners.

Borrowers only need to take a photo of their identity card or citizen’s identity card and mortgage with a phone book to be able to borrow an amount of VND 2-30 million without having to meet or sign any loan documents. any. After that, the subjects will verify the borrower’s phone book to determine the accuracy and use the basis for debt collection later.

Borrowers will have to pay within 3-5 days of the original principal amount, interest will be cut immediately upon disbursement. If the borrower fails to pay the principal as committed, the amount will be multiplied, “parental interest”. Subjects will give different decentralized debt collection departments texting, calling reminders, threats, mental terror from borrowers to their relatives and all relationships in the phone book. previously provided by the borrower.

The subjects even cropped the borrower’s image and then posted it on social networks to smear the reputation, lower the honor, and humiliate the borrower to force the borrower to pay the debt or his family to pay. Terrorist tricks of loan sharks have caused public outrage for a long time.

However, it must be said again and again, that loan sharking, terrorism, and smearing to collect debt is a violation of the law, but the main cause also comes from a loophole in the automatic application process. In order to attract borrowers, lenders often skip the verification of customer information. Therefore, borrowers can use junk sims, virtual social network accounts, virtual contacts, fake documents … to borrow money at the same time from many different apps and then “burst” the debt.

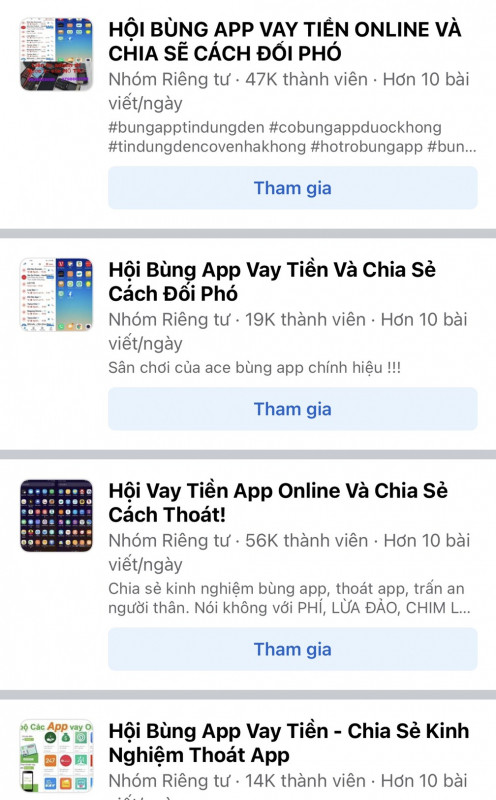

Even on social networking groups, borrowers also teach each other experiences to “flare” money when borrowing through the app. Just going online and typing the phrase “how to make money through the app” will give a series of closed, open groups with tens of thousands of members on how to “flash” loans through the application.

According to the reporter’s research, there are two popular types of loans: loans through apps and loans on websites. If you borrow through the app, users will have to open access to personal information such as contacts, messages, Google sync and call history. As for loans via the website, users will have to leave a link to their Facebook profile, Zalo and call history within 6 months.

When the payment is due, the debt collection group will access the contacts, take phone numbers to terrorize relatives and friends, and force the borrower to pay. In many cases, they were also threatened to release personal photos and chat messages on social networks to stigmatize them.

Therefore, in these groups often show a way for members to “burst” debt by finding and buying virtual sims, “raising” Facebook, virtual Zalo, using fake IDs and “plowing” virtual contacts…

On a group with more than 11,000 members, one member posted: “Everyone, when the RBC is on fire, does it post pictures with calling relatives? Interest is too high to pay. Does it allow principal to be repaid”, immediately below a series of nicks in the comments how to “swallow” the debt, but most of them “inbox me only”. There is a nick that teaches how to remove the sim, change a new phone number, there is a nick that shows how to ask the network operator to make a service to block contacts.

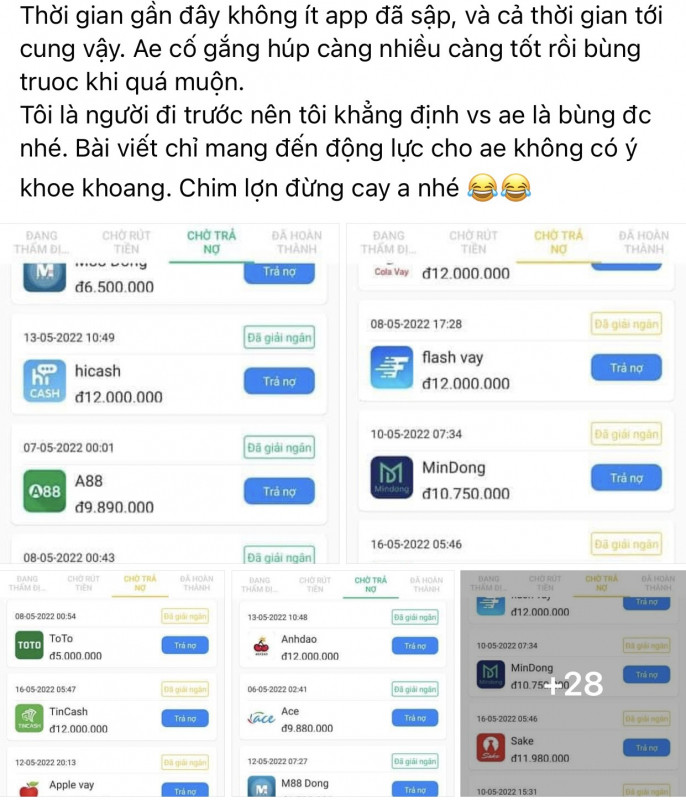

A member specializing in “rubbing” debt said: the loan level of the app for first-time borrowers is only about 500,000 to 2 million VND (short installment period). In order to obtain a large amount of money, many people have used the method of borrowing at low rates and paying on time to increase their loan limit. After 3-4 times (lasting about 2 months), the maximum loan amount is up to 20 million VND, at this time the borrower will use the trick of choosing the highest loan and then “rubbing”. At the same time, the “junk” sims used to borrow money are also quickly destroyed to cut off contact with the lending app.

The fertile ground of the middle group

Since then, debt avoidance services have also sprung up like mushrooms after the rain, widely advertised on private groups such as making fake IDs, “plowing” new contacts, receiving “plowing” online loan applications. ; sell virtual Facebook accounts; sell fake contacts; Receiving calls to reassure relatives… With fake ID cards and new contacts, borrowers can easily borrow money without fear of affecting their families and relatives. Some members even sell ready-made “beautiful” documents to borrow money through the app at a small cost.

An HN member posted on the group: “There are 10 beautiful, clean male ID cards, never borrowed an app before. The quantity is still small, get super cheap price, direct transaction in Ho Chi Minh City. Who needs inbox”, immediately in the comment, many members advertised the service to fake ID card, beautiful number, real paper can borrow the app easily and only get a friendly price of 20% of the app loan amount.

When a member of HH asked on the association: “May I ask if any of you have had success with TM explosion? I’ve been burning for more than a year, now it finds out my new household registration book and phone number”, then a nick named LL in the comment showed off his victory: “I’ve been burning since 2019 and feel so peaceful. I don’t remember how much, but it feels normal.” And the nick named MQ also proudly shows “I owe more than 12 bulbs and have been burning for 40 days”. And immediately many nicks asked for their experience because they also borrowed money through this app but could not afford to repay (?) A nick named NNV commented: “This child is dangerous if he gets social insurance. Inbox me just for”.

Another nick also proudly shows off the achievement of breaking 5-6 apps. Even if relatives and friends are persecuted, it doesn’t matter. “It’s okay to be called, the person being called they say they don’t know, don’t know, go somewhere else to collect debt, even being cursed for, they have to suffer”, this member shared. Another member advised “just let it go”; If you can’t remove the sim, then block strange phone numbers from calling, “no one will come to your house to claim a debt of just over 10 million dong, so just automatically “ruffle” the debt”.

There are signs of fraud to appropriate property

According to Captain Trinh Cong Anh, an officer of the Department of Cyber Security and High-Tech Crime Prevention and Control, Hanoi Public Security, currently, online loan activities via apps and web are having quite complicated developments. Borrowing money through the app has the advantage of being very convenient and fast, meeting the needs of borrowing money with a small amount in daily life. However, there have appeared many money-lending apps with high interest rates and groups on social networks that teach each other how to appropriate loans. Both acts of usury and loan fraud are condemned and handled according to the law.

Because in fact, lenders charge too much interest, making borrowers unable to pay, so they find a way to “burst”. And borrowers, because they find it easy to “burst”, easily borrow, find ways to borrow a lot to appropriate that amount of property. Since then, it has led to others being harmed when they are constantly terrorized, smeared, forced to pay debts on behalf of borrowers.

Ms. Bui Khanh Ly (Cau Giay) said urgently: “I know my cousin specializes in borrowing through this app because he has a lot of betting debt. Many times, cousins are called terrorist. Surely my brother “booms” so now he is paying money to his relatives. But no wonder it asked me to do anything. Every time I get a terrorist call or spam text message, I take a screenshot and send it to my brother, but I’m embarrassed to reply.”

And Mr. Tran Van Hao (Dong Da) is also frustrated when his brother-in-law comes from Nam Dinh, not understanding how much gambling and electronics are online, but the last time the subjects came to his house to collect the debt. Not to mention, Mr. Hao, who lives in Hanoi, is often called and threatened, even having his photo merged with the photo of his brother-in-law advertised on social networks. Frustrated but can not do anything because related to his brother-in-law. Before that, his brother-in-law also borrowed a debt of many people in the family and could not repay it: “It was too much, my brother borrowed an app and didn’t pay, so the family suffered this replacement”, he said. Hao shook his head wearily.

According to lawyer Giap Quang Khai, Bac Giang Bar Association, the act of using fake information to borrow money online through an app, web and then stealing debt, has signs of fraud to appropriate property specified in Article 174 of the Ministry of Finance. Penal Code 2015. Those who incite, incite, instruct to cheat, or provide necessary documents to the person who commits the above fraud, may be criminally handled as an accomplice.

Individuals who have acts of using fake documents, taking advantage of a loan application to borrow money for personal spending purposes, but do not pay the debt by the due date, which is reflected in behaviors such as debt default. , turn off the phone, run away, find all ways to avoid not paying the debt in accordance with the regulations and conditions of the app … if there are enough grounds to prove fraudulent behavior from the beginning with the aim to appropriate money from organizations , individuals, through using loan app services, may have signs of the crime of “fraudulent appropriation of property” specified in Article 174 of the Penal Code 2015.

(According to World Security)

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here